Oh, Bitcoin! Once the darling of digital dreams, now dipping below a modest $110,000 for the first time since early September. Yes, you read that right – it’s lost 5% on Thursday alone, as global risk-assets markets take a rather dramatic dive. But don’t worry, corporate demand for Bitcoin is as steady as your aunt’s unfashionable hairstyle, with US-based firms boldly capitalizing on this slump. After all, who doesn’t love a bargain in the crypto market? 😏

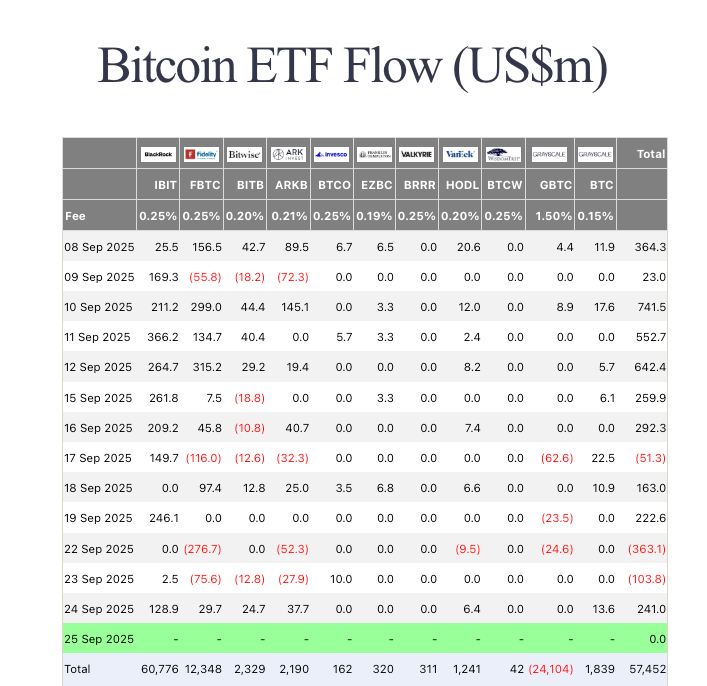

Bitcoin ETFs record $241 million inflows on Sept. 24, 2025 | Source: FarsideUK

And let’s talk about Bitcoin ETFs, shall we? They’ve somehow managed to record a robust $241 million in inflows on Wednesday. So despite the $466 million in outflows earlier in the week, things aren’t entirely grim. It’s a bit like getting a bouquet of flowers after a bad breakup – not exactly fixing things, but it helps you pretend everything’s fine for a moment. 😅

Leading the ETF pack, BlackRock’s IBIT ETF was the star, scooping up a cool $128.9 million. Not to be outdone, Ark Invest’s ARKB and Fidelity’s FBTC contributed $37.7 million and $29.7 million, respectively. Not a shabby showing, really. But it’s all a bit like the tortoise and the hare, right? 🐢

In other news, DCC Enterprises, ever the opportunist, announced yet another purchase of 50 BTC worth $5.5 million on Thursday, bringing their total stash to 1,058 BTC. CEO Norma Chu is feeling particularly bullish, doubling down on a goal of acquiring 10,000 BTC by the end of 2025. You know, just a casual million-dollar ambition. No biggie. 😎

Disciplined accumulation in any market conditions.

₿ +50 BTC added today🟠 1,058 BTC total holdings📈 +1,556% BTC yield since May

📄 Full update: #Bitcoin #BTC #CorporateTreasury #BitcoinTreasury $DDC

– ddcbtc (@ddcbtc_) September 25, 2025

Since launching its Bitcoin treasury in May 2025, DCC has raked in a hefty +1,556% BTC yield on its holdings. Impressive, if you like to watch people make money while the rest of us stare at charts and wonder where it all went wrong. 📊

Bitcoin Price Forecast: Elliott Wave Predicts A Sizable Correction Toward $100K

Ah, the dreaded word: correction. Bitcoin is currently consolidating near $109,600 after falling below the all-important $110,000 mark. Technical indicators are flashing a little red, with the RSI languishing at 37.17 – which, for those not familiar, means it’s got some further downside to cover before we hit the oversold stage. Nothing like a good market plunge to get the blood pumping! ⚡️

According to Elliott Wave theory (yes, another cryptic theory to add to the pile), Bitcoin has completed its five-wave cycle and is now on its way down the corrective pattern rabbit hole. You’ll want to pay attention to the $101,500 level, where the first extension of wave (c) lies. If that doesn’t hold, we’re looking at a potential dive to $91,352. How exciting! 😬

Bitcoin (BTC) Technical Price Forecast | TradingView

On the optimistic side, if Bitcoin can manage to reclaim the mid-Bollinger Band at $114,100, there’s hope for a rebound. But for now, macro headwinds seem to be making sure the crypto ship stays firmly afloat in choppy waters. Looks like we’re all in for a bumpy ride, folks. Hold on tight! 🎢

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Brent Oil Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Shiba Inu’s Lucie Warns: Fakes Are Out to Get You! 🐕🦺

- Bitcoin’s Crazy Ride: Will It Hit $175K or Just Leave Us Laughing? 🤣🚀

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

2025-09-25 23:27