Hark! What’s the Hullabaloo?

By Francisco Rodrigues (All times ET unless indicated otherwise)

Well, ain’t this a fine kettle of fish! Seems as though President Trump, bless his heart 😇, with his “reciprocal tariffs” – sounds mighty fancy, don’t it? – sent the whole economic shebang into a tizzy. Investors, they’re scarpering away from anything that smells of risk, including that there bitcoin (BTC) and all them other cryptocurrencies. Seems folks are scared of a little excitement these days. 🙄

And wouldn’t you know it, Federal Reserve Chairman Jerome Powell, that fella with the furrowed brow, added fuel to the fire late Wednesday. Said the central bank expects unemployment to rise, the economy to slow, and inflation to go up because “some part of those tariffs come to be paid by the public.” Land sakes, it’s like he’s predicting the end of times! 😱

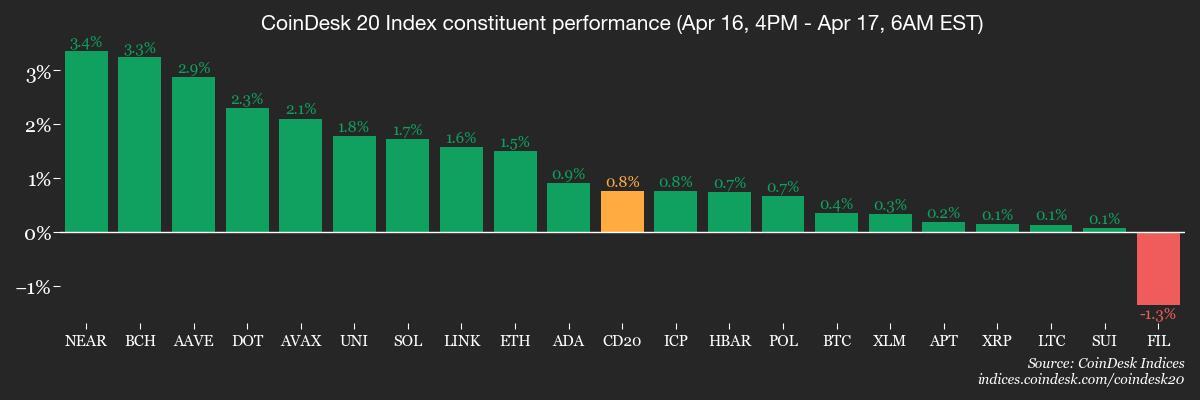

His words, they weighed heavy on the markets, sent the Nasdaq down 1.17% and the S&P 500 dropping 2.24% before the closing bell. Still, bitcoin, bless its little heart, is up more than 1% in the last 24 hours, while the CoinDesk 20 (CD20) index, which is supposed to capture the broader market, added 1.8%. Even though everyone and their brother knows crypto is about as stable as a one-legged stool in a hurricane. 🤪

According to Michael Brown, some analyst fella at Pepperstone, demand for “assets which provide shelter from political incoherence and trade uncertainty” is likely to keep growing, The Telegraph reported. Now, isn’t that a mouthful? Sounds like he’s trying to sell snake oil if you ask me. 🐍

While bitcoin has done better than the stock market – up 1% in the past month compared with the Nasdaq’s near 8% drop – institutional investors are running headlong into gold, the old reliable safe haven. Seems like they finally remembered what their grandpappy told them. 🤔

That there precious metal is up 11% over the last month and 27% this year to around $3,340 a troy ounce. Bank of America’s Global Fund Manager Survey (sounds important, don’t it?) shows that 49% of fund managers see “long gold” as Wall Street’s most crowded trade, with 42% of fund managers forecasting it to be the best-performing asset of the year. Good gravy, are they all gonna start wearing gold teeth? 🦷

UBS analysts wrote in a note that the “case for adding gold allocations has become more compelling than ever in this environment of escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks & diversification away from US assets & the US$,” Investopedia reported. Well, I’ll be hornswoggled! It’s like they’re all reading from the same script. 🎭

Gold fund flows have hit $80 billion so far this year, while SoSoValue data shows spot bitcoin ETFs saw $5.25 billion net inflows in January and net outflows since the uncertainty started. Month-to-date, over $900 million left these funds, after February and March saw $3.56 billion and $767 billion of net outflows, respectively. Stay alert! 🧐

Token Talk

By Shaurya Malwa

- Raydium’s platform for introducing tokens, LaunchLab, went live late Wednesday.

- It directly competes with Pump.fun, which recently pivoted away from Raydium and started its own exchange, PumpSwap, prompting Raydium to introduce a perceived competing platform. Sounds like a schoolyard squabble to me. 😠

- The Solana ecosystem saw a surge in activity with LaunchLab’s debut, creating over 1,750 tokens shortly after it started up. The price of Raydium’s RAY token rose as much as 10% in the hours afterwards. Well, ain’t that a sight to behold! 🤑

- LaunchLab’s dynamic joint curve system offers linear, exponential and logarithmic curves — three types of pricing mechanisms that influence how token values change based on user trading — a shift from the fixed-slope pricing models used in memecoin launch platforms. Don’t ask me to explain that. My head’s already spinning. 😵💫

- Integration with major Solana trading apps like Axiom, BullX and JupiterExchange enhances LaunchLab’s visibility, potentially driving broader adoption across the ecosystem. Fancy words for… well, I ain’t quite sure. 🤷♂️

Derivatives Positioning

- Open interest in bitcoin futures on the CME reached 138,235 BTC, the highest level the month, as traders re-enter the basis trade. The annualized basis on the CME has climbed to 8%. Sounds like they’re playing a high-stakes game of poker. 🃏

- With just over a week remaining until the April options expiry on Deribit, the $100,000 strike remains the most dominant, holding over $315 million in notional open interest. Good gravy, that’s a lot of zeroes! 💰

- The futures perpetual funding rate turned negative again on Wednesday during Fed Chair Powell’s speech. Throughout the week, funding rates have oscillated between positive and negative, highlighting continued short-term uncertainty around bitcoin’s direction. Seems like nobody knows what’s comin’. 🔮

Market Movements:

- BTC is unchanged from 4 p.m. ET Wednesday at $84,312 (24hrs: +0.4%)

- ETH is up 1.26% at $1,593.44 (24hrs: +0.91%)

- CoinDesk 20 is unchanged at 2,459.45 (24hrs: +1.36%)

- Ether CESR Composite Staking Rate is down 1bp bps at 3%

- BTC funding rate is at 0.012% (4.3866% annualized) on Binance

- DXY is up 0.11% at 99.49

- Gold is up 0.35% at $3,338.30/oz

- Silver is down 1.49% at $32.44/oz

- Nikkei 225 closed +1.35% at 34,377.60

- Hang Seng closed +1.61% at 21,395.14

- FTSE is down 0.82% at 8,207.47

- Euro Stoxx 50 is down 0.56% at 4,938.69

- DJIA closed on Wednesday -1.73% at 39,669.39

- S&P 500 closed -2.24% at 5,275.70

- Nasdaq closed -3.07% at 16,307.16

- S&P/TSX Composite Index closed -0.16% at 24,106.80

- S&P 40 Latin America closed +0.32% at 2,345.32

- U.S. 10-year Treasury rate is up 3 bps at 4.31%

- E-mini S&P 500 futures are up 0.9% at 5,353.25

- E-mini Nasdaq-100 futures are up 1.02% at 18,573.25

- E-mini Dow Jones Industrial Average Index futures are up 0.81% at 40,175.00

Bitcoin Stats:

- BTC Dominance: 63.89 (-0.07%)

- Ethereum to bitcoin ratio: 0.01889 (0.64%)

- Hashrate (seven-day moving average): 905 EH/s

- Hashprice (spot): $43.9

- Total Fees: 5.78 BTC / $482,907

- CME Futures Open Interest: 138,235 BTC

- BTC priced in gold: 25.4 oz

- BTC vs gold market cap: 7.15%

Technical Analysis

- Bitcoin has bounced cleanly off the golden pocket zone, with the 0.618 and 0.65 Fibonacci levels at $74,995 and $73,213 holding as support.

- This area marked the first real retracement from the $109,396 high and has shown strong buyer interest.

- The bounce also coincided with a breakout from the daily downtrend that has been in place since February — a key shift in structure worth noting.

- BTC is now sitting just below the daily 50 and 200 exponential moving averages, which have begun to converge.

- These levels often act as decision points, and with the price pressing right up against them, the next move should offer clearer direction. A clean break and hold above would give bulls more control, while a rejection could see prices head back toward the golden pocket.

- The weekly 50 EMA — currently $78,071 — is also in play and adds to the confluence just below. As long as BTC holds above the broken trendline and continues to defend this cluster of support, short-term momentum remains constructive.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $311.66 (+0.3%), up 0.98% at $314.70 in pre-market

- Coinbase Global (COIN): closed at $172.21 (-1.91%), up 0.87% at $173.70

- Galaxy Digital Holdings (GLXY): closed at C$15.58 (+0.84%)

- MARA Holdings (MARA): closed at $12.32 (-2.07%), up 0.81% at $12.42

- Riot Platforms (RIOT): closed at $6.36 (-2.9%), up 0.31% at $6.38

- Core Scientific (CORZ): closed at $6.59 (-3.8%), up 1.67% at $6.70

- CleanSpark (CLSK): closed at $7.28 (+0.0%), up 0.27% at $7.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.91 (-0.58%)

- Semler Scientific (SMLR): closed at $31 (-9.88%)

- Exodus Movement (EXOD): closed at $37.19 (-2.16%), up 2.18% at $38

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$171.1 million

- Cumulative net flows: $35.36 billion

- Total BTC holdings ~ 1.10 million

Spot ETH ETFs

- Daily net flow: -$12.1 million

- Cumulative net flows: $2.26 billion

- Total ETH holdings ~ 3.30 million

Overnight Flows

Chart of the Day

- Yesterday, the SOL/ETH ratio surged to a record high, closing at 0.0833 and highlighting sol’s continued strength relative to ether.

- Ether’s weakness also showed in the the ETH/BTC ratio, which slipped to 0.0187, its lowest level since Jan. 6, 2020.

In the Ether

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- 🤑 New Hampshire’s Bitcoin Bond: Revolution or Reckless Gamble? 🤑

- Brent Oil Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Whale of a Time! BTC Bags Billions!

2025-04-17 14:29