Ah, mes amis, behold the relentless ascension of Bitcoin Dominance (BTC.D), that tireless actor stealing the stage and leaving altcoins squinting into the spotlight! While some market oracles whisper of a grand correction, perhaps a golden hour for altcoins to dance their way into favor, a wise sage advises caution—and a stout heart.

He insists that this current act diverges from the old script: Bitcoin holders clutch their treasures tighter than a miser with his last sou, disinclined to exchange their glittering bitcoins for those flashy but fickle altcoins.

Is Bitcoin’s Rise a Comedy of Errors for Altcoin Dreams?

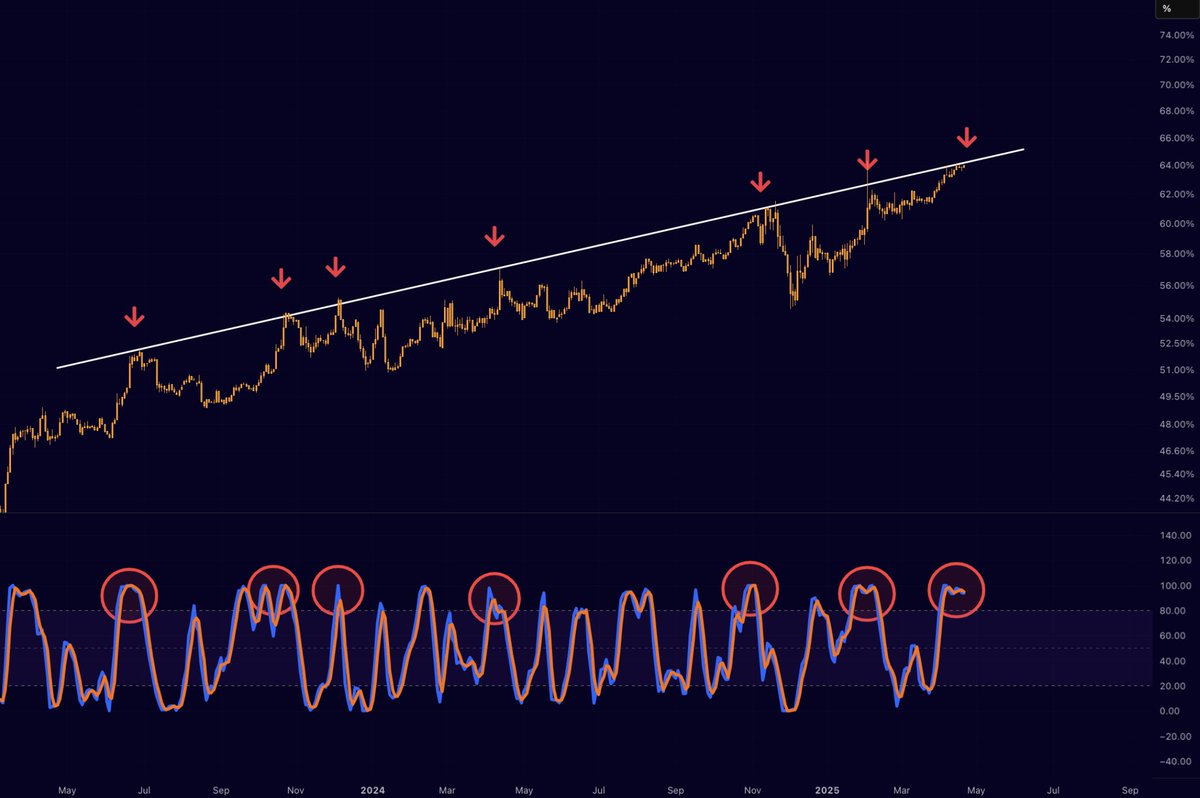

Last week, BeInCrypto murmured tales of Bitcoin Dominance soaring to heights unseen these four years past. Our dear BTC.D now basks at 64.5%, an 11% stretch since the year’s dawn—as if it had swallowed a spring tonic! 🍾

Prophets of the market foresee a crack in this armor. Monsieur Crypto, the self-styled arbiter of charts, foretells rejection from a fearsome trendline, a battlement where Bitcoin dominance has often found its stubborn match.

“Bitcoin dominance? Prepare for a slap in the face! When it wobbles, altcoins will spring forth like gladiators in the arena!” proclaims this sage, wielding his keyboard as a rapier.

An optimist of renown adds his bold voice to the chorus:

“Bitcoin Dominance plummets! Altseason approaches! All one requires is patience—and perhaps a dash of insanity,” chirps Merlijn The Trader, as if conjuring magic.

BeInCrypto parades similar forecasts like a carnival. Yet, not all jesters agree when this altseason masquerade will commence.

Enter Scott Melker, host of The Wolf Of All Streets Podcast, who snarls at these hopes with a grimace, asserting that this cycle is no mere repetition but a radical new drama.

On the grand stage of X (formerly Twitter), Melker expounded that once investors pirouetted gracefully between Bitcoin and altcoins, swaying dominance in their wake.

“Now, from the bustling bazaars of retail to the grand halls of institutions—and even the royal courts of governments—gold coins flow into Bitcoin’s coffers. Alas! Does one invest an ETF into a doge? Nay, mon ami.”

Melker laments that altcoins today fall not from strategic choice, but from the desperate hands of holders forced to sell—financial capitulation rather than strategic ballet.

Meanwhile, Bitcoin holders clutch their treasures with a dragon’s steadfast grip, refusing to unleash their hoard upon altcoins. This, Melker implies, demands altcoins to summon foreign capital if they hope to ascend from the ashes.

Such behavior reflects a grander evolution in the crypto court, with Bitcoin now aspired to as a fortress against the fires of inflation.

“Could it be, that Bitcoin sheds its reckless youth to don the noble guise of an inflation hedge? Only the gleam of gold and Bitcoin stand firm in the storm,” an observer mused, perhaps sipping absinthe.

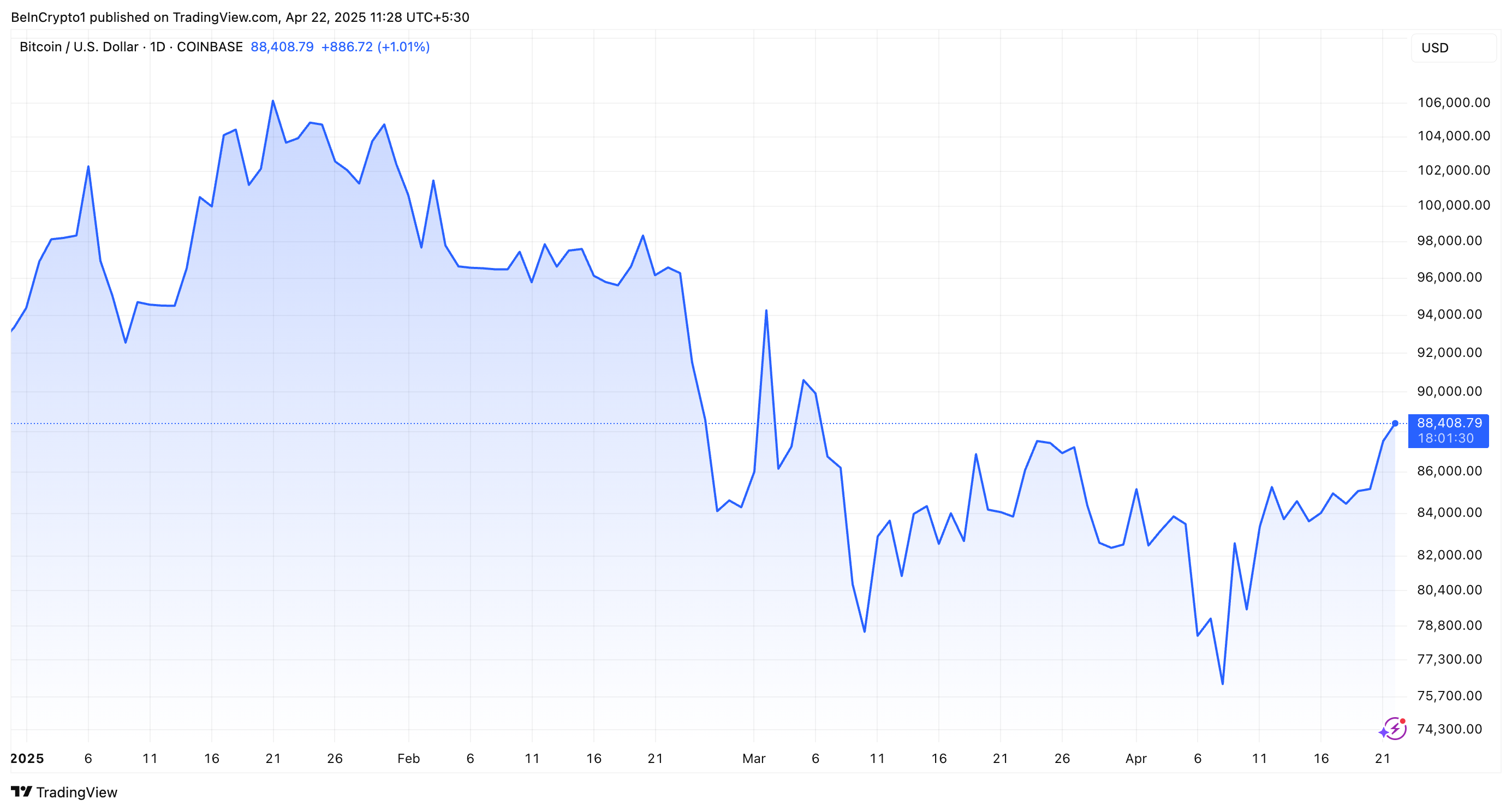

Meanwhile, the mighty US Dollar Index (DXY) took a nosedive to a three-year low, prompting Bitcoin to don its superhero cape and rally with vigor. Faster than a herald’s trumpet, Bitcoin smashed through $87,000—an echo of glory days on Liberation Day.

In the span of a mere day, our digital titan grew by 0.91%, trading now at a princely $88,408—a sum that makes mere mortals dream, and altcoins sigh.

And lo, golden sceptres rise as well! The dollar’s decline brought forth a dazzling surge in gold, crowning it anew at $3,456, a price to make even kings envious.

“Gold’s ascent +47% in a year is no jest,” declares The Kobeissi Letter, sounding more like a royal decree than mere market talk.

Thus, it appears the tale is told: Bitcoin and gold, twin champions in the arena of uncertainty, claim their thrones as reliable sanctuaries. Meanwhile, altcoins wait in the wings, hoping their moment in the limelight does not prove but a fleeting farce. 🎭

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Jito’s Spectacular Rise: The Token That Just Won’t Quit! 🚀

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

2025-04-22 12:23