It’s like watching a squirrel on caffeine—Bitcoin wobbles between $103,997 and $104,281, as if unsure whether to leap or hide behind the tree. As of June 1, 2025, the mighty crypto giant boasts a market cap of a staggering $2.06 trillion, which is roughly equivalent to the GDP of a small moon. Over the past 24 hours, it’s traded around $15.8 billion worth of digital gold, bouncing within a narrow corridor of $103,127 to $104,947, suggesting it’s taking a breather after a modest stumble. Nothing like a good ol’ consolidation to keep the fans guessing!

Bitcoin

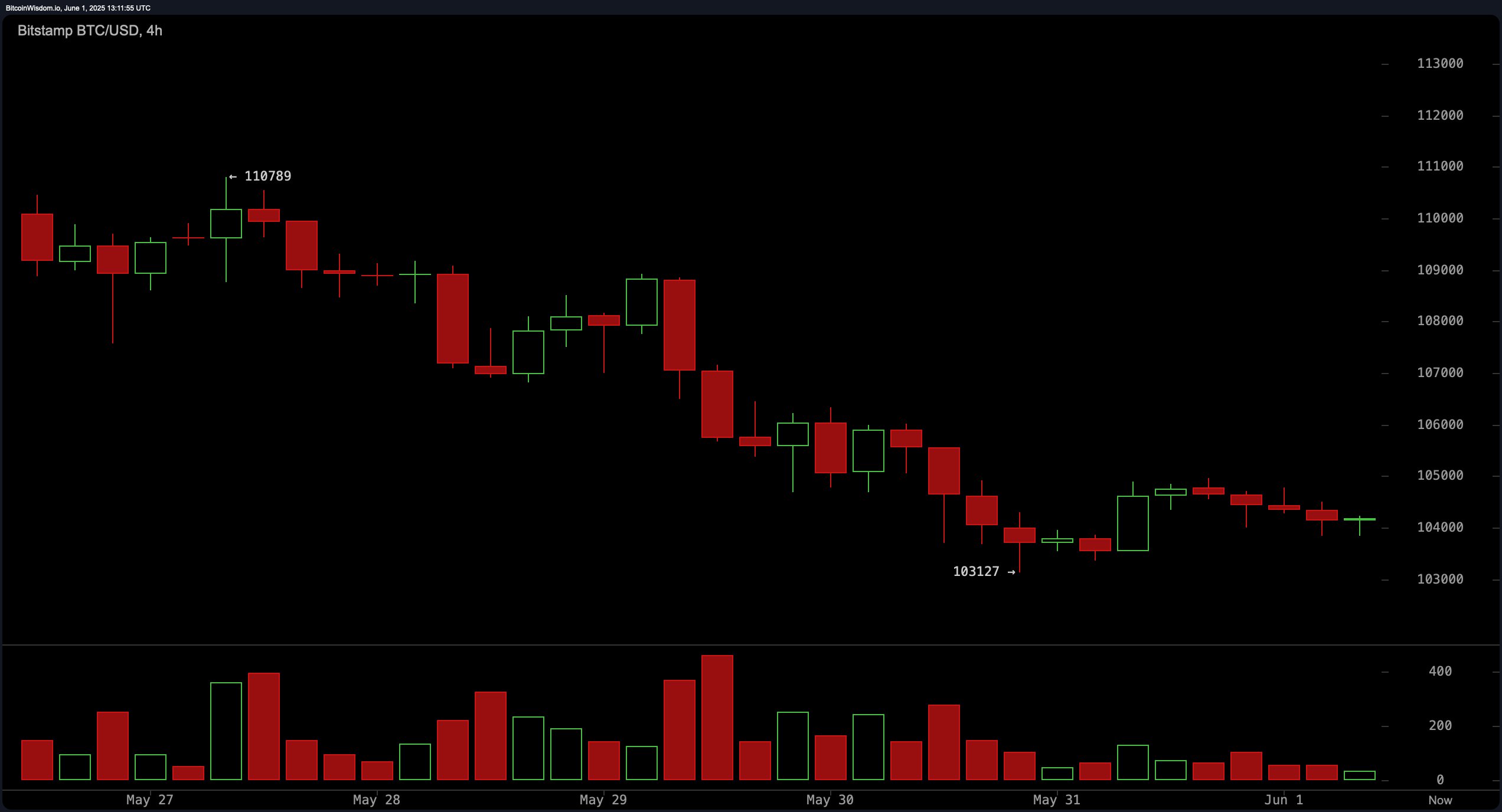

The hourly chart looks like Bitcoin’s doing the limbo—squeezing between $103,127 and $104,947, with a whisper of increased green candles hinting that the little critter might be hoarding energy. Early signs point towards an inverse head and shoulders formation, a fancy way of saying “Hey, I might go up soon!” If the volume joins the party with a bang, it could break free and dart above $104,900, maybe even punch through $105,000—perfect for short-term thrill-seekers. But beware: if it slips below $103,000, the bullish party might be over, and the crypto hamster wheel continues.

The 4-hour chart shows Bitcoin Eurovisioning in a downtrend—think of it as a rollercoaster that’s lost a few tracks. From a high of $110,789, it’s now playing the game of “Lower highs and lower lows,” with panic candles performing like a fire drill. The volume peaks during red candles suggest folks are selling faster than hotcakes at a festival, probably because they’re worried or just eager to escape. Still, if it can push above $105,000, it might just turn the tide and surprise everyone. But fail, and it might head back to the comfort zone below $100,000—because that’s just how markets roll.

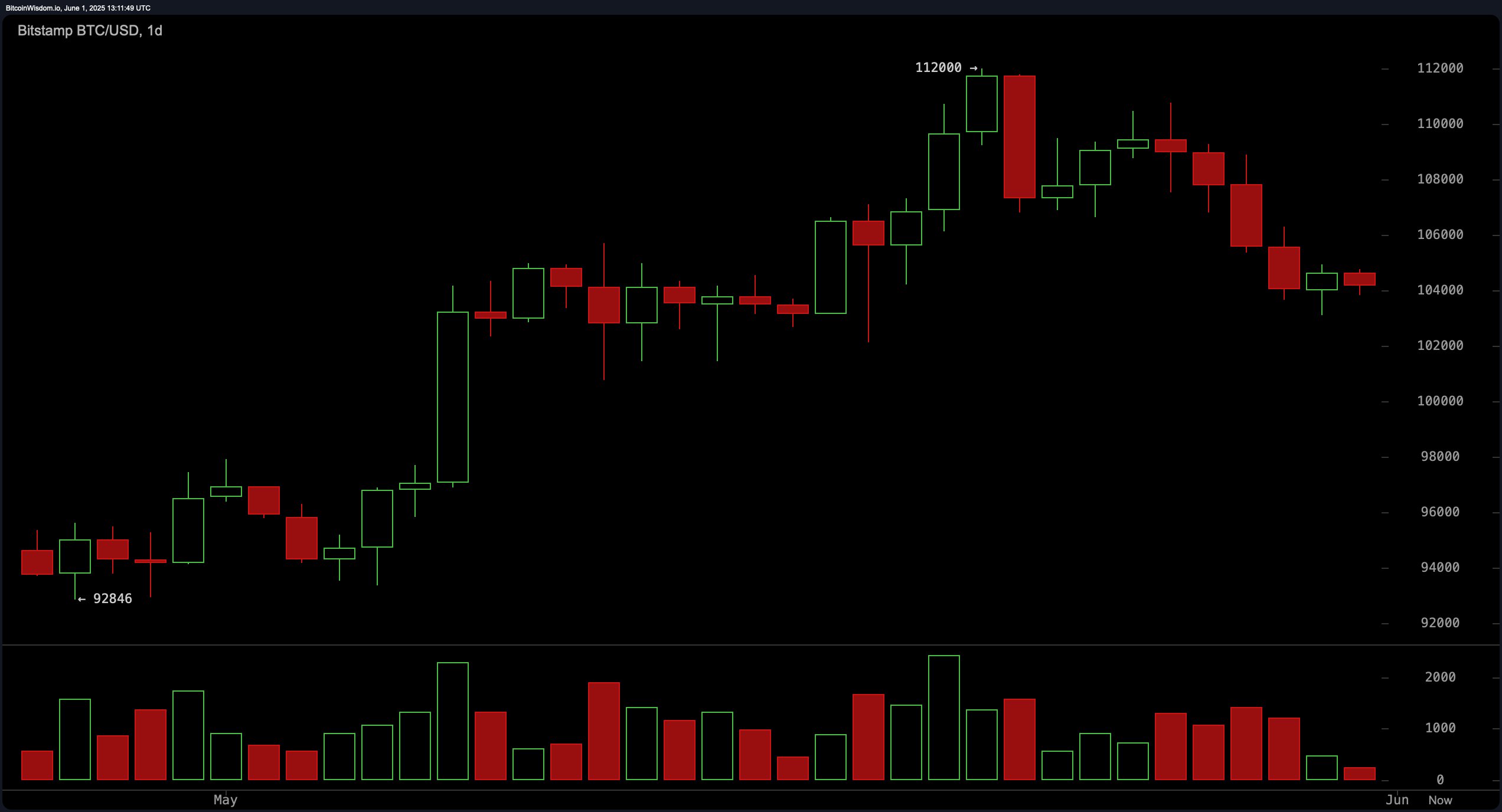

Zoom out to the daily view and Bitcoin’s showing off its long-term uptrend, from roughly $92,846 to nearly $112,000. But like a teenager’s mood swings, it’s now pulling back to the $104,000 neighborhood, giving traders a chance to yawn and sip their coffee. A bearish engulfing candle at the top hints this might just be profit-taking rather than a meltdown, with volumes tapering off like a dull Monday. If a bullish reversal patterns emerges with enough enthusiasm (read: volume), there’s hope yet—a sign of “maybe things will get better.”

Oscillators are playing hard to get—they’re neitherbuying nor selling with gusto. The RSI sits at a neutral 50, while the stochastic oscillator is trying to look busy at 22. The CCI is a bit down at -61, echoing “Meh, nothing to see here.” Momentum is down, MACD is riding a rollercoaster, and other indicators like the ADX and Awesome oscillator are just shrugging their shoulders. It’s a market in limbo—like waiting for the Wi-Fi to connect at the café.

The moving averages tell their own story. Short-term EMAs and SMAs are in a grumpy mood, suggesting bearishness, whereas the long-term ones cheer for an uptrend. It’s like the market is having an internal family dispute—short-term gloom versus long-term optimism. A calm yet disciplined dance of consolidation before the next big move.

Bullish Outlook: The Comeback Kid

If Bitcoin can muster the courage to break above $105,000 with folks actually Buying in with gusto, it could tip the scales and rally toward $110,000 or even $112,000. The signs of accumulation on support levels and supportive moving averages look promising—like a betting pool for the next big rally. Stay tuned and hold onto your hats!

Bearish Outlook: The Grim Reaper

Fail to hop above the $105,000 hurdle? Then expect more selling, more red candles, and maybe a visit down below $100,000—because markets have a sense of humor like that. All indicators point toward caution, with momentum and moving averages hinting that the bearish crowd is not quite done yet. Don’t say you weren’t warned—sometimes the only way is down.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Brent Oil Forecast

- Nasdaq’s Crypto Circus: New Assets and the Ripple Effect! 🎪💰

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- USD TRY PREDICTION

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Fantasy.top’s Desperate Dash to Base: A Crypto Comedy 🎭

2025-06-01 16:57