Bitcoin, it seems, has wandered into a cautious corner of the cavernous marketplace, nursing its latest recovery like a dragon nursing indigestion after a heavy banquet. The price meanders back toward the downside with the delicacy of a wizard tiptoeing through a library. The pullback is more polite than panic-driven, but signs of waning demand are turning up like suspicious cobwebs in a long-forgotten tower. Spot buying remains faint, leverage continues to unwind, and sellers are still lurking beneath the surface. Put together, these clues make the case for another visit to lower support levels, with the $75,000 region emerging as a beacon to watch as February makes its entrance.

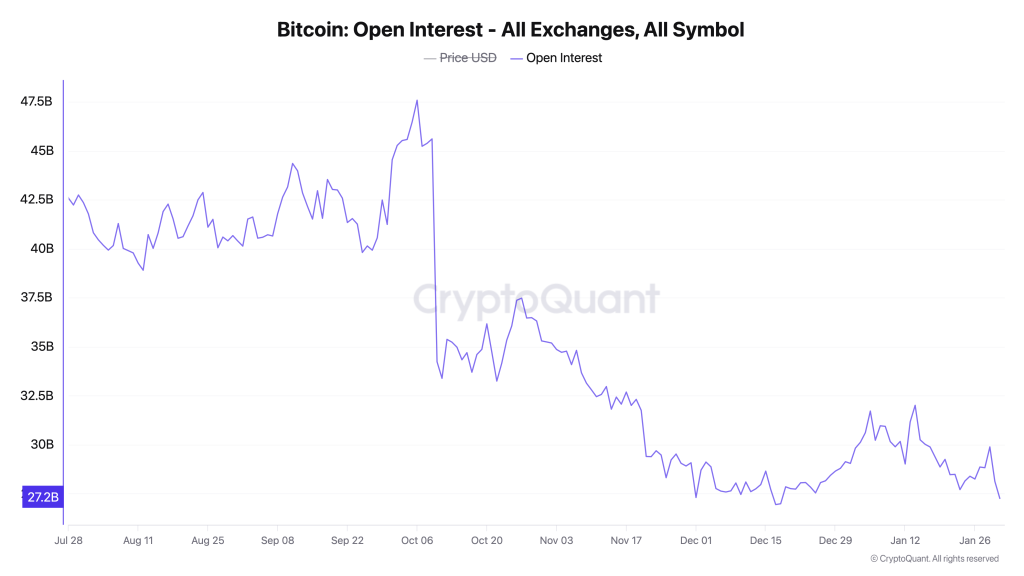

Open Interest: Leverage Steps Back, Not In

Open interest across exchanges has declined as if the market suddenly remembered it left the stove on-broad deleveraging rather than heroic dip-buying. In plain terms: traders are closing positions instead of marching in with fresh longs to defend the current perch. And crucially, open interest has struggled to recover alongside price, which suggests conviction is thinner than a goblin’s disguise.

When leverage exits the market without being replaced, the price often drifts toward the next support zone. This behavior aligns with the broader correction seen on the price chart and adds weight to the bearish near-term outlook, like a pensioner carrying a heavy stick of rock up a hill.

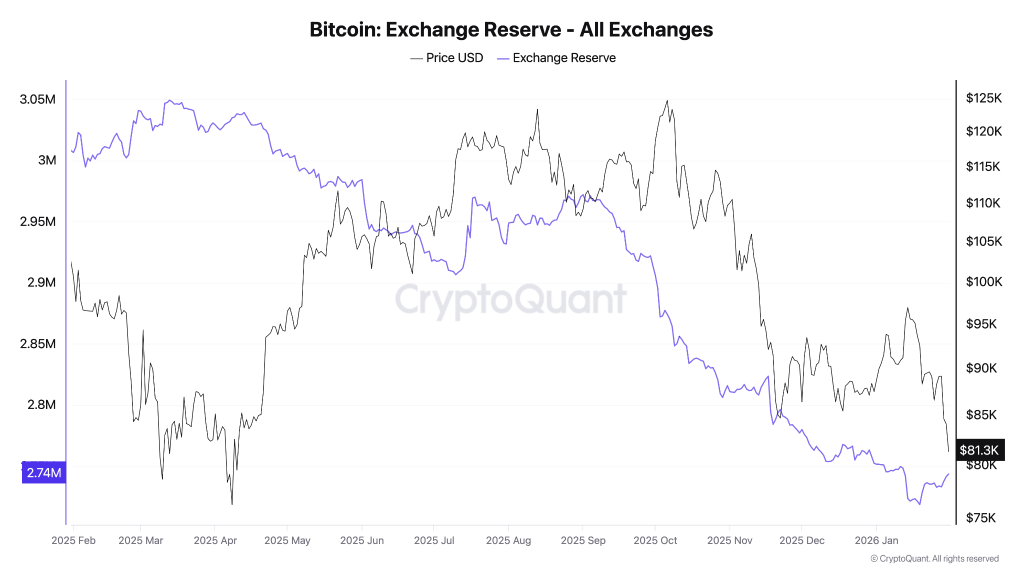

Exchange Reserves: Spot Supply Gradually Increases

Exchange reserve data shows Bitcoin balances ticking higher after a prolonged period of decline. While this does not scream panic selling, it does signal that more BTC is becoming available to sell, should someone remind it of its old competitive hobbies.

In past cycles, rising reserves during a corrective phase have often coincided with extended pullbacks rather than quick reversals. With spot supply increasing and no clear signs of aggressive accumulation, downside pressure remains a real risk if demand does not improve.

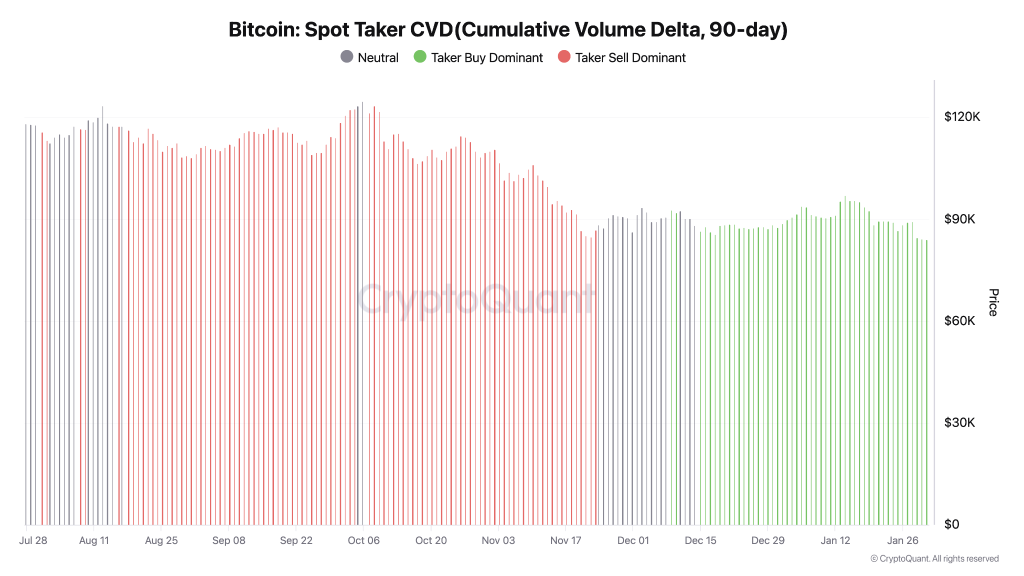

Spot Taker CVD: Sellers Still Have the Upper Hand

Spot taker CVD reinforces this cautious view. Over the past several months, sell-side market orders have dominated, and while selling pressure has eased slightly, buyers have yet to take clear control.

The lack of a strong bullish shift in CVD suggests that recent stabilization is more about sellers slowing down than buyers stepping up. Without sustained spot buying, any bounce is likely to remain corrective rather than trend-changing.

Is Bitcoin (BTC) Price Heading to $75,000?

Ever since the BTC price dropped below $100,000, it has slipped into a mood more bearish than a guild of ogres with bad coffee. It broke down below the rising wedge, which has been the start of a long descending waltz.

After breaking the wedge, the BTC price has also completed a small upside correction that set off a fresh descending trend. Meanwhile, the weekly RSI is heading toward the lower threshold, indicating Bitcoin is yet to mark the bottom. Considering the chart structure, the next strong support sits just below $75,000, around $74,500, which could be the range where buyers may finally muster a claim to control.

Conclusion: What Comes Next for Bitcoin?

Taken together, price structure, derivatives positioning, and spot market behavior all lean toward further downside exploration. Bitcoin does not appear to be in a capitulation phase, but it also lacks the conditions typically seen at durable bottoms. Unless spot demand strengthens and leverage begins to rebuild alongside rising prices, Bitcoin may continue drifting lower toward the $74,000-$76,000 support zone. A bounce from there is possible, but for now, the data reads as cautious optimism’s distant cousin.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- Brent Oil Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

2026-01-31 19:06