In a twist that could make your morning coffee seem dull, Bitcoin dipped below $100,000 with all the grace of a elephant on a pogo stick, shedding a hefty 6.7 percent over the course of a week. Apparently, the whales found a new hobby-selling-like kids in a candy shop on a sugar rampage, and ETFs? Well, they decided to take an extended holiday, disappearing faster than a sock in a washing machine.

Yes, dear reader, our feline friend has tumbled off the perch and is now sitting humbly under the $100,000 mark. Whales (those large fish with wallet muscles) have been more active than a bee in a bottle, rushing to offload their holdings, and it’s caused quite a ruckus in the pool. This weekly performance? The worst in months, with a decline that could make a penny whistle sound flat-6.7% in just a week, a feat that would impress even the most disillusioned economist, or a very anxious one.

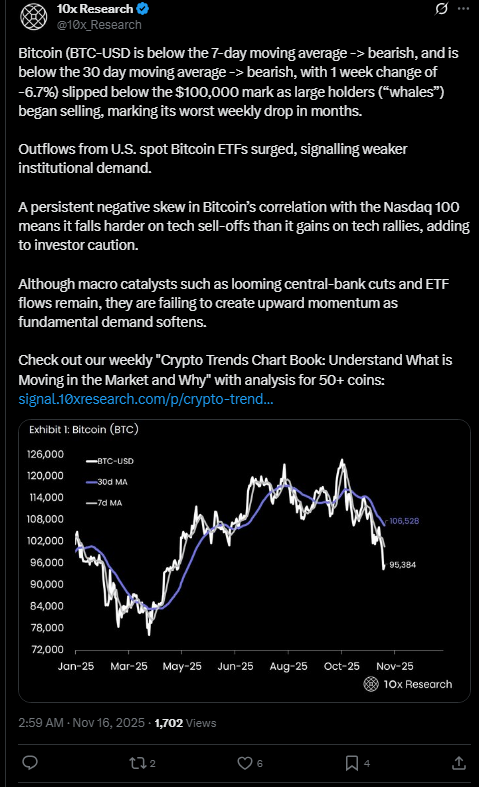

According to the learned scribblings of 10x Research on X, Bitcoin is currently trading below its 7-day and 30-day moving averages. Both suggest it’s in the doghouse, and the mood in the market is gloomier than a rainy Sunday. Oh, joy.

Source – X

Meanwhile, U.S. spot Bitcoin ETFs have been clearing out their cash like a bargains weekend at Harrods, dropping more than a billion dollars in a single day. Over three weeks, these funds have been melting faster than ice cream on a summer day, losing a whopping $2.64 billion. A veritable exodus of institutional confidence-probably because they saw a ghost of rally and ran screaming.

Market Gets All Shaky-Shaky: Whales, Outflows & a Dash of Panic

The market’s been more turbulent than a rollercoaster on steroids-major U.S.-listed Bitcoin ETFs saw the second-largest daily outflow in their history. To paraphrase the market mavens on X: “It’s a bearish fiesta, folks.” Whales are selling like they’re trying to buy a yacht, and ETFs are running for the hills, leaving retail investors gazing at their screens like a kid at a magic show.

Our hefty friends with deep pockets have been moving their loot onto exchanges, probably dreaming of making a quick buck before the whole show collapses. Risk-averse Wall Street types are clutching their hats, peering nervously at the tumbling prices, as if waiting for a sign from Orwell’s Big Brother that it’s safe to breathe again.

Meanwhile, Bitcoin’s dance partner-tech stocks-are leading a wild ripple effect. When tech stocks soar, Bitcoin stays sulkily the same; when tech tanks, Bitcoin seems to join the party-or rather, the hangover.

And what’s causing this carnival of chaos? Speculation about central-bank rate cuts and macroeconomic shenanigans, sure. But, in essence, everyone’s just watching Bitcoin’s mood swing-a declining demand and uncertain future. It’s as predictable as a cat’s mood in a rainstorm, and just about as joyful.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Silver Rate Forecast

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

- USD GEL PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

2025-11-17 09:06