In a most theatrical turn of events, Bitcoin has once again ascended to the lofty heights of $105,000, a mere 24 hours after a rather dramatic plunge, courtesy of the ever-volatile macroeconomic circus. One might say it was a classic case of “who said what” between the illustrious Donald Trump and his erstwhile companion, Elon Musk, that sent the crypto market into a delightful tizzy, already reeling from its corrective phase.

As the dust settles and a semblance of stability returns—if only temporarily—our friends at Glassnode have graced us with their latest on-chain analysis, revealing the pivotal price levels that are currently the talk of the town in the Bitcoin bazaar.

Bitcoin Poised for a Breakout: Traders Eye $114K and $83K Like a Hawk 🦅

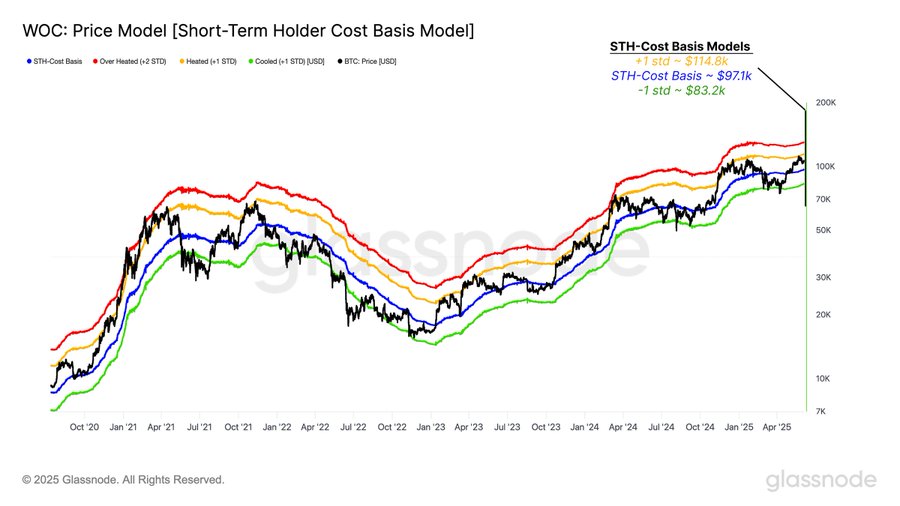

In a rather enlightening post on June 7, Glassnode has shared insights into the potential price movements of Bitcoin, employing the Short-Term Holder (STH) cost basis model, which, as the name suggests, reflects the average price paid by those who have recently dipped their toes into the Bitcoin waters—specifically, those who have acquired their coins within the last 155 days. How quaint!

This STH cost basis is not merely a number; it is a reflection of the risk appetite of the fresh-faced investors, who, bless their hearts, are often the most susceptible to the whims of price fluctuations. It serves as a barometer of market sentiment, capable of acting as both a fortress and a trap, depending on the direction of the wind.

According to the ever-reliable Glassnode, the current STH cost basis for Bitcoin is estimated at a rather precise $97,100. Utilizing the standard deviation bands from the Work of Cost (WOC) model, they have identified the $114,800 price level as the +1STD zone—a veritable hotbed of market activity.

Should Bitcoin breach this $114,800 threshold, one can expect a veritable stampede of buying pressure, propelling our beloved cryptocurrency into uncharted territories. However, should the price falter and dip below the critical support level of $97,100, we may witness a rather unfortunate retest at $83,200, which could spell disaster for the bullish structure currently in play.

Bitcoin Price Overview: A Comedy of Errors

As of this very moment, Bitcoin is trading at $105,745, reflecting a modest gain of 1.07% over the last 24 hours. Meanwhile, the daily trading volume has taken a nosedive of 34.27%, now valued at a staggering $38.66 billion. If Bitcoin can maintain its position above the STH cost basis of $97,100, we might just see a bullish push towards that tantalizing resistance at $114,800.

However, should the critical support at $97,100 crumble, we may be in for a rather rude awakening, with the specter of bearish consequences looming large.

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- Brent Oil Forecast

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- This Will Break the Internet: Is Bitcoin About to Explode Past Its All-Time High?

- Bitcoin’s Dramatic Dive: A Comedy of Errors and Accumulation! 💸😂

2025-06-08 17:12