Okay, so the price isn’t exactly exploding just yet. But like the awkward buildup to a Netflix drama, something big is probably coming. Hold your horses, folks.

BlackRock’s Massive Bitcoin ETF Inflows – Is It Panic or Just Serious FOMO?

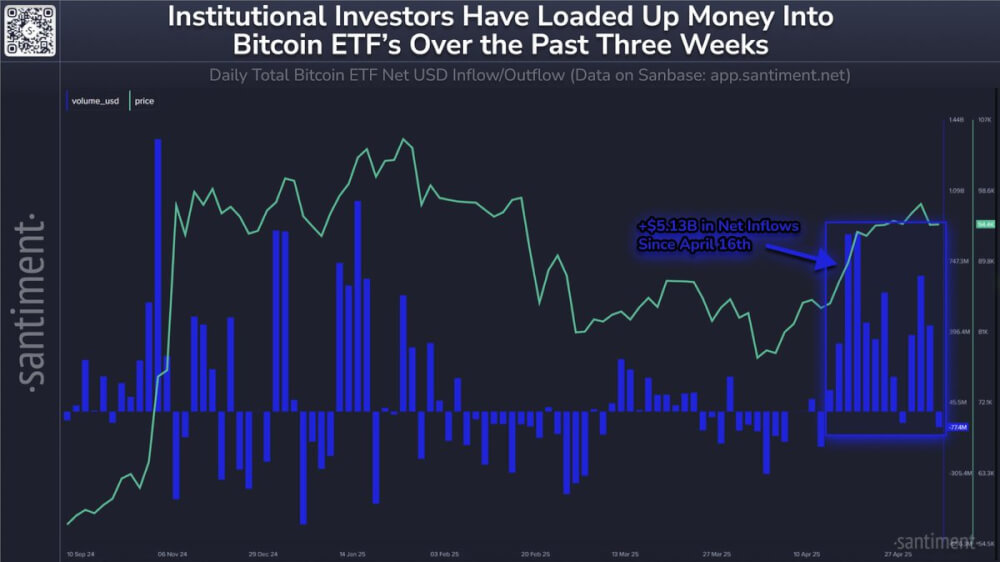

Since April 16, Bitcoin ETFs have seen over $5.13 billion in net inflows. That’s like throwing a party, and guess who’s the life of it? BlackRock’s iShares Bitcoin Trust, which casually added $4.7 billion in just a few weeks. Easy, right?

It’s serious. Like, you just walked into a room and everyone’s already talking about how much money is pouring in. But… surprise, surprise! It’s not all roses. On May 6, Bitcoin ETFs saw a combined outflow of $85.7 million. Oops, someone’s getting cold feet.

But Wait – The Fed Might Just Save Bitcoin’s Day

Now, before you get all dramatic, these inflows happen right before the Federal Open Market Committee (FOMC) meeting. According to Polymarket data, there’s a 98% chance the Fed keeps rates at 4.50%. No hike this time, apparently. Oh, sweet relief!

If the Fed really holds back, this could be the third straight meeting without a rate increase – which is just the kind of chill backdrop Bitcoin loves. Inflation is slowing down, rates are on a pause, and voila! Bitcoin’s risky friends might just take the opportunity to rally. Buckle up, Bitcoin fans.

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Gold Rate Forecast

- Whale of a Time! BTC Bags Billions!

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Crypto Chaos: Whales Dump 100B SHIB! Is $0.00001 Next? 🤯💥

- Dogecoin’s Wild Ride: Will It Bark or Bite? 🐶💰

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

2025-05-07 16:06