Oh, darling, it seems the small fish in the Bitcoin pond are swimming away faster than a debutante fleeing a dull soirée. Data reveals that the Bitcoin Retail Investor Demand Change has turned negative-yes, *negative*. The little hands, bless their hearts, seem to have lost interest in this digital gold rush. How frightfully inconvenient for the crypto glitterati.

A Decline in Retail Volume Over the Past Month

In a recent post on X (formerly Twitter, darling), CryptoQuant’s community analyst Maartunn spilled the tea about the latest trend in the Bitcoin Retail Investor Demand Change. This particular metric, darling, measures the 30-day shift in demand among retail holders-the tiniest of players in this grand casino. These transfers, often valued at less than $10,000, are like the hors d’oeuvres of the crypto world. When the metric is positive, it’s champagne all around; when it dips below zero, well, let’s just say the party’s over.

And now, here’s a chart that tells the tale of retail woe over the past few years:

As you can see, the Bitcoin Retail Investor Demand Change had a fleeting moment of glory earlier, but since Bitcoin’s all-time high (ATH) above $124,000, it’s plummeted like a diva tripping over her own ego. The current value indicates that transaction volume for transfers under $10,000 has dropped by approximately 5.7% over the past month. Oh, the drama! It seems the retail crowd has decided to exit stage left.

“They’re the tourists of the crypto market,” quips Maartunn, “here for the hype, gone when it fades.” And fade it has, darling, as Bitcoin’s price has dipped by roughly 10% since its ATH. Looking back at the chart, the last time retail sentiment soured was in June when BTC dipped below $100,000. What followed? A rally to new ATHs, of course! But will history repeat itself, or are we witnessing the beginning of a rather dreary second act?

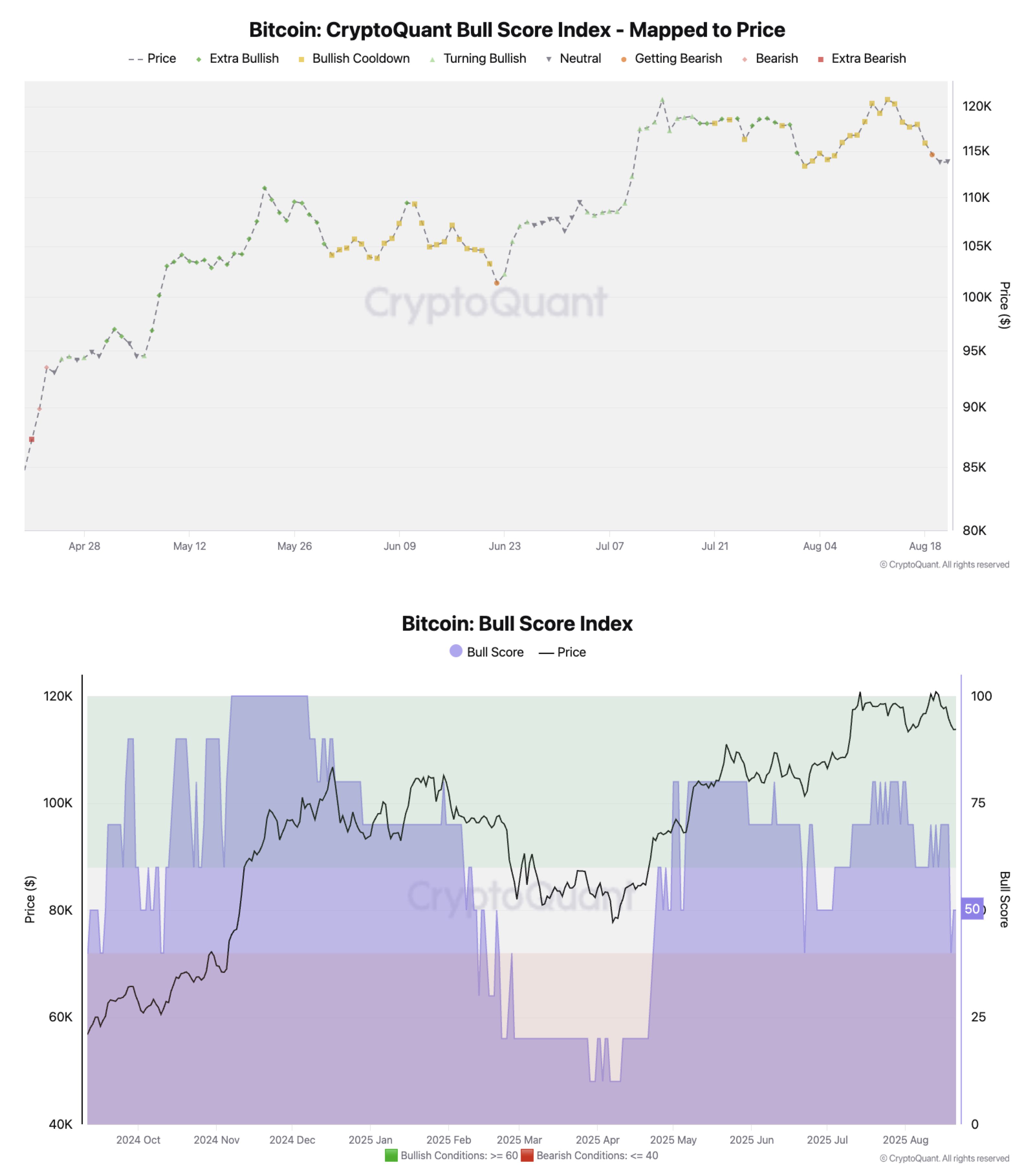

Meanwhile, in other news that’s sure to make you clutch your pearls, CryptoQuant’s Bull Score Index-oh, such a bullish name for something so neutral-has slipped into the “meh” zone, according to Julio Moreno, head of research at the analytics firm. He shared this gem in another X post:

“For risk management purposes,” Moreno warns, “further softening in the index indicates price could go lower.” Oh, how thrillingly ominous! One might need a stiff drink after that forecast.

BTC Price

Bitcoin, darling, has continued its downward spiral, with its price slipping under $112,300 during the past day. Here’s a visual representation of this tragic decline:

But chin up, my dears! After all, what’s a financial rollercoaster without a bit of chaos, a dash of despair, and a smidgen of hope? 🎢💔✨

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Brent Oil Forecast

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- Crypto Chaos Unleashed: Shocking Gains and Ironic Downfalls 😂

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- KuCoin’s Bold Foray Into Thailand: Crypto Drama Meets Tropical Charm! 🐘💸

2025-08-22 10:14