Ah, Bitcoin, that digital chimera, flits about the financial firmament at $67,411 on this, the 20th of February, 2026, at the ungodly hour of 8 a.m. EST. It consolidates, you see, after a most dramatic recovery from its recent capitulation low. The broader structure, alas, remains as corrective as a poorly written novel, and the burden of proof still rests on those bullish fools to reclaim higher ground.

Bitcoin Chart Outlook: A Tale of Woe and Whimsy

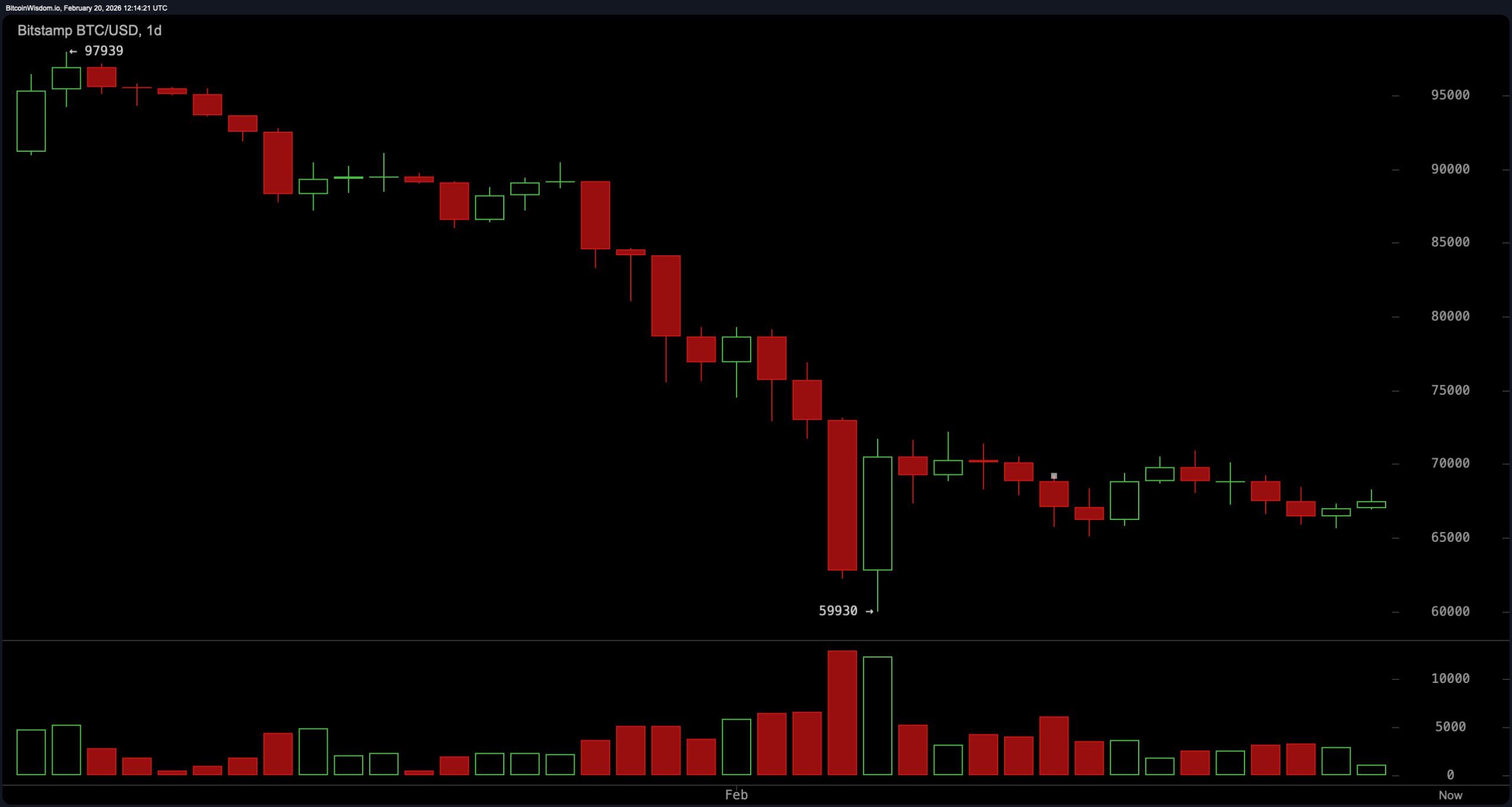

The daily chart, a disciplined but unforgiving mistress, tells a story as bleak as a winter in Bronte country. Bitcoin remains ensnared in a downtrend, from its lofty $97,000 high to the ignominious $59,930 swing low, followed by a sharp bounce on what one might call “heavy volume,” though one suspects it’s more a case of desperate souls clutching at straws.

Price, that fickle minx, presses against daily resistance between $70,000 and $72,000, while key daily support remains at $59,930, with interim footing near $64,000 to $65,000. Structurally, the pattern of lower highs is as intact as a Victorian maiden’s virtue, keeping the higher timeframe bias neutral to bearish unless $72,000 is reclaimed with the authority of a colonial governor. This is not trend reversal territory – yet.

On the four-hour chart, bitcoin compresses within a tightening range, like a corset on a particularly stout lady, after forming a local bottom at $65,620. Price has carved slightly higher lows but faced rejection at $70,937 and again in the $68,500 to $69,500 zone. Current support sits between $65,500 and $66,000, while resistance is layered between $68,500 and $69,500. This type of compression, following a bounce, often precedes expansion. Whether that expansion resolves higher toward $70,937 and $72,000, or rotates lower toward $63,000 and potentially $59,930, will depend on momentum and participation. For now, the range rules the tape, much like a domineering aunt at a family gathering.

The one-hour chart shows a short-term uptrend from $65,600 to $68,300, followed by a clear rejection near $68,300. A pullback candle signals slowing momentum, and volume does not reflect aggressive breakout conviction. In other words, the market tested the ceiling and found it sturdier than a British stiff upper lip. Without a decisive close above the $69,000 to $69,500 region on a strong four-hour structure, upside attempts risk fading back into the mid-range. Intraday traders may enjoy the volatility, but breakout traders are still waiting for confirmation that has yet to arrive, much like a guest at a party waiting for the host to serve dinner.

Oscillators, those fickle indicators, paint a picture as nuanced as a Waugh novel. The relative strength index (RSI) reads 36, neutral and not yet in oversold territory. The Stochastic oscillator stands at 46, also neutral. The commodity channel index (CCI) registers −56, maintaining a neutral posture, while the average directional index (ADX) at 58 suggests trend strength but without directional clarity in this context. In short, they are as indecisive as a debutante at her first ball.

The Awesome oscillator prints −9,884, neutral, and momentum shows −1,392 with an upside bias. The moving average convergence divergence (MACD) level at −4,308 reflects upward crossover momentum within a broader corrective environment. Oscillators, in short, are not panicking – but they are not celebrating either. They are, one might say, maintaining a stiff upper lip.

Moving averages, however, remain firmly overhead, like a cloud of disapproving aunts. The exponential moving average (EMA) and simple moving average (SMA) (10) sit at $68,247 and $67,769, respectively, both above the price. The EMA and SMA (20) stand at $71,201 and $69,683, reinforcing near-term resistance. Higher still, the EMA and SMA (30) at $74,176 and $75,404 extend the ceiling, followed by the EMA and SMA (50) at $78,637 and $82,188. The EMA and SMA (100) at $85,870 and $85,876, along with the EMA and SMA (200) at $92,807 and $99,393, point to the broader downtrend. Until price begins reclaiming these dynamic levels, rallies risk looking more like relief than reversal, much like a brief respite from a tedious dinner party.

Bull Verdict:

Bitcoin must decisively clear $69,500 on a strong four-hour close and reclaim $70,937, with expanding volume, to build momentum toward the $72,000 daily structure break. A confirmed move through $72,000 would invalidate the series of lower highs on the daily chart and shift the higher timeframe bias away from neutral-to- bearish, opening the door for a broader structural recovery rather than another short-lived relief bounce. One can only hope the bulls have the fortitude to see it through.

Bear Verdict:

Failure to hold the $65,500 to $66,000 support zone would expose $63,000 as the first downside objective, with a high-probability retest of the $59,930 major swing low if momentum accelerates. With price still trading below all key exponential moving averages (EMA) and simple moving averages (SMA) from the 10-period through the 200-period, and daily structure defined by lower highs, the macro posture continues to favor downside risk unless proven otherwise. The bears, it seems, are lurking in the shadows, ready to pounce.

FAQ ❓

- What is Bitcoin’s price on Feb. 20, 2026? Bitcoin is trading at $67,411, consolidating within a $65,000 to $70,000 range after a sharp bounce from $59,930. A most precarious position, one might say.

- What are the key resistance levels for Bitcoin right now? Immediate resistance sits between $68,500 and $69,500, with major daily resistance at $70,937 and $72,000. Formidable barriers, indeed.

- What are the critical support levels for Bitcoin? Strong support is located between $65,500 and $66,000, with major downside risk toward $59,930 if that zone fails. A precipice, if ever there was one.

- Is Bitcoin in a bullish or bearish trend? The daily structure remains neutral-to- bearish, as price trades below key exponential moving averages (EMA) and simple moving averages (SMA) despite short-term momentum stabilization. A most uncertain outlook, to be sure.

Read More

- Gold Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Silver Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2026-02-20 17:08