In the vast, unforgiving arena of markets, where fortunes rise and fall with the capricious whims of the gods of finance, Bitcoin stands shackled, its chains forged not by iron but by the weight of uncertainty.

What to know:

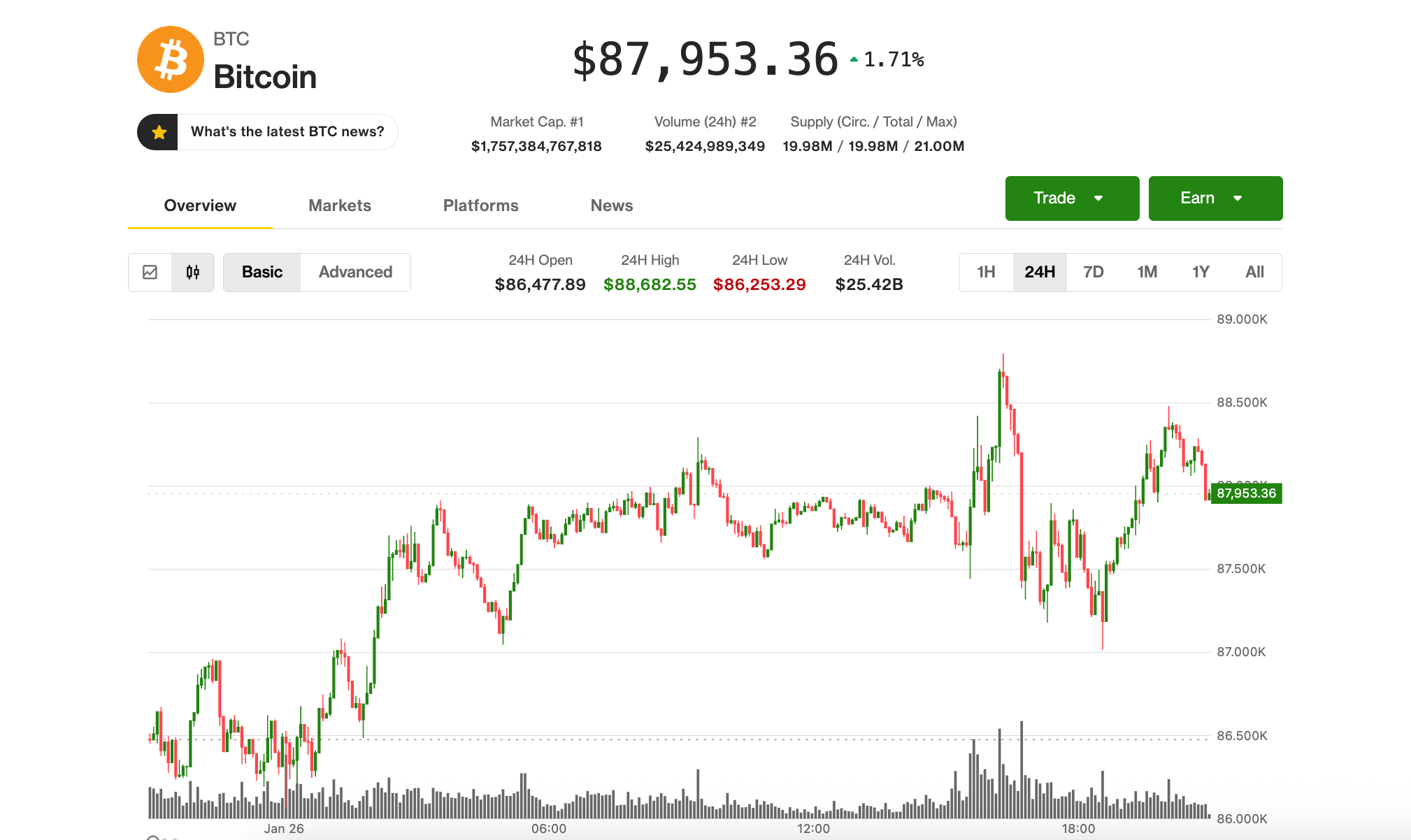

- Bitcoin, that digital Prometheus, clings to existence near $87,700, its flame dimmed by the weekend’s panic-stricken selling. A mere shadow of its former self, it hovers like a condemned soul awaiting judgment.

- Meanwhile, the ancient titans-gold and silver-continue their ascent, their luster undimmed by the same tempest that batters crypto. Yet, even they, in their hubris, show signs of fatigue, retreating from their Olympian heights as if reminded of their mortality.

- Analysts, those modern-day oracles, prophesy doom for crypto, their voices heavy with the weight of impending government shutdowns and the delayed Clarity Act. Their words, like stones, sink into the already troubled waters of the market.

On this fateful Monday, Bitcoin remains trapped in a purgatory of its own making, oscillating around $88,000. Gold and silver, in a display of audacious bravado, surge past $5,000 and $118 respectively, only to retreat, as if mocking the very idea of permanence. “Gold and silver casually adding an entire bitcoin market cap in a single day,” quipped Will Clemente, a crypto analyst whose wit cuts through the gloom like a knife through butter.

The U.S. dollar, once the unchallenged emperor of currencies, now lies prostrate, its index at its weakest since September. The Federal Reserve and the Bank of Japan, in a rare act of camaraderie, intervene to prop up the yen, a gesture as futile as trying to stop the tide with a broom.

Bitcoin’s Range-Bound Purgatory

The absence of bullish fervor in Bitcoin, despite the dollar’s weakness, has cast a pall over traders. “Recent price action has reinforced the bearish outlook,” declare the analysts at Swissblock, their words dripping with the gravity of a funeral dirge. A fall below $84,500, they warn, could unleash a cascade of selling, driving prices down to $74,000. Yet, they offer a glimmer of hope: if support holds and risk metrics cool, it might present a golden opportunity for the bulls.

Bitfinex analysts, ever the pragmatists, predict Bitcoin will remain shackled between $85,000 and $94,500. They note shifts in the options market, where traders, like chess players, maneuver tactically, pricing in transitory risks rather than long-term upheaval. Spot bitcoin ETFs, once the darlings of the market, now bleed outflows exceeding $1.3 billion, a testament to the waning risk appetite of investors.

The Specter of Government Shutdown

Jim Ferraioli, Schwab’s crypto sage, sees little hope for a breakout without a resurgence in on-chain activity, ETF flows, or miner participation. The Clarity Act, he believes, could be the catalyst needed, but its passage is threatened by the looming government shutdown. Until then, Bitcoin is doomed to trade within the narrow confines of the low $80,000s and mid-$90,000s, as institutional players remain on the sidelines, their hands firmly in their pockets.

And so, the dance continues-Bitcoin in its limbo, gold and silver in their fleeting glory, and the market, ever fickle, watching with bated breath. In this theater of the absurd, one thing is certain: the only constant is change, and the only certainty is uncertainty.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- USD THB PREDICTION

- Is XRP’s $50 Dream Just a Pipe Dream or the Ultimate Crypto Cinderella Story? 🤑

- ETH’s Grand Gesture: A Love Letter to Bulls or a Joke on Bears?

2026-01-26 23:49