So, Bitcoin is currently hanging out at $107,400-basically the emotional equivalent of wearing socks with sandals. Down 3% in 24 hours, 7% over the week, and now everyone’s clutching their popcorn like it’s a horror movie and BTC might finally actually ghost the bull run.

Volatility? Crashing. Volume? Still screaming like it owes money. Analysts are whispering dramatically about “the monthly close” like it’s some ancient prophecy. Honestly, it’s just a candle. But also… what if it’s not?

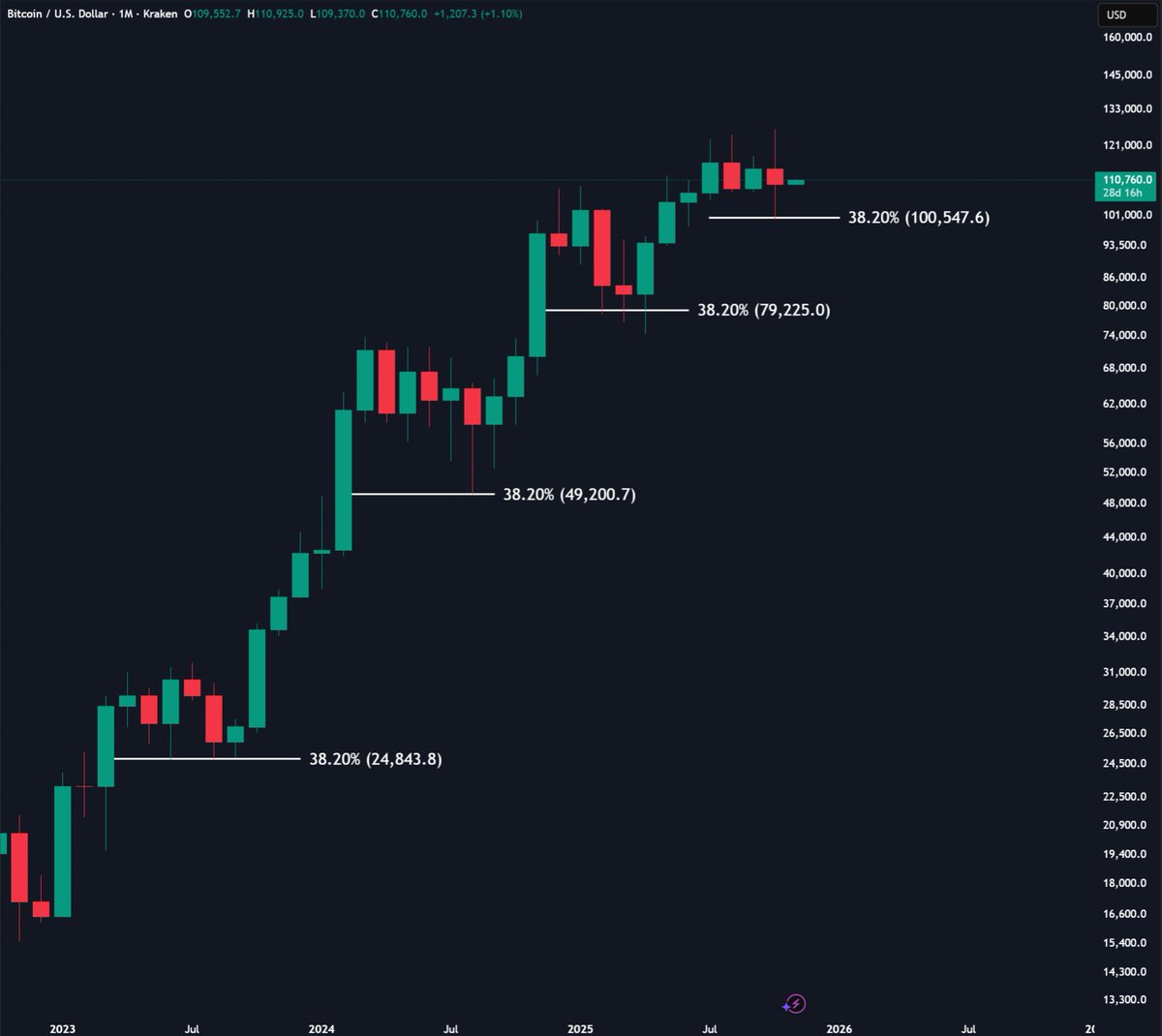

Fibonacci Drama: The Level That Won’t Quit

Since 2023, BTC has been using the 38.2% Fibonacci level like a safety blanket. Every time the market sneezed, price dropped straight to one of these mystical zones-$24,843, $49,200, $79,225, then bam $100,547-and bounced like, “Psych! I’m fine!”

Last month’s candle dipped right to $100,500 and then did a full backflip out. Heroic. Legendary. But Cas Abbé (crypto psychic) drops this bomb: “If BTC closes below this, the bull run is probably over.” Big yikes. We’re still above-by the skin of our teeth and a LinkedIn premium subscription.

Bollinger Bands Are Squeezing Like a Drama Queen

Super₿ro (yes, that’s his name, no notes) says the weekly Bollinger Bands are tighter than my jeans after Thanksgiving. Band Width at 15? That’s record-low volatility. And historically? This kind of squeeze usually ends in a fake-out drop followed by a “surprise!” moon mission 🚀🌕.

$BTC weekly

tightest squeeze in history for the weekly Bollinger Bands

prior squeezes led to a headfake lower and then a rip higher

– Super฿ro (@SuperBitcoinBro) November 3, 2025

Translation: “Panic now, regret later.” Classic.

Liquidity Zones: Where the Real Housewives of Crypto Fight

Daan Crypto Trades says BTC blew past the $108,500 support like it wasn’t even there-rude. Now the battlefield shifts: $112,000 is the next big offer wall, but the real action’s brewing between $105k and $106k, where bids are piling up like unread texts from your ex.

Ted Pillows-bless him-throws in:

“What if we dump in the first week and then pump to a new ATH?”

Darling, that’s not a prediction, that’s a wish list. But honestly? Mood.

Oh, and-fun fact-those zones are riddled with long liquidations. So if price drifts down there, we might just get a volatility fireworks show. 🎆 Free entertainment!

OGs Are Cashing Out. Like, All of Them.

CryptoQuant drops the cold truth: long-term holders sold a collective $33 billion of BTC in October. That’s $1 billion a day in quiet hallway drama. CryptoPatel nails it:

“These aren’t weak hands. These are OGs booking profits near the top.”

So yeah. The people who bought BTC when Satoshi was still active? They’re politely exiting stage left. Respect.

Meanwhile, US demand’s gone lukewarm, and big boys like Peter Brandt are shorting BTC futures like it’s a bad Tinder date. The market’s digesting it all like a heavy brunch. Price is still shy of highs, but also… still here. Still breathing. Still crypto.

So no, the bull run isn’t confirmed dead. But it is mid-conversation about its life choices. 🥂

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin’s Bumpy Ride: Will it Sink or Swim? Find Out Before Your Coffee Gets Cold! 🚀💸

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Brent Oil Forecast

- Tokens, Trinkets, and Trials: The Crypto Conundrum Unveiled!

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

- Bitcoin Bulls Refuse to Back Down: $107K Double Top? More Like $116K Next Stop!

- Stripe’s Latest Acquisition: A Crypto Wallet Adventure Awaits! 🚀💰

2025-11-03 13:04