Bitcoin, the golden child of the digital age, wavers at the edge of despair, teetering at $111,500 after a 4% plunge in a day and a 10% nosedive in a week, as CoinGecko’s ledger grimly records its fall from grace. The market, a restless beast, thrashes within a vast cage of uncertainty, its movements erratic yet directionless. Volatility reigns supreme, yet the tides of fortune refuse to rise or fall-stuck in a purgatory of indecision.

BTC: A Battle at the Fortress of Resistance

The $115,500-$116,000 zone, once a savior in shimmering armor, now dons the cloak of a villain, repelling Bitcoin’s feeble advances. Bulls, armed with hope and caffeine, eye $119,500 as their holy grail, while bears cackle at the thought of $107,300 becoming the new floor. Below that, the abyss yawns wider between $103,900 and $100,800-a chasm where dreams go to die.

“Nothing special today,” sighs Michaël van de Poppe, the weary oracle of crypto, as if the market’s chaos is merely Tuesday. “Just some standard chop here,” he adds, while the rest of us clutch our wallets and pray for mercy.

– CryptoMichNL, October 14, 2025 🤡

Michaël van de Poppe, the weary oracle of crypto, sighs, “Nothing special,” as if the market’s chaos is merely Tuesday. His words hang in the air like a drunkard’s promise: volatility will persist until the cows come home, and even then, they’ll demand a 20% cut.

Volume, the pulse of the market, beats steadily, yet the rhythm is maddeningly inconclusive. Traders, a pack of wolves in sheep’s clothing, circle like vultures, waiting for the inevitable feast.

$100K in Sight? Analysts Chart a Descent into Madness

Ali Martinez, with a chart as cryptic as a prophet’s scroll, warns of a potential descent to $100,000, asking, “What are the odds?”-a question that hangs in the air like a guillotine. His map of doom marks $108,000 and $106,500 as stepping stones, with $101,800 as the final resting place for the overconfident.

Ted, a sage in the land of crypto, points to the $110,000-$111,000 battleground, where the CME gap looms like a specter, whispering promises of either salvation or doom. “If Bitcoin holds this level,” he muses, “we could see a bounce back”-or a spectacular faceplant into the void.

“Mass liquidations are no longer signs of collapse but cleansing phases.”

If not, a move toward $107,000 may follow-a destination where even the bravest investors lose their nerve.

The Sinking Ship of Sentiment

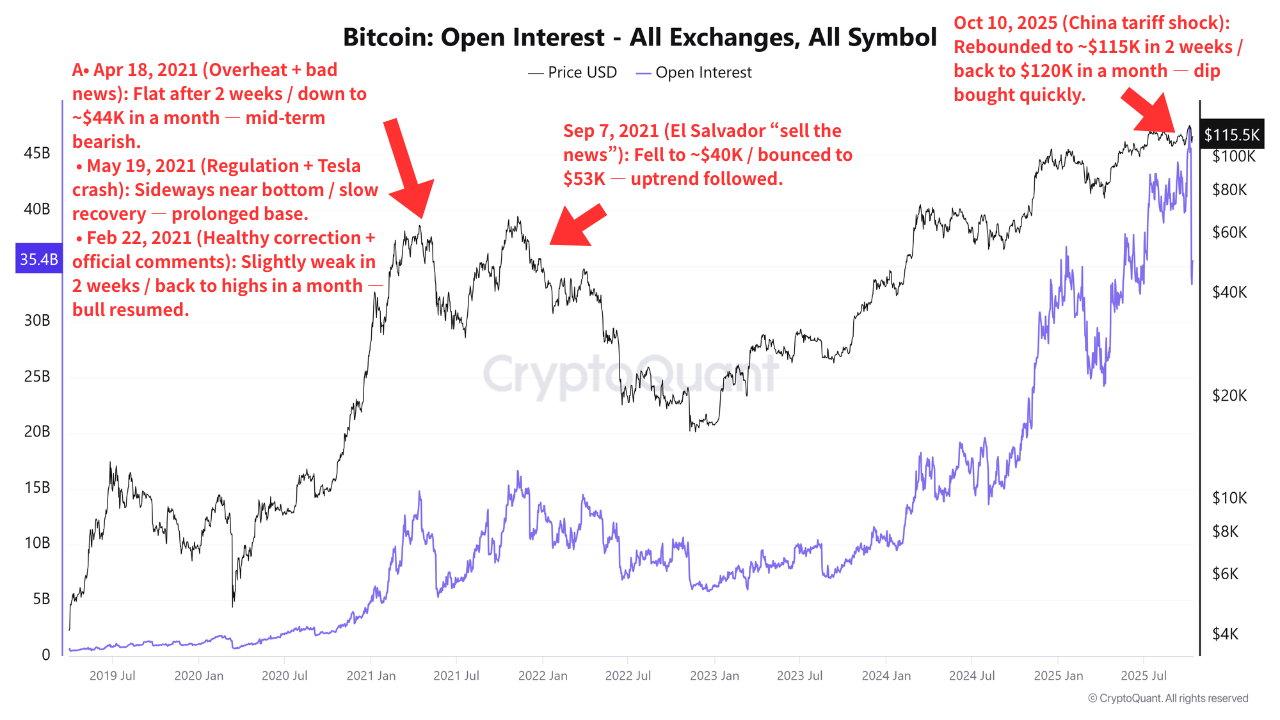

Social data reveals a collective soul in freefall, Bitcoin’s sentiment plunging to -1.55, a number so bleak it makes a rainy Tuesday in Siberia look cheerful. After the October 10 sell-off, triggered by trade tensions, the market’s mood darkened faster than a bear market in a blackout.

Yet, some on-chain seers cling to hope, citing history’s five great liquidation events as proof of Bitcoin’s phoenix-like resilience. “Mass liquidations are no longer signs of collapse but cleansing phases,” they declare, as if reciting a mantra to ward off madness.

Bitcoin’s recent crash erased $19 billion in open interest, a sum that could buy every crypto bro a new pair of NFT sneakers. Yet, as leverage resets and funding rates normalize, the market stirs like a dragon waking from its cave-hungry, volatile, and ready to play.

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Whale of a Time! BTC Bags Billions!

- Crypto Riches or Fool’s Gold? 🤑

2025-10-14 17:03