Lo! Behold the tumultuous dance of the digital coin, Bitcoin, whose fate hangs in the balance as it teeters between the abyss of despair and the summit of glory. The very fabric of its existence is woven with the threads of technical analysis, on-chain whispers, and the capricious whims of the market’s great behemoths-those sly creatures, the whales, who have long since sipped from the cup of profit, leaving behind a trail of liquidity and treachery. 🐙

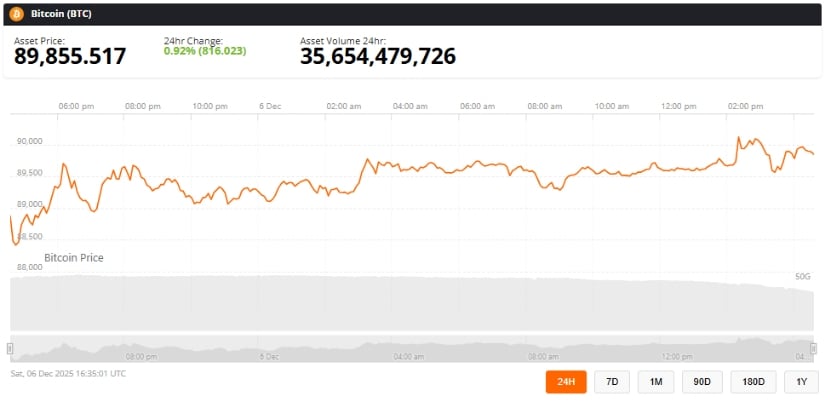

Bitcoin Price Today

Behold, the noble Bitcoin (BTC) now rests at $89,855, a mere 0.92% above its former self, as if sighing in relief after a harrowing ordeal. With a trading volume of $35.65 billion, it is as though the market itself has taken a deep breath, yet the specter of $88,000 looms like a shadow, a testament to the resilience of its supporters. 📉

Observe the cunning of the sellers, who have repeatedly been repelled by the $88,200 threshold, their efforts as futile as a moth attempting to pierce the veil of the moon. Yet, the $90,000 barrier remains an unyielding fortress, its gates guarded by the specters of past failures. One might say the market is a fickle lover, ever reluctant to commit. 💔

Indeed, the wise trader Ted, whose insights are as rare as a unicorn in a field of daisies, has noted that the retest of $88,000 was but a fleeting moment, a whisper in the wind. To reclaim $90,000 is to seize the very soul of the market, or so the sages of the crypto world claim. A failure to do so, they warn, may send the price tumbling back into the arms of $87,000-$88,000, where the crowd gathers like moths to a flame. 🦋

On the daily chart, the Binance price action reveals a supply wall of such magnitude that even the mightiest of bulls may falter. A breakout, if it comes, could unlock a path to $95,000, yet without the alchemy of spot demand or ETF inflows, the market may remain in a state of stasis, a prisoner of its own making. 🧊

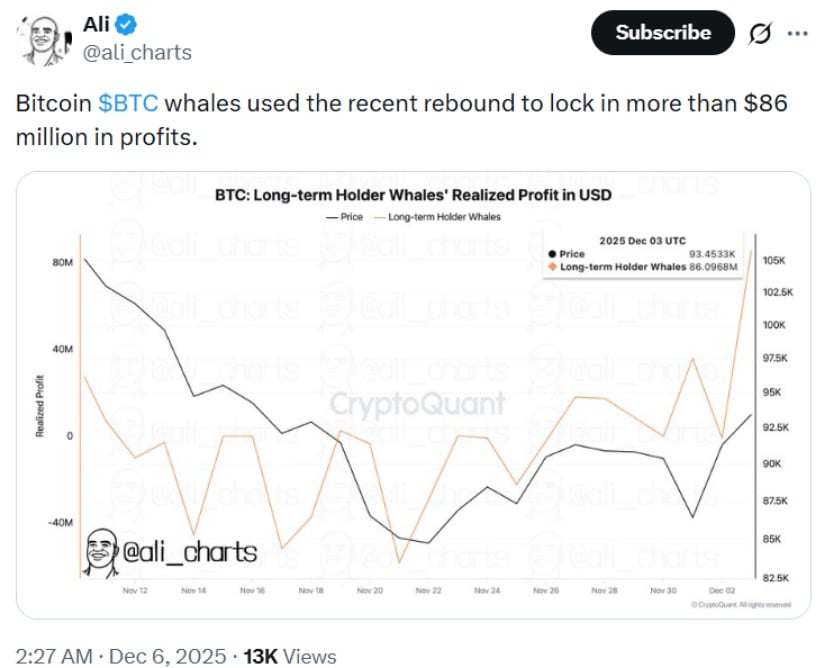

Whales Realize $86M in Profits

Lo and behold, the on-chain data from CryptoQuant reveals a surge of realized profits on December 3, as the whales, those ancient and cunning beings, seized their moment of glory, securing over $86 million in gains. This is but a continuation of a timeless pattern, where long-term holders, like the wise old owl, sell into strength during the tempests of volatility. 🦉

Though this act may momentarily stifle the bullish fervor, it does not herald a new era of despair. Rather, it is a liquidity reset, a moment of reflection for the market, as it digests the chaos of the past. The whales, ever the masters of their craft, know that the true test lies not in the immediate, but in the long arc of time. 🕰️

Historically, these profit-taking episodes, especially near the peaks of the market, have often preceded short-term corrections, yet they rarely alter the grand design unless accompanied by the fading of ETF inflows or the weakening of spot demand. The recent spike, as BTC approached the $93,500 region, is but a echo of the past, a reminder that the market is a cycle of rebirth and decay. 🌱

Technical Indicators Suggest a Possible Bounce

From the vantage point of technical analysis, the intraday charts reveal a mixed but slightly hopeful tapestry. The esteemed analyst CryptoAnalystSignal describes the current setup as a descending channel on the 1-hour timeframe, with price touching the lower boundary, poised for a potential breakout. It is as if the market itself is holding its breath, waiting for the fateful moment. 🌬️

Key insights from the chart’s analysis:

-

The RSI, that faithful servant of the market, hovers at lower levels, a sign of seller fatigue and the possibility of a rebound. 📈

-

The $88,200 support zone, a beacon of hope, continues to generate consistent reactions, as if the buyers are defending it with the zeal of a knight in battle. 🛡️

-

BTC approaches the 100-period moving average, a line that has often served as a magnet during moments of stabilization. 🧭

How Bitcoin Could React Next

Bitcoin’s next move, dear reader, hinges upon its ability to reclaim the $90,000 resistance, a task as daunting as scaling the Himalayas. A confirmed breakout would signify renewed buyer aggression, drawing the attention of momentum traders who watch BTC today with the fervor of a pilgrim seeking enlightenment. 🙏

However, should it fail to break through, the price may retreat once more toward the $87,000-$88,000 area, where liquidity is dense as the heart of a forest. These zones, as history has shown, offer both the promise of rebound and the threat of breakdown, depending on the whims of ETF flows, broader risk sentiment, and the ebb and flow of spot demand. 🌊

For now, Bitcoin remains in a state of neutral but fragile equilibrium-supported by the steadfast demand at $88K, yet constrained by the equally formidable supply near $90K. It is a dance of tension, a performance of uncertainty. 🎭

Final Thoughts

The rebound from the $88,000 support zone is a testament to the active buyer interest, yet the specter of whale profit-taking and the persistent resistance at $90K continue to cast a shadow over its ascent. Until BTC can reclaim this level with conviction, the market remains locked in a tight mid-range structure, a prisoner of its own indecision. 🧩

With traders watching ETF flows, liquidity maps, and the broader Bitcoin price prediction trends, a decisive break above $90K could indeed reset the bullish momentum. Conversely, continued rejection may trigger another revisit to the lower support band, shaping Bitcoin’s short-term trajectory in the days ahead. It is a tale as old as time, a story of hope, fear, and the eternal quest for the next big thing. 🌟

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- SUI ETF? Oh, the Drama! 🤑

- Bitcoin’s Wild Ride: Is It a Bull or Just a Bump? 🐂💰

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

- Pi Network’s New Apps: The Future of Crypto or Just Another Snake Game? 🐍

- The Hilarious Collapse of Floki: Can It Bounce Back or Just Keep Drooling?

- Crypto Chaos Unleashed: Shocking Gains and Ironic Downfalls 😂

2025-12-06 22:48