Ah, Bitcoin! The digital currency that has all the stability of a tightrope walker on a windy day. Currently, it seems to be engaged in a rather elaborate game of hide and seek, with a trading range that’s more of a consolidation move than a full-blown party. It’s like waiting for a bus that’s perpetually late, but hey, at least it’s still above the $105,000 support zone—most days, anyway.

Now, if we were to consult the mystical scrolls of technical analysis, we’d find that Bitcoin’s price action is doing a little dance with the Global M2 Money Supply metric. It’s a bit like watching two awkward teenagers at a school dance—eventually, one of them is bound to make a move, and it’s only a matter of time before Bitcoin struts its stuff into a new all-time high.

Global M2 Offset Models: The Crystal Ball of Cryptocurrency

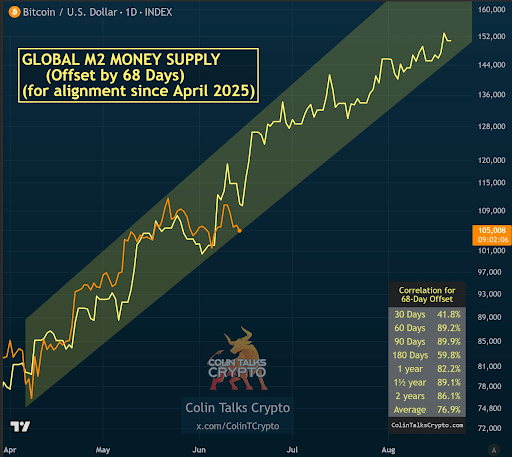

According to the wise sage Colin, affectionately dubbed “The M2 Guy” (because who doesn’t love a good nickname?), Bitcoin’s price seems to be tracking the global M2 money supply with a correlation that’s tighter than a pair of jeans after the holidays. When you offset the data by 68 to 76 days, it’s like finding the perfect pair of socks—everything just fits.

Colin’s charts, which are as colorful as a peacock in a paint factory, reveal this trend with all the subtlety of a marching band. The short-term 68-day offset chart aligns with Bitcoin’s behavior since April 2025, while the 76-day chart offers a longer-term view, like a wise old tortoise telling tales of yore.

In both cases, the M2 curve is pointing skyward, much like a catapulted potato, suggesting that Bitcoin is poised for a bullish trajectory. Colin, in his infinite wisdom, describes this as a form of confluence—when two correlated indicators agree, it’s like finding a two-for-one sale on chocolate. The average correlation across both charts is a staggering 76.6 to 76.9%, which is statistically significant enough to make even the most skeptical mathematician raise an eyebrow.

What Does This Mean For Bitcoin Price? 🤔

The 68-day offset chart shows Bitcoin trailing the M2 curve with the precision of a Swiss watch, boasting an impressive 89.9% accuracy on the 90-day timeframe. The 76-day offset, while a tad less accurate in the short term, still displays a strong correlation over longer intervals—92.2% over one and a half years and 86.2% across two years. It’s almost as if Bitcoin has developed a sixth sense for global liquidity trends, especially now that its price is tied to the whims of Spot Bitcoin ETFs.

This relationship becomes even more intriguing considering the M2 money supply itself is climbing like a cat up a tree. If this alignment continues, Bitcoin may soon follow suit, soaring back above the $110,000 level and possibly breaking its all-time high. Colin believes this next move is not just likely, but could happen faster than you can say “cryptocurrency.”

If Bitcoin plays its cards right, it could continue to move within a channel of higher highs and higher lows, eventually crossing above $150,000 in August. As of now, Bitcoin is trading at $106,549, up by a whole 1% in the past 24 hours—because every little bit counts, right?

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- SUI ETF? Oh, the Drama! 🤑

- Brent Oil Forecast

- Bitcoin’s on Fire! Institutions Hoarding Like It’s Toilet Paper 2020 🚀💰

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

- Bitcoin’s Next Move Will SHOCK You! $85K or $83K?

- USD MXN PREDICTION

- Bitcoin Apocalypse Imminent?! 😱

2025-06-16 16:36