Well, folks, it’s official: Bitcoin has lost its mind 🤯. It’s currently trading at a whopping $118,404, and I’m pretty sure my aunt is behind it all. I mean, who else could single-handedly drive up the price of a cryptocurrency? 😂 Just kidding, it’s actually institutional investors and renewed confidence in the market. But let’s be real, my aunt’s enthusiasm for Bitcoin is probably worth at least a few thousand dollars.

Apparently, there’s been a surge in institutional interest, with spot Bitcoin ETFs recording billions in net inflows. I guess that’s what happens when you get a bunch of rich people in a room and tell them about a shiny new investment opportunity 💸. Asset managers like BlackRock, Fidelity, and VanEck are now major players in the market, which is just a fancy way of saying they’re the cool kids on the block 🤓.

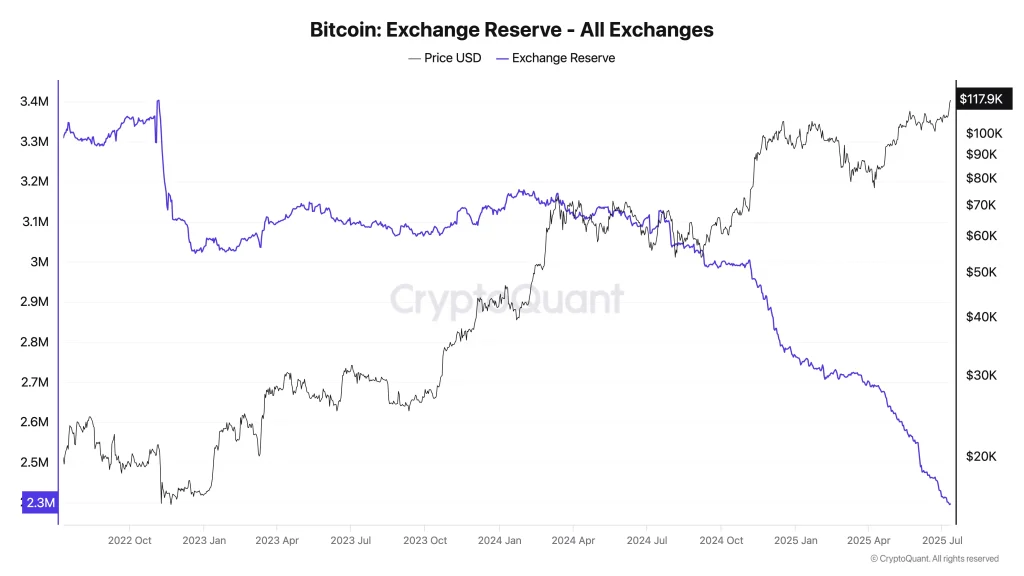

On-chain data shows that people are moving their Bitcoin to cold storage, which is like the cryptocurrency equivalent of hiding your money under the mattress 🛏️. This is supposedly a sign of long-term accumulation, but I think it’s just people trying to avoid paying taxes 🤑. Either way, it’s contributing to the price appreciation, so I guess we should all just start hoarding our Bitcoin and see what happens.

The Perfect Storm of Macro Tailwinds and Technical Triggers

It turns out that global macroeconomic conditions are also playing a role in Bitcoin’s breakout. Who knew? 🤔 Central banks are signaling a potential shift towards interest rate cuts, which is like a big ol’ green light for investors to go wild 🚦. A weakening US dollar and rising concerns about long-term inflation are also making Bitcoin look like a pretty attractive hedge 🌟.

The BTC price has reached the final barrier before entering a strong discovery phase, which is just a fancy way of saying it’s about to get real 🚀. There’s a possibility of a pullback, but if it rises above the range, we could see a new high of around $130K 🤑. The RSI is yet to enter the overbought range, which is like a big ol’ “buy” signal 📈.

And let’s not forget about the poor souls who got their shorts wiped out 🤦♂️. A whopping $300 million worth of shorts were liquidated in a single day, which is like a big ol’ “oops” 🤦♂️. But hey, at least it amplified the rally, right? 🎉 The alignment of favorable macro conditions and internal market mechanics suggests that this move is not just speculative, but rather the foundation of a broader, more sustained bull cycle 📈.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

2025-07-11 13:25