Ah, Bitcoin, that fickle darling of the digital realm, stood at $114,846 on the 13th of October, 2025, its market capitalization a staggering $2.29 trillion. The traders, those restless souls, had been busy-$84.28 billion in volume, a veritable tempest of activity, with prices oscillating between $113,696 and $115,792. A drama, indeed, played out in numbers and charts, as if the very fate of the world hung in the balance. Or perhaps, just the fate of a few wallets. 🤑

Bitcoin

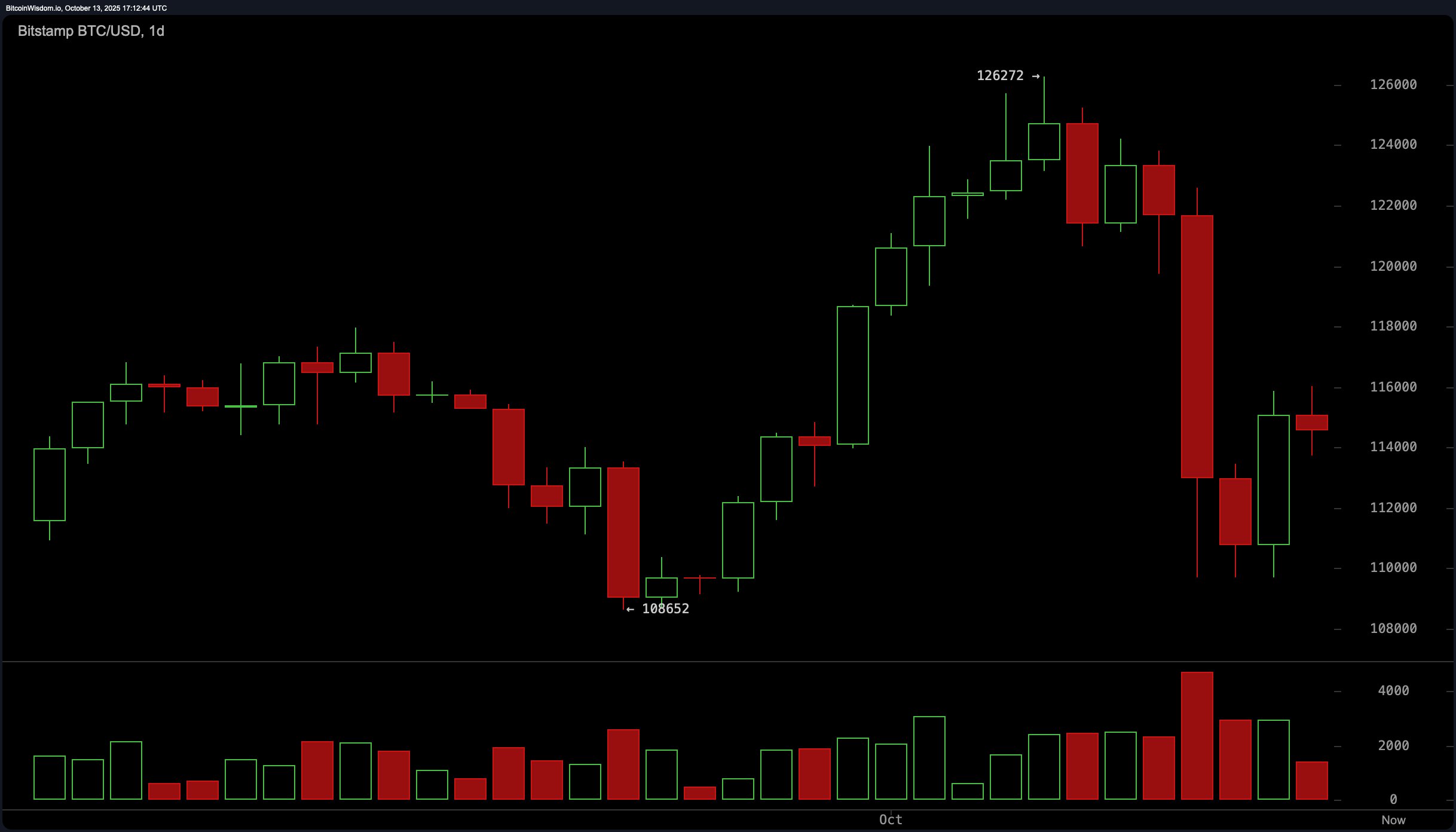

The daily chart, that grand canvas of financial destiny, reveals a tale of woe-a double top near $126,000, a bearish engulfing candle, and a subsequent plunge to $108,652. A short-lived rebound, like a fleeting smile on a somber face, failed to ignite sustained volume. The market, it seems, is indecisive, consolidating near $114,000-$116,000, as if pondering its next move with the gravity of a Tolstoy protagonist. 🧐

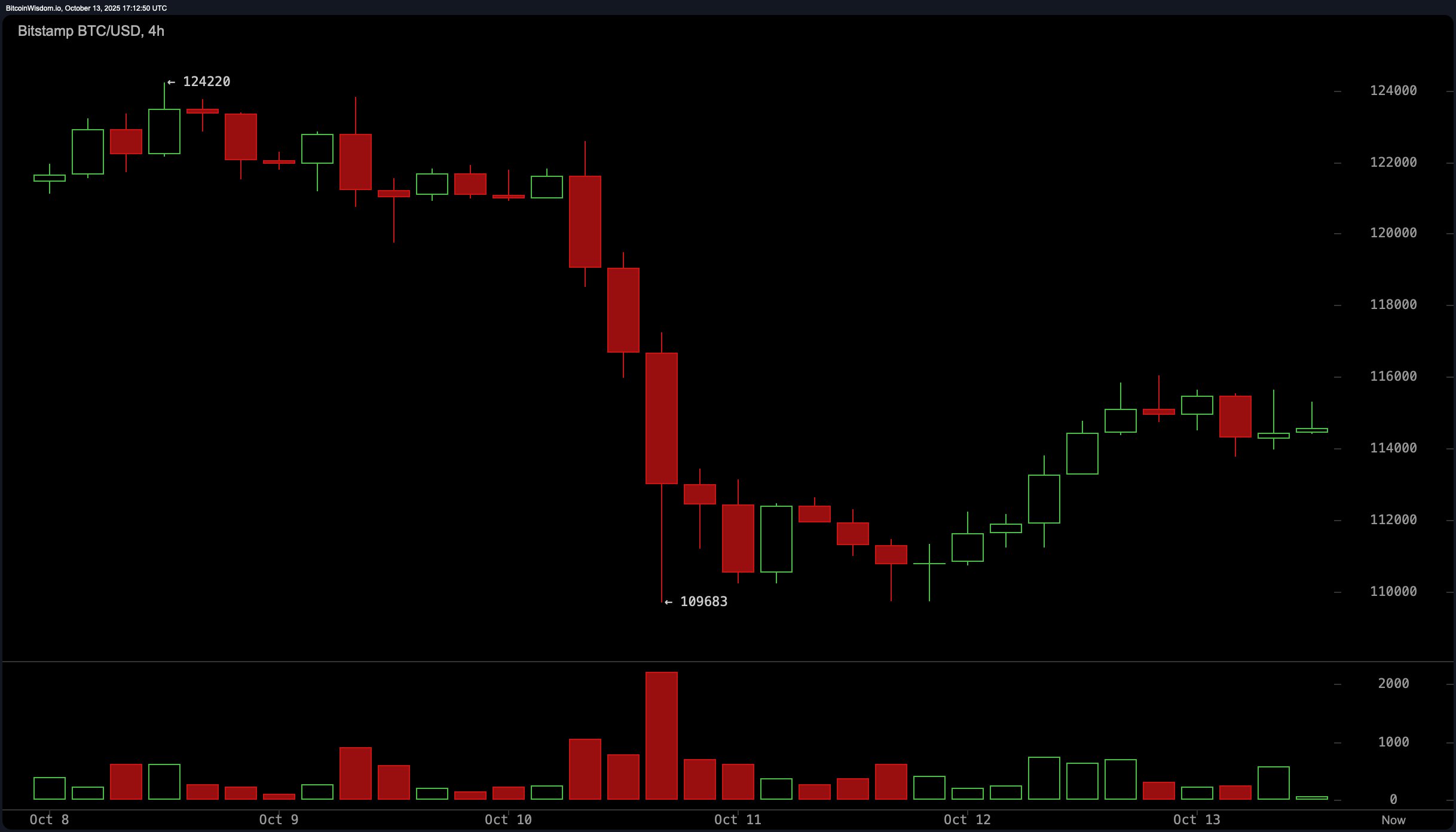

The 4-hour chart, a more intimate portrait, shows Bitcoin breaking out of a descending trendline, only to falter at $116,000. Volume, that fickle companion, has been declining-a sign of waning momentum or the quiet before the storm? The price, trapped in a holding pattern, awaits its cue, like an actor on stage, unsure whether to rise or fall. 🎭

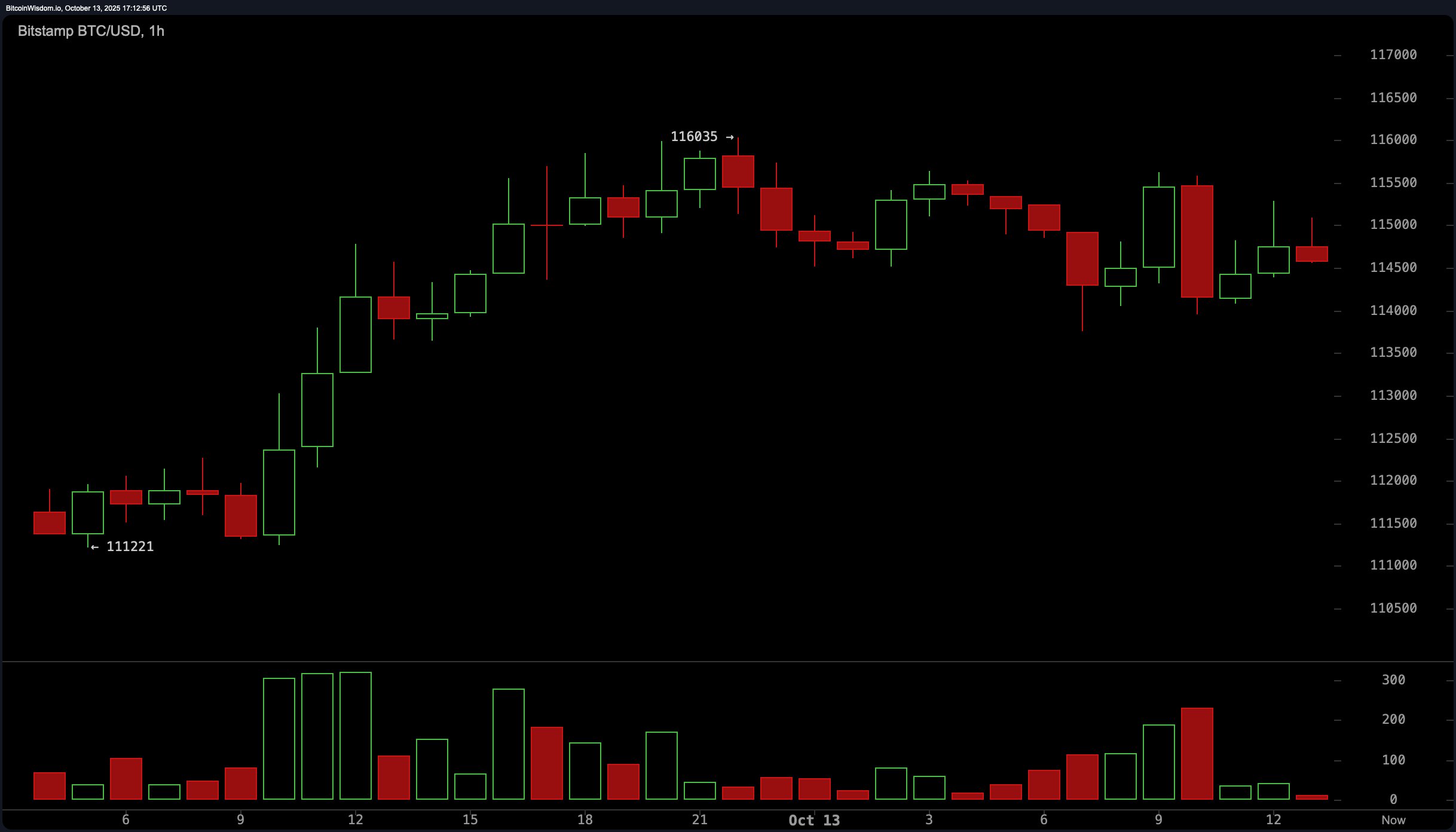

On the hourly chart, Bitcoin’s range-bound structure is as narrow as a Russian novel’s focus on the human condition. Rejections near $116,000 suggest resistance, while support lingers around $114,000-$114,500. Volume, ever the harbinger, has dried up-a prelude to a grand movement, perhaps? A breakout above $116,200 could lead to $118,000, but failure to hold $114,000 risks a deeper fall. The market, it seems, is as unpredictable as a Tolstoy plot twist. 🌀

Oscillator readings, those wise old sages of the market, paint a neutral picture. The RSI at 47, the stochastic oscillator at 24, and the CCI at −26-all suggest a lack of conviction. Yet, the awesome oscillator, momentum indicator, and MACD whisper of downside pressure. Moving averages, those steadfast guardians of trend, lean bearish in the short term but offer support in the long. Bitcoin, it seems, stands at a crossroads, awaiting the volume that will decide its fate. 🌪️

Bull Verdict:

Should Bitcoin reclaim $116,500 with volume, the bulls may yet have their day. A retest of $118,000-$120,000 could follow, a triumph of optimism over uncertainty. But such is the nature of markets-hope and despair, forever entwined. 🐂

Bear Verdict:

If $114,000 fails to hold, a retreat to $110,000-$108,000 looms. The bears, with their sell signals and short-term moving averages, stand ready to pounce. Yet, even in decline, there is beauty-a reminder that all things, even Bitcoin, are transient. 🐻

🧠 FAQ 🧠

- Where is Bitcoin trading now?

Bitcoin is currently priced at $114,846, consolidating between $113,696 and $115,792. A mere blip in the grand scheme of things. 📊 - What key level must Bitcoin break to move higher?

Bitcoin must reclaim and hold above $116,500 with volume confirmation. Easier said than done, no? 🚀 - What support level is crucial for Bitcoin bulls?

Holding above $114,000 is essential to prevent a drop toward $110,000-$108,000. A thin line between triumph and tragedy. 🎭 - Are technical indicators bullish or bearish today?

Momentum and moving averages lean bearish, while oscillators remain mostly neutral. A true Tolstoy novel of indecision. 📉

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Whale of a Time! BTC Bags Billions!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Riches or Fool’s Gold? 🤑

2025-10-13 21:58