Pray, allow me to impart upon you the curious tale of Bitcoin, that most fickle of digital suitors, whose value hath danced a most erratic quadrille in the year of our Lord 2025. ‘Twas a year of mixed fortunes, wherein this market leader aspired to reach the lofty heights of six figures, only to find itself, like a debutante left standing after the final reel, struggling to maintain its esteemed position as the clock struck twelve upon the year’s demise.

Lo, the new year hath dawned, and Bitcoin, ever the optimist, hath once more ventured above the $90,000 mark. Yet, the air is thick with uncertainty, and even the wisest of market sages dare not predict what caprices the digital asset market may indulge in during 2026. 🌪️

A Symmetrical Triangle: Harbinger of Fortune or Mere Fancy?

On the third of January, a certain Mr. Ali Martinez, a market analyst of some repute, took to the social media platform X to proclaim a most bullish prognosis for Bitcoin’s future. This crypto pundit, with charts and trendlines as his weapons of choice, suggested that the world’s largest cryptocurrency might be preparing for a 15% ascent in the weeks to come. 🌟

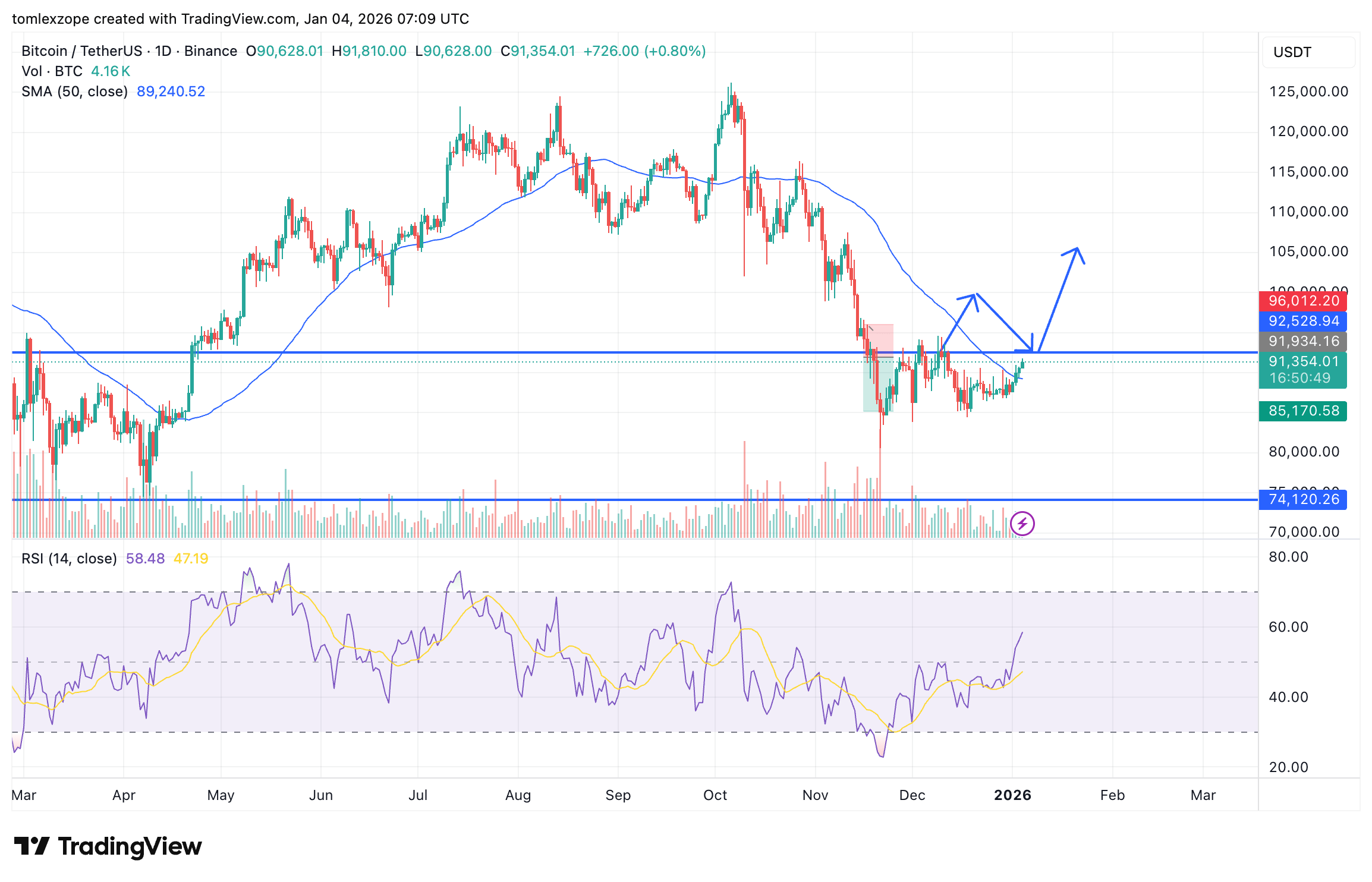

The foundation of this sanguine prediction lies in the appearance of a symmetrical triangle pattern on the 4-hour timeframe of Bitcoin’s price chart. A pattern, I am told, characterized by a diagonal falling upper trendline and a diagonally rising lower trendline-a veritable geometric puzzle for the uninitiated. 📐

In this triangular formation, the asset price (Bitcoin, in this instance) contracts and moves toward the apex, much like a society matron squeezing into her finest gown. Eventually, it breaches either the upper trendline, heralding a breakout, or crosses the lower boundary, signaling a breakdown. Thus, this symmetrical triangle may offer a continuation or reversal signal, depending on the direction of the break. A most intriguing conundrum, is it not? 🤔

It is worth noting, dear reader, that symmetrical triangles are oft considered continuation patterns, wherein the price tends to break in the initial trend direction before entering the triangle. Should this theory hold true in our present scenario, Bitcoin’s price is likely to continue its upward trajectory after breaking the upper trendline. A most hopeful prospect, indeed! 🚀

The critical resistance in the upper trendline lies around the $91,000 region, and our flagship cryptocurrency must achieve a sustained close of at least two candlesticks above this level to confirm a bullish breakout. The price target, I am informed, is determined by adding the length of the widest point of the triangle to the breakout point-a calculation that hath yielded a target above $102,000, representing a 15% surge from the current price point. 🧮

Bitcoin’s Current State: A Glimpse at the Ledger

As I inscribe these words, the price of BTC stands at approximately $91,560, reflecting an over 1% increase in the past 24 hours. A modest gain, perhaps, but one that doth not go unnoticed by those with a keen eye for such matters. 📈

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Brent Oil Forecast

- XRP: The Calm Before the Storm?

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Silver Rate Forecast

- 🚀 Bitcoin Hits $125K: Is the Moon Next, or Just a Crypto Circus? 🎪

2026-01-04 15:09