Ah, the enigmatic Bitcoin, trading at a rather precise $107,259, with a market capitalization that could make even the most stoic of souls ponder—$2.13 trillion, as of this fateful day, May 25, 2025. In the last 24 hours, a staggering $24.98 billion has exchanged hands, with prices oscillating between $106,954 and $109,225, a reflection of the chaotic dance of market volatility and the fervent engagement of its participants.

Bitcoin

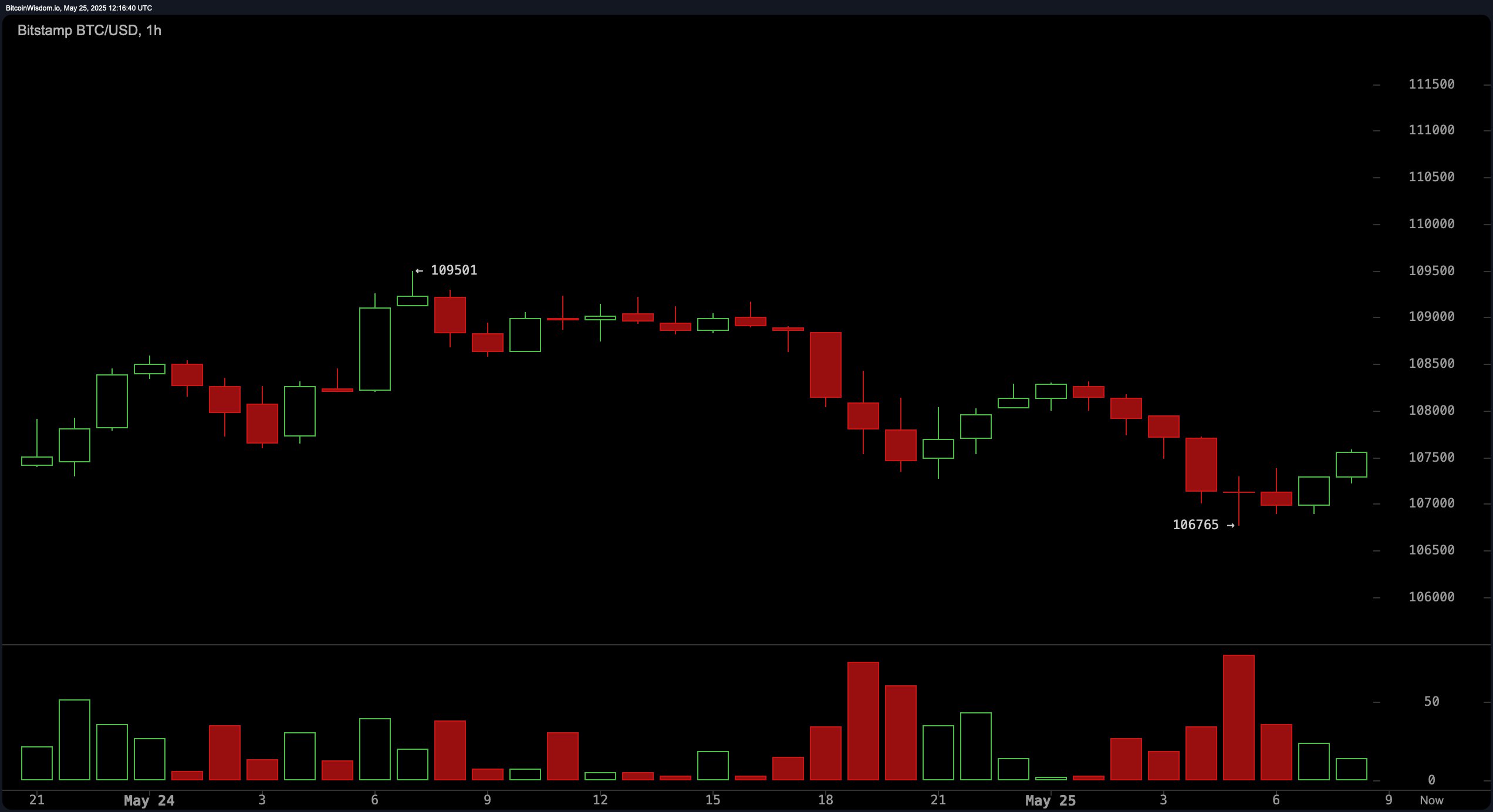

Behold the hourly BTC/USD chart, a veritable tapestry of human emotion, where Bitcoin seeks to find solace after a brief descent, stabilizing around $106,765. Recent price movements whisper of a potential double bottom, or perhaps a subtle bullish divergence, as if the market itself is caught in a philosophical quandary. The volume, once a roaring beast, now declines on downward moves, yet shows a flicker of life with the emergence of green candles—could this be a sign of a momentum shift? For the daring intraday traders, scalping opportunities beckon between $107,000 and $107,300, with tight stops below $106,700. Cautious souls, however, may wish to wait for a break above $108,000, targeting a near-term goal of $108,800 to $109,500, all while trailing stop-losses as the price ascends like a phoenix from the ashes.

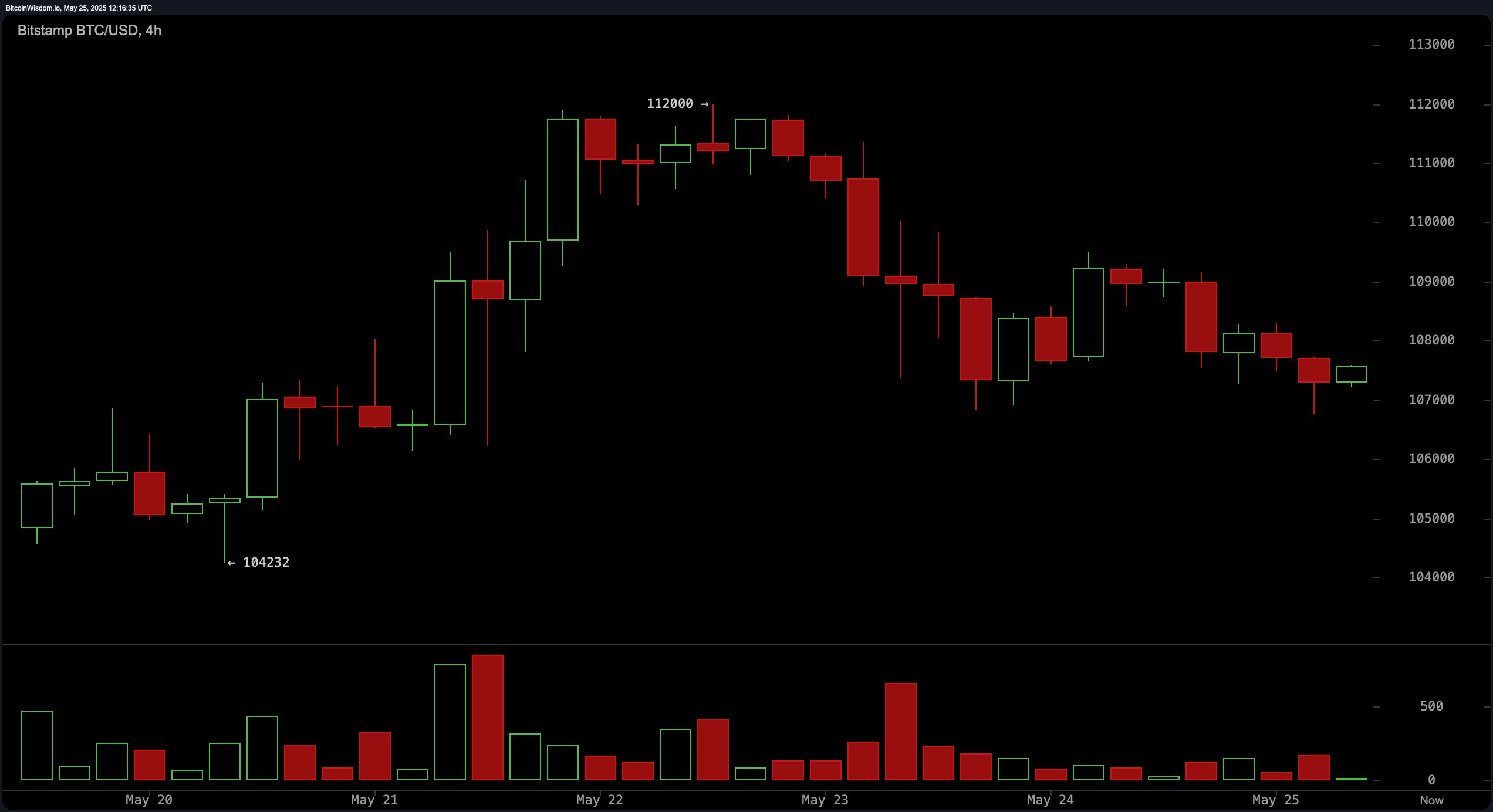

On the 4-hour chart, our dear Bitcoin follows a rounded top pattern, initiating a downward spiral post the lofty $112,000 peak. A series of lower highs and lows emerges, with bearish volume surging like a tide during the fall from $111,000 to $107,000, a testament to the dominance of sellers. Short-term traders may find a glimmer of hope if the price rebounds from the $106,500–$107,000 region, provided the sell volume diminishes. Conversely, a bullish crossover above $108,500, accompanied by supporting volume, could signify a valid entry point for the hopeful. Potential exits lie within the $109,500 to $110,000 range, yet a decisive move above $110,000 is essential to alter the current narrative.

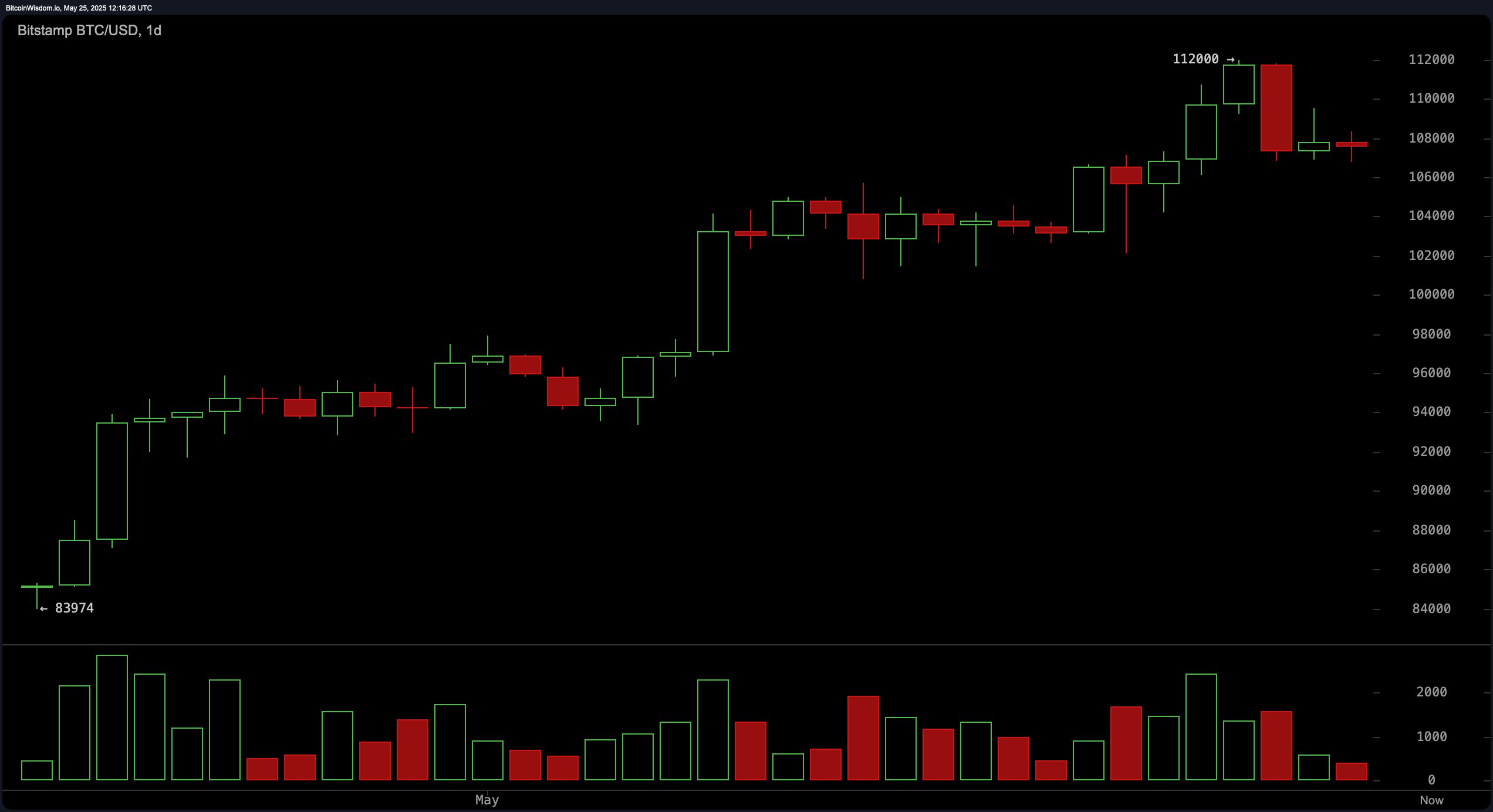

From a daily perspective, our beloved Bitcoin (BTC) remains ensconced in a broader uptrend, despite the rejection at the psychological barrier of $112,000. Support, like a comforting friend, lies between $104,000 and $106,000, a region to observe for signs of stabilization and possible bullish reversals. The volume data from this timeframe reveals a surge in selling during the retreat from $112,000, indicative of profit-taking rather than structural frailty. Swing traders, with their keen eyes, should seek strong bullish confirmation near the $106,000 mark before embarking on long positions, with the $112,000 resistance as their beacon of profit realization.

As we delve into the realm of key oscillators, most indicators present a picture of neutrality, albeit with subtle bearish undertones. The relative strength index (RSI) sits at 63, embodying a non-committal stance. The Stochastic oscillator and the commodity channel index (CCI) linger at 60 and 81, respectively, both suggesting a neutral momentum. The average directional index (ADX) stands at 33, revealing a lack of dominant trend strength. Yet, the momentum indicator at 3,575 and the moving average convergence divergence (MACD) at 3,700 signal sell actions, hinting at short-term bearish pressure that traders must consider in their existential deliberations.

Ah, the Fibonacci retracement levels, those mystical lines that delineate crucial support and resistance zones across all timeframes. On the daily chart, key levels include 38.2% at $101,294 and 50% at $97,987, both acting as potential accumulation zones should further declines occur. The 4-hour chart emphasizes support between $107,199 (61.8%) and $108,116 (50%), aligning with intraday bounce zones. Meanwhile, the hourly chart marks critical retracements at $107,810 and $108,133, strengthening the case for near-term support around $107,800, particularly for traders watching for a rebound.

As we ponder the significance of moving averages (MAs), they continue to support a bullish longer-term outlook. All exponential moving averages (EMAs) and simple moving averages (SMAs) from 10-period to 200-period are currently aligned in buy mode, as if the universe itself is conspiring in favor of the optimistic. Short-term signals are evident with the 10-period EMA and SMA both above $106,890. Longer-term confidence is bolstered by the 200-period EMA at $89,658 and SMA at $93,966, underscoring a broad upward price structure. This layered support suggests that unless significant downside pressure emerges, the overall trend remains constructive, giving investors reasons to remain optimistic, or at least to chuckle at the absurdity of it all.

Bull Verdict:

The alignment of all major moving averages in buy territory, alongside the potential double-bottom formation on the hourly chart, favors a bullish continuation. If Bitcoin holds above $107,000 and reclaims the $108,500 level with volume confirmation, a renewed attempt at $112,000 appears not just viable, but almost inevitable. Longer-term trend structures remain intact, supporting upward momentum barring any macroeconomic shocks, or perhaps a sudden existential crisis.

Bear Verdict:

Despite the upward trajectory on broader timeframes, the recent price rejection at $112,000 and sell signals from the momentum indicator and moving average convergence divergence (MACD) suggest a note of caution. Failure to hold support near $107,000 or a break below $106,700 could accelerate a move toward deeper retracement levels at $104,000 and $101,294, exposing Bitcoin to further correction, much like a tragic hero in a Dostoevskian tale.

Final Take:

Bitcoin finds itself at a technical crossroads, with its bullish structure still valid but beset by short-term headwinds. Traders must remain adaptive—favoring long setups above $108,500 while preparing for deeper support testing if $106,700 fails. Confirmation through volume and price action is essential before committing to directional trades, for in this volatile phase, risk management remains paramount, much like the moral dilemmas faced by our favorite characters in the great Russian novels.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

2025-05-25 16:58