Today in International Don’t-Tell-Your-Therapist-About-This News, the balance of Bitcoin crouching on crypto exchanges has shrunk down to the lowest it’s been. You know, fewer Bitcoins just hanging around like loafers at a Starbucks, window-shopping for an exit ramp. And, as the world holds its breath, one has to wonder—will this sudden disappearing act push BTC back over the majestic, mildly absurd $111,000 mark?

After an awkward tumble below $100k (which, in crypto years, is basically a decade-long crisis), Bitcoin pulled itself together with the pluck of a contestant who forgot their line on live TV and just started tap dancing. Now, it’s only about 4% shy of the mythical number, hovering like someone pretending not to care about an ex’s Instagram story. Meanwhile, the on-chain “sentiment,” which is tech bro for “vibes,” has never been more bullish. I’m not sure what a bullish vibe actually smells like, but it’s probably Axe body spray with notes of eternal optimism.

We Now Know Where All the Bitcoins Went

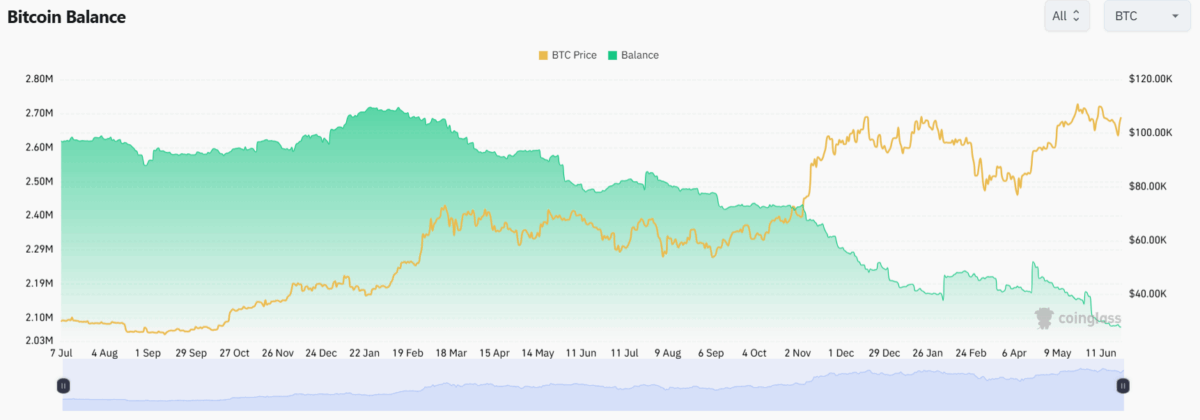

Coinglass, which is either a data provider or a lost subscription box for crypto-themed drinkware, claims Bitcoin balances on exchanges have hit an all-time low. Of the 2.07 million BTC left, Coinbase Pro is gripping 638,226 like a toddler clinging to a stuffed squirrel, with Binance in second place (535,797 BTC) and presumably practicing deep-breathing exercises.

The remaining 18 exchanges are holding onto about 895,270 coins collectively, because when Bitcoin goes out of style, you just know someone’s going to repurpose it into an NFT of a potted plant. All this points toward whales and investors going into Pokémon mode: gotta catch ’em all (then never, ever spend them).

The Chart That Launched a Thousand Tweets

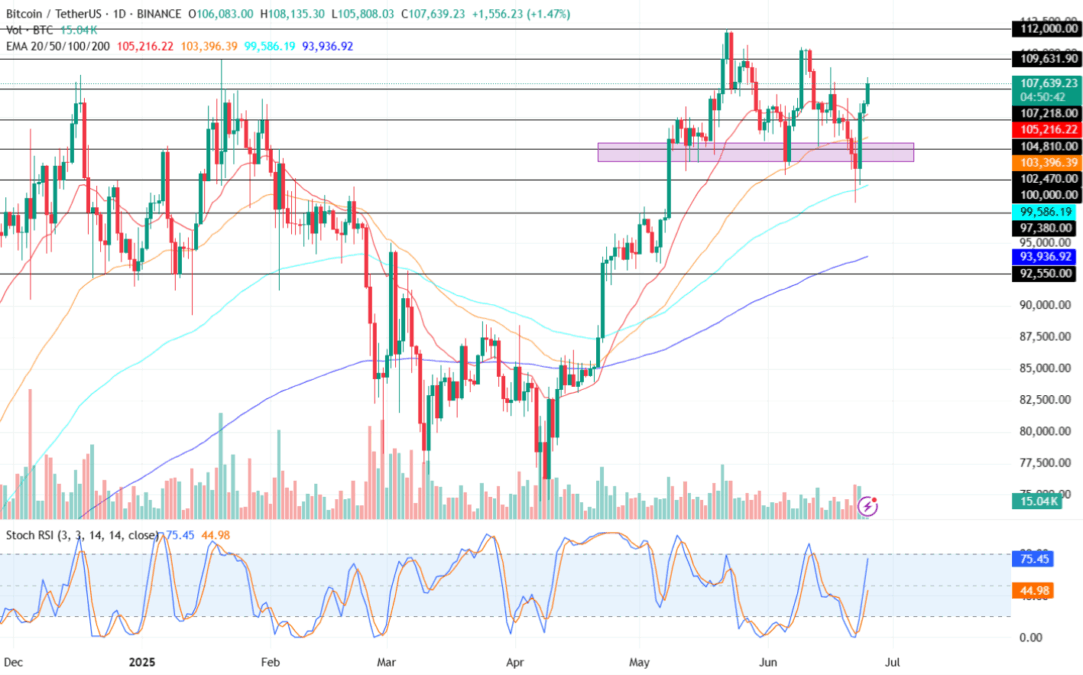

Is your pulse racing? Bitcoin just put in a gym montage, jumping 8% over three days, from $98,500 to $107,500—with trading volumes that make me suspect someone is out there clicking “refresh” for sport. Market cap is now $2.14 trillion, with Bitcoin’s dominance shooting over 65% for the first time since people remembered to water their houseplants in January 2021.

Let’s talk Exponential Moving Averages, because nothing says “party” like four squiggly lines that stress you out even more than your tax accountant. Every EMA on the chart—from 20 to 200—is now lagging under the price trend, basically waving white flags and mumbling about volatility. Investors everywhere are feigning understanding while frantically re-Googling “how does crypto work” (again).

Then, there’s the Stochastic RSI, which is now in a full-on upward sprint after breaking away from the “oversold” dungeon. The 3-day average trendline (apparently it’s blue, for those following along in color) is about to retest its “overbought” VIP lounge. This is supposed to mean things look sunny for Bitcoin, but in crypto, “sunny” usually comes right before someone gets a sunburn.

If Bitcoin keeps up this bullish routine, it could crash straight into resistance at $109,631, or even vault to $111,970, causing Twitter to implode under the weight of victorious rocket emojis 🚀. If, however, the vibes go sour—think, someone brought up politics at Thanksgiving—BTC could trip back to $107,218 or keep rolling downhill to $104,810, sobbing softly and promising to do better.

So, will Bitcoin make a comeback? Will it face-plant at the finish line? Will your cousin Chad ever stop DMing you laser-eye memes? Stay tuned. Same crypto time, same crypto channel. 🥸

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- This Blockchain Bridge Will Make You Say ‘Crypto, Seriously?’ 🚀

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Bitcoin’s Bumpy Ride: Will it Sink or Swim? Find Out Before Your Coffee Gets Cold! 🚀💸

- Pudgy Penguins: The Meme Coin That Dares to Be Different 🐧✨

2025-06-26 00:54