The final week of 2025, that dreary pre-Christmas purgatory, gave way to the first trading days of 2026 like a weary traveler shedding a heavy coat. The exchange-traded fund (ETF) world, ever the dramatic, staged a reset led by Bitcoin’s triumphant rebound. Ether, that oft-mocked stepchild of crypto, managed decent inflows, while XRP and Solana-those quiet conspirators-whispered their secrets into the market’s ear.

Bitcoin Leads ETF Reset as XRP, Solana Stay Resilient

The turn of the calendar, that sacred ritual of markets, brought a noticeable reset across U.S. spot crypto ETFs. Investors, like moths to a flame, rotated back into bitcoin, while altcoin funds-those poor relations of the crypto aristocracy-were selectively caressed. Shortened holiday trading? A mere footnote in this opera of greed and hope, especially on the BTC side, where conviction was as thick as Turgenev’s prose.

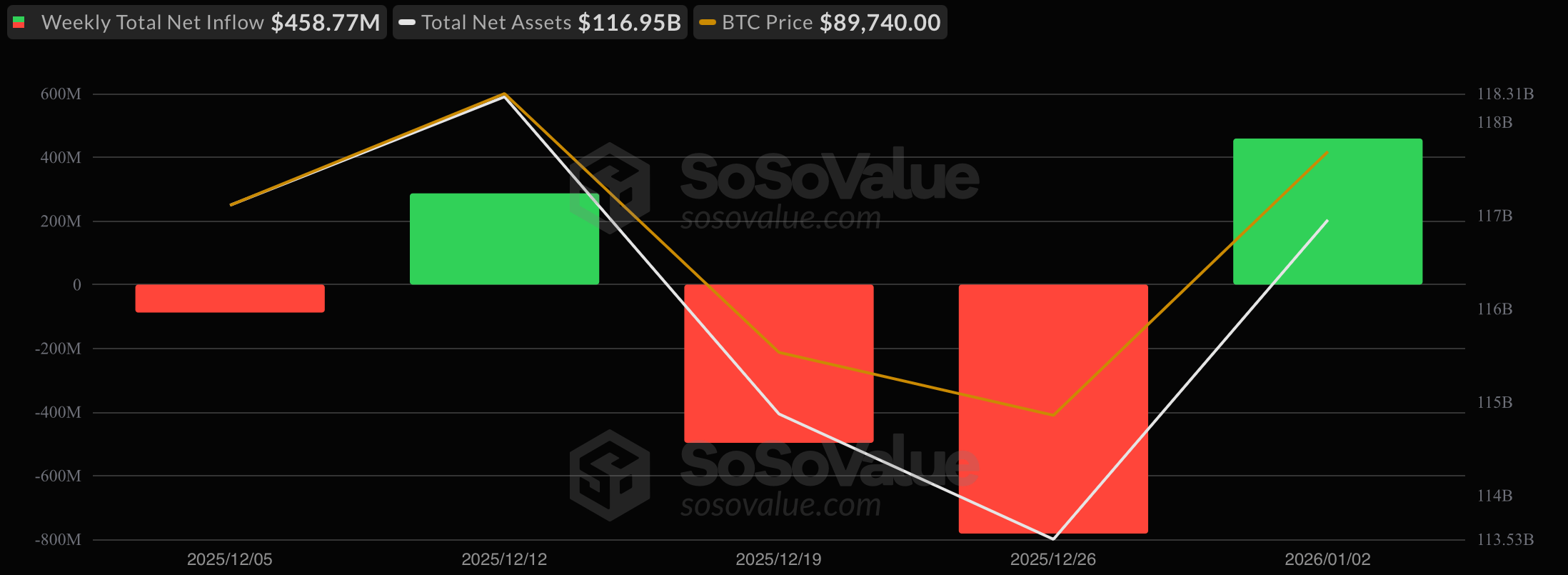

From Dec. 29 to Jan. 2, U.S. spot bitcoin ETFs gobbled up $458.77 million, snapping the late-December outflow streak like a dog shaking off water. Blackrock’s IBIT, that gluttonous titan, devoured $324.15 million for the week, leaving crumbs for the rest. Fidelity’s FBTC, after a festive fast, nibbled $105.78 million, while Bitwise’s BITB and Ark & 21shares’ ARKB-those modest sippers-managed $41.60 million and $33.08 million, respectively. Grayscale’s GBTC and Bitcoin Mini Trust, meanwhile, bled $54.2 million, a reminder that even legacy products can’t escape the market’s fickle kiss.

Ether ETFs, that eternal optimist, ended the week in positive territory, slurping up $161 million in net inflows. Grayscale’s ETHE, the glutton of the bunch, consumed $103.78 million, while its Ether Mini Trust added $32 million. Bitwise’s ETHW and Blackrock’s ETHA-those cautious sipper-managed $18.99 million and $12.37 million, respectively. Fidelity’s FETH and Vaneck’s ETHV? A mere peck at the trough, suggesting investors were nibbling with the delicacy of a mouse.

XRP ETFs, those stealthy assassins of the crypto world, extended their post-launch momentum. The group inhaled $43.16 million, with Franklin’s XRPZ ($21.76 million) leading the charge. Bitwise’s XRP, ever the understudy, added $17.27 million, while 21Shares’ TOXR and Grayscale’s GXRP-those humble servants-contributed marginally. Together, they whispered their success into the void, a quiet rebellion against the market’s noise.

Solana ETFs, those patient gardeners, added $10.43 million over the week. Bitwise’s BSOL ($6.23 million) and Fidelity’s FSOL ($2.53 million) did most of the heavy lifting, while Grayscale’s GSOL and Vaneck’s VSOL-those meticulous weeding hands-made lighter but positive contributions. All SOL ETFs remained net positive, a testament to demand as steady as a heartbeat.

Overall, the week marked a clean transition into 2026. Bitcoin, that old lion, reclaimed leadership with a roar. Ether, the timid deer, showed early signs of balance. And XRP and Solana, those shadowy foxes, quietly strengthened their grip, setting a tone for Q1 2026 that was neither a crescendo nor a whisper, but something in between-a market’s sigh.

FAQ ❓

- What drove U.S. crypto ETF flows into early 2026?

U.S. spot bitcoin ETFs pulled in $458.77 million as investors, like pilgrims to a shrine, flocked back to BTC at the start of 2026. The holiday trading? A mere footnote in this grand ballet of capital. - How did ether ETFs perform during the same period?

U.S. ether ETFs posted $161 million in net inflows, a tentative stabilization after the chaos of late 2025. Investors, ever the cautious dancers, stepped lightly. - Are XRP ETFs still attracting institutional demand?

XRP ETFs added $43.16 million, extending their post-launch charm offensive. The market, it seems, still believes in fairy tales. - What trend is emerging for Solana ETFs in 2026?

Solana ETFs remained net positive with $10.43 million, accumulating like snow in a Russian winter-slowly, steadily, and with a hint of inevitability. 🌨️

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- Brent Oil Forecast

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- 🤑 How Bitcoin Heist Hints at Silicon Wannabe Trumps

- This Will Break the Internet: Is Bitcoin About to Explode Past Its All-Time High?

2026-01-05 20:14