Ah, Bitcoin. The digital darling of the financial world, now limping like a wounded wolf in the Siberian tundra. The latest report on Digital Asset Fund Flows reveals a staggering $751 million fleeing the cryptocurrency, as if it were a sinking ship in a storm. Institutions, those cold-blooded titans of capital, seem to be cashing out, leaving the rest of us to wonder: is this the beginning of the end? 🤔

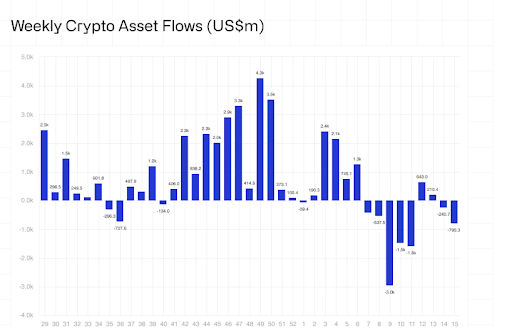

CoinShares’ weekly report paints a grim picture: $795 million in outflows from the crypto market, with Bitcoin alone bleeding $751 million. This mass exodus, one of the largest of the year, comes as Bitcoin’s price hits a wall, like a drunkard stumbling into a brick alley. James Butterfill, the Head of Research at CoinShares, notes that since early February 2025, digital asset investment products have seen cumulative outflows of $7.2 billion, wiping out nearly all year-to-date gains. Three weeks of declines, with Bitcoin leading the charge—or rather, the retreat. 🏃♂️💨

As of now, net flows for 2025 stand at a paltry $165 million, a far cry from the multi-billion dollar peak just two months ago. This sharp decline signals a cooling sentiment among institutional investors, who seem to be tiptoeing away from the market like thieves in the night. The Bitcoin price, once a roaring lion, now struggles to regain its past glory, hindered by these relentless outflows. Until the market stabilizes, Bitcoin’s path to new all-time highs remains as uncertain as a Russian winter. ❄️

Despite the $751 million hemorrhage, Bitcoin still clings to a modestly positive position with $545 million in net year-to-date inflows. But the sheer scale of the outflows is alarming. Is this a sign of profit-taking, or are institutions spooked by macroeconomic uncertainty? Either way, the big players seem to be pulling out, at least for now. Even Ethereum, Solana, Aave, and SUI weren’t spared, with outflows of $37 million, $5.1 million, $0.78 million, and $0.58 million, respectively. Even short Bitcoin products, designed to thrive in downturns, saw $4.6 million in outflows. The market, it seems, is a sinking ship, and everyone’s scrambling for the lifeboats. 🚣♂️

What’s driving this exodus? Rising economic uncertainty, fueled by tariff policies, has cast a dark shadow over investor sentiment. The wave of negativity began in February when former US President Donald Trump announced plans to impose tariffs on imports from Canada, Mexico, and China. However, a late-week rebound in crypto prices followed Trump’s temporary reversal of the tariffs, offering a brief glimmer of hope. Total Asset Under Management (AUM) across digital assets recovered from $120 billion to $130 billion, an 8% increase. But is this just a temporary reprieve, or the calm before the storm? 🌪️

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- EUR ILS PREDICTION

- ETH’s Shocking Secret REVEALED! 😲

- XRP’s $2 Hold: A Crypto Tale with Bulls, Breakouts, and a Dash of Drama 🐂💥

- USD ARS PREDICTION

- Silver Rate Forecast

- BTC AUD PREDICTION. BTC cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Is Bitcoin About to Make a Dramatic Exit? 🥂

2025-04-16 03:05