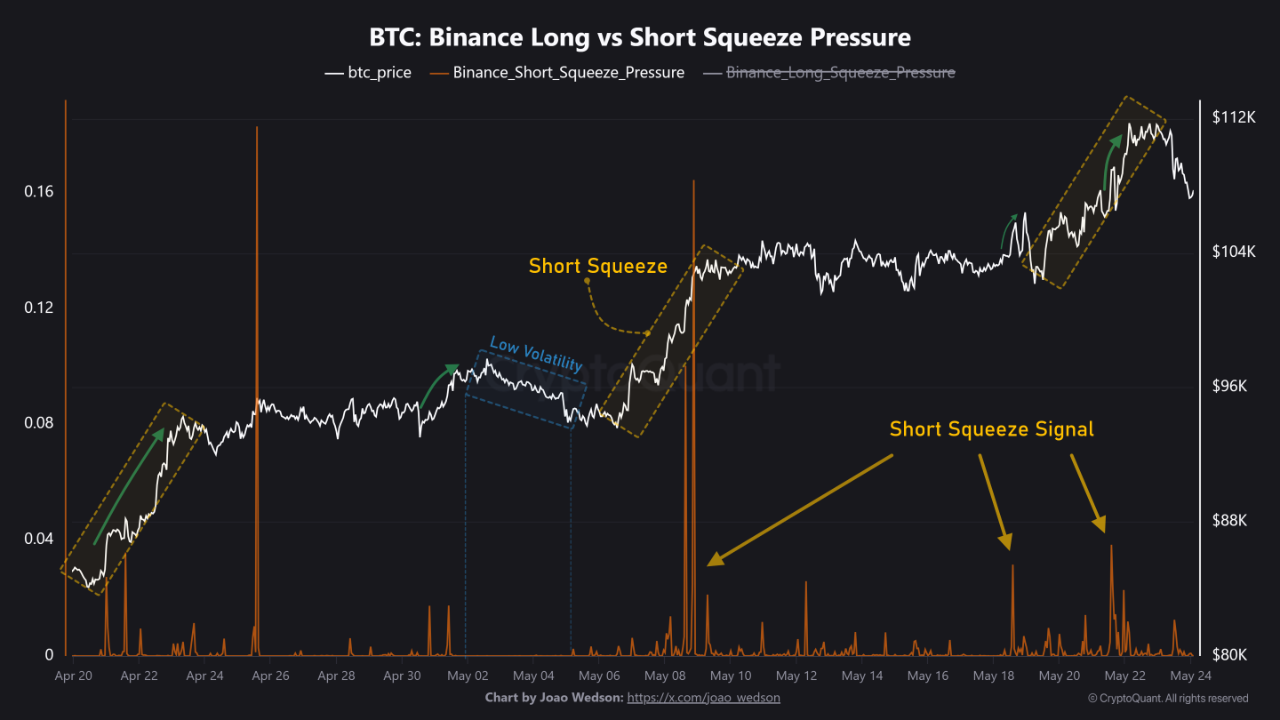

So, between April and May, this little indicator was like a drama queen, throwing multiple short squeeze signals—think of it as the moment when short sellers are sweating bullets, leading to some serious liquidations and, oh boy, a wild ride in Bitcoin’s price! 🎢

The chart (yes, the one that looks like a toddler’s drawing) shows how those spikes in the Short Squeeze Pressure metric (in orange, because why not?) have been the harbingers of strong upward moves in BTC’s price (the white line that’s just trying to keep it together).

For instance, around May 7–8, a dramatic squeeze signal was followed by a price breakout faster than you can say “to the moon!” 🚀 Confirming that this metric has some serious predictive powers—like a crystal ball, but less tacky.

But hold your horses! The current scene is more neutral than a British sitcom. Right now, there are no strong squeeze signals, which means short sellers are taking a breather. This balanced outlook suggests a possible cooling-off period—where price action might just chill out for a bit. 🥱

Wedson, our market oracle, points out that this metric is crucial for tracking when traders holding short positions might be forced to close up shop, often leading to rapid price shifts. It’s like a game of musical chairs, but with more money and fewer chairs.

While the short squeeze pressure has eased for now, history has a funny way of repeating itself—so don’t get too comfy! It could come back with a vengeance, bringing significant volatility along for the ride. Traders, stay alert! 👀

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Bitcoin’s Droll Dance: Profits Plummet While Prices Prance! 💃🕺

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Corporate Giants Dive into Bitcoin with $458 Million Bet: Is This the End of Fiat?

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Polygon’s Rise: A Most Curious Affair! 🧐

- Dogecoin’s Journey to $5: The Hilarious Truth Behind the Hype! 🚀💰

2025-05-24 23:28