- It appears that Bitcoin has decided to go its own way, leaving Gold in the dust, as it attracts a veritable flood of liquidity into the market. Who knew cryptocurrencies could be so fickle?

- Meanwhile, the available Bitcoin in the market is playing hide and seek, and the whales, those great behemoths of the crypto sea, seem to be taking a nap.

Bitcoin [BTC], that cheeky little rascal, has been consolidating above the $100,000 mark, frolicking within a range-bound level on the chart like a cat in a sunbeam.

This consolidation, following a rather impressive price breakout, suggests that buying activity is as high as a kite on a windy day.

This little shift has led our dear Bitcoin to lose its correlation with Gold, but fear not, dear reader, for there’s more to this tale, and what it could mean for Bitcoin’s price is positively riveting.

Bitcoin loses correlation, but at what cost?

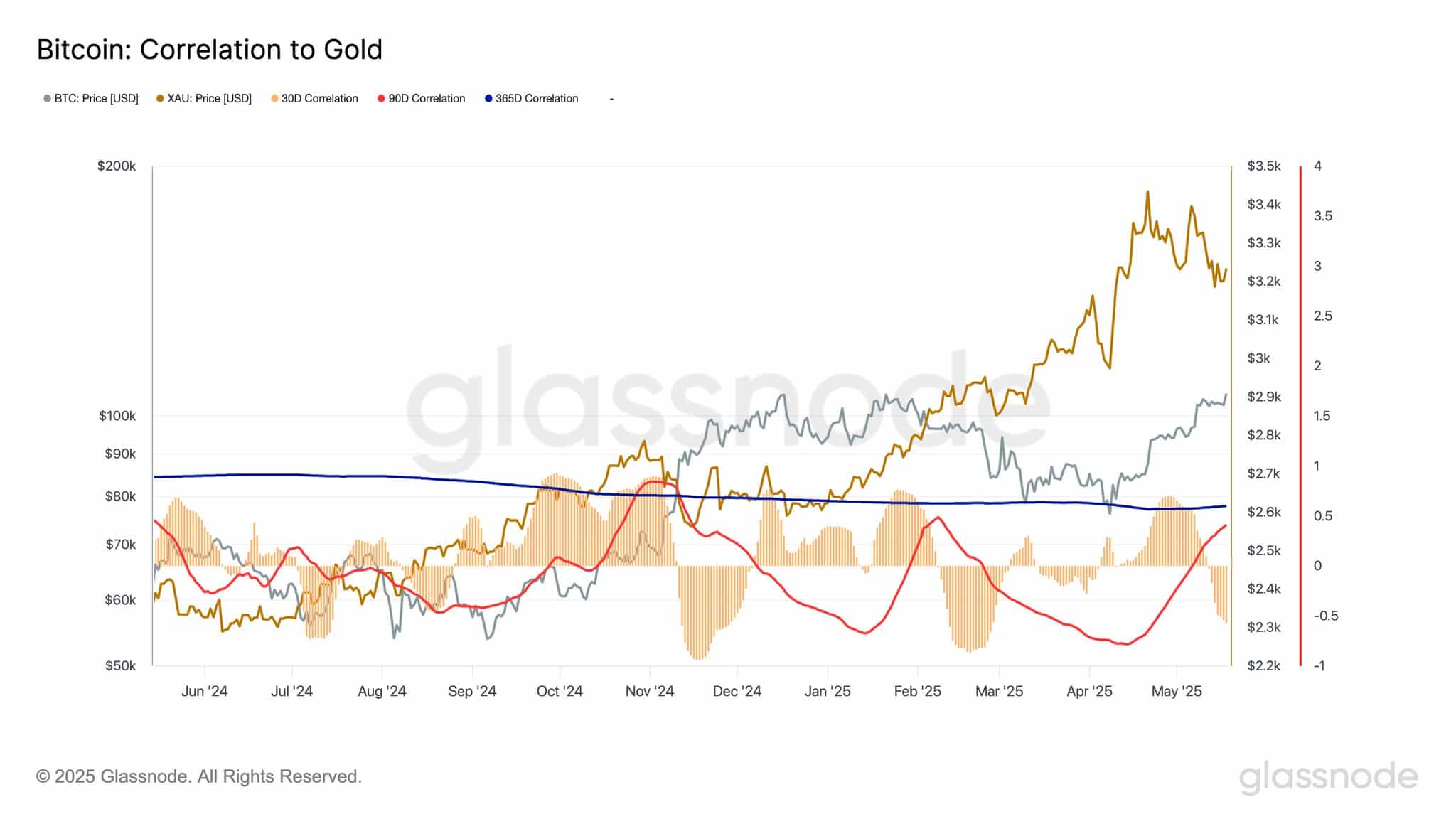

Reports from the ever-reliable Glassnode suggest that Bitcoin has indeed lost its correlation with Gold, as per the 30-day chart. It’s like a bad breakup, really.

According to the analysis, the correlation between these two assets now stands at a rather dismal negative 0.54, marking its lowest level since February 2025. Ouch!

A close inspection of the chart reveals that the last time this occurred, there was a significant liquidity outflow from Bitcoin, while Gold enjoyed a rather lavish inflow. Talk about a role reversal!

Between November and December, when the 30-day correlation dropped to this level, Bitcoin surged like a caffeinated rabbit while Gold took a nosedive.

Given these contrasting market movements, AMBCrypto has donned its detective hat to examine additional factors to assess Bitcoin’s potential trajectory. Elementary, my dear Watson!

Where is liquidity going?

Two key metrics were employed to determine the liquidity flow in the market: Exchange Reserve and Exchange Netflow. Sounds fancy, doesn’t it?

The Exchange Reserve simply calculates the amount of the asset available on exchanges. A drop in this metric implies there are fewer Bitcoin on exchanges, increasing the tendency for holding and reducing immediate selling pressure. Quite the clever ruse!

At the time of writing, the Exchange Reserve has plummeted to a new all-time low of approximately 2.43 million Bitcoin. It’s like a game of musical chairs, and there are fewer chairs than players!

Not only has the Bitcoin reserve continued to drop, but the amount of Bitcoin being bought has also been on the rise. It’s a veritable shopping spree!

This is confirmed by the Exchange Netflow, which measures the difference between buying and selling activity for Bitcoin in the market. When the netflow is red, it means more Bitcoin has been bought than sold. When it’s green, it implies there is more selling than buying. Simple as pie!

Observing the chart closely, one can see more red appearing, confirming strong purchase sentiment. It’s like a stampede of eager buyers!

If this buying trend continues, alongside a drop in reserves and a more negative netflow, it could significantly support further upward movement. Up, up, and away!

What does cooling whale activity mean?

Whale activity on exchanges has continued to drop, particularly in the past 24 hours, plunging to a new low. It’s as if the whales have decided to take a sabbatical!

This could suggest several things. However, based on current market activity, it’s likely that whales are preparing for long-term holding. Perhaps they’re knitting cozy Bitcoin sweaters?

This forecast aligns with the decline in exchange reserves, suggesting that whales who previously accumulated large amounts of Bitcoin have yet to move their holdings. They must be quite comfortable!

If this holding trend persists, it could strengthen BTC’s potential for an upward breakout, possibly surpassing its current consolidation phase. The sky’s the limit!

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- USD CHF PREDICTION

- INR RUB PREDICTION

- Will XRP Break $3 or Just Break Our Hearts? 🤡

- GBP AED PREDICTION

- ETH CAD PREDICTION. ETH cryptocurrency

- Ethereum’s Sudden Surge: A 10% Spike in Active Addresses! Is $1,850 Next?

2025-05-20 07:16