Ah, the ever-dramatic Bitcoin! It seems our dear friend has taken a rather unfortunate tumble, sliding down a slippery slope of 2.65%-a veritable nosedive from last week’s dizzying heights of $124,500. According to the ever-reliable data from Brave New Coin, BTC is now playing a rather thrilling game of hopscotch between $115,008 and $118,519, showcasing volatility that would make even the most seasoned acrobat blush. 🎪

And let’s not forget Ethereum and its merry band of altcoins, who have decided to join the pity party, with ETH retreating over 6%. It appears traders are donning their defensive armor, preparing for the impending macroeconomic circus. 🎭

Technical Analysis: Bitcoin Tests 50-Day EMA

Now, let’s turn our gaze to the technical side of things, shall we? Bitcoin’s recent decline has brought its technical analysis into sharper focus than a spotlight on a stage. BTC has briefly flirted with the 0.618 Fibonacci retracement of its August rally and is now testing the waters at the 50-day exponential moving average (EMA). How thrilling! 💃

In a rather dramatic twist, over $30 million in long positions were liquidated as prices broke through key intraday supports. Analysts are cautioning that a sustained drop below the EMA could expose BTC to deeper losses, with $112,000 being the next major risk zone. Oh, the suspense! 🎢

Some traders, ever the optimists, are interpreting this sell-off as a healthy reset for the market. After all, who doesn’t love a good spring cleaning? The sharp decline has cleared out excessive leveraged positions, potentially setting the stage for a more stable recovery-if, of course, buying interest returns around the $115,000 support region. Fingers crossed! 🤞

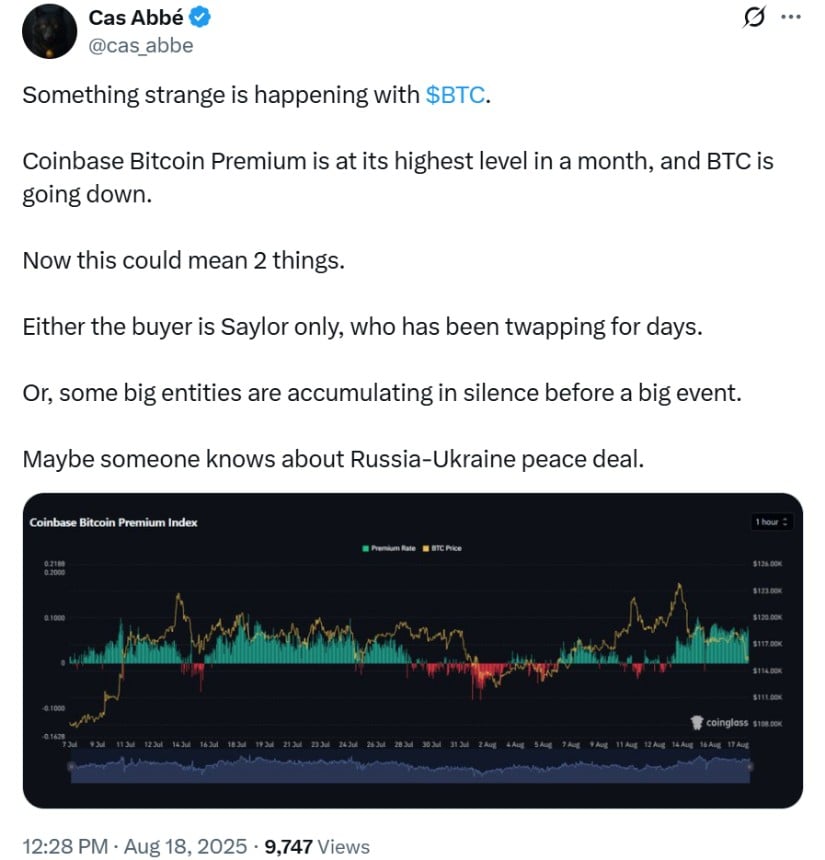

Institutional Activity: Whales and Treasury Firms Keep Accumulating

Despite the near-term turbulence, institutional accumulation remains a consistent theme in Bitcoin news today. Dutch asset manager Amdax has announced plans to list its new Bitcoin treasury vehicle, AMBTS, on Euronext Amsterdam, targeting an eventual holding of 1% of total BTC supply. Quite ambitious, wouldn’t you say? 🐋

Meanwhile, Tokyo-listed firm Metaplanet, often compared to MicroStrategy, has purchased another 775 BTC for approximately $93 million at an average price of $120,006. This brings its total reserves to a rather impressive 18,888 BTC. Talk about a lucky number! 🍀

“Market corrections offer us an opportunity to strengthen long-term positions,” said Metaplanet president Simon Gerovich in a recent statement. How very noble of him! Such moves highlight a growing conviction among Bitcoin whales and institutions, even as retail sentiment cools. 🥶

Macro Drivers: Inflation and Geopolitics Weigh on Risk Assets

Beyond charts and technicals, macro dynamics continue to steer Bitcoin’s trajectory like a ship lost at sea. Investors are closely watching the upcoming Jackson Hole symposium, where central bankers are expected to clarify monetary policy outlooks. Hopes of aggressive rate cuts have faded, dampening the risk appetite across equities and crypto alike. How dreary! ☔

Geopolitical uncertainty is another factor. A scheduled meeting between U.S. President Trump and Ukrainian President Zelenskiy has traders on high alert for developments that could ripple through global markets. Meanwhile, Washington has advanced its Strategic Bitcoin Reserve initiative, using seized Treasury-held BTC to bolster national digital holdings-a sign of growing state-level involvement in crypto assets. How very modern! 🏛️

Despite the bearish momentum, institutional demand and structural scarcity remain intact. The upcoming halving is expected to tighten supply, and consistent ETF inflows could help Bitcoin regain upward momentum. Fingers crossed for a miracle! 🙏

Looking Ahead: What’s Next for Bitcoin Price Prediction?

For now, Bitcoin price today finds itself at a crossroads, much like a character in a melodrama. Short-term sentiment hinges on whether BTC can defend $115,000 and the 50-day EMA. A decisive breakdown could trigger a slide toward $112,000, while a rebound may set the stage for another test of resistance above $118,500. The tension is palpable! 🎭

Looking further ahead, catalysts such as Bitcoin ETF news, the halving in 2025, and ongoing institutional accumulation are likely to define Bitcoin’s trajectory. As uncertainty lingers, traders are advised to monitor both technical signals and macro headlines for clues on BTC’s next move and long-term outlook. And remember, darling, in the world of crypto, anything can happen! 🎉

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Silver Rate Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- ZK Price: A Comedy of Errors 📉💰

2025-08-18 22:38