Bitcoin, that eternal wanderer of the digital realm, recently ascended to new heights, only to be met with a fleeting retreat as the market’s feverish excitement cooled. 🌡️

Yet, in the face of such volatility, the ETF market has shown a steadfast resilience, and Bitcoin has largely returned to its former glory. With a substantial influx of ETF funds, the price of Bitcoin may soon surpass its previous all-time high, or so the optimists whisper. 📈

Bitcoin is Ready To Bounce Back, or So They Say

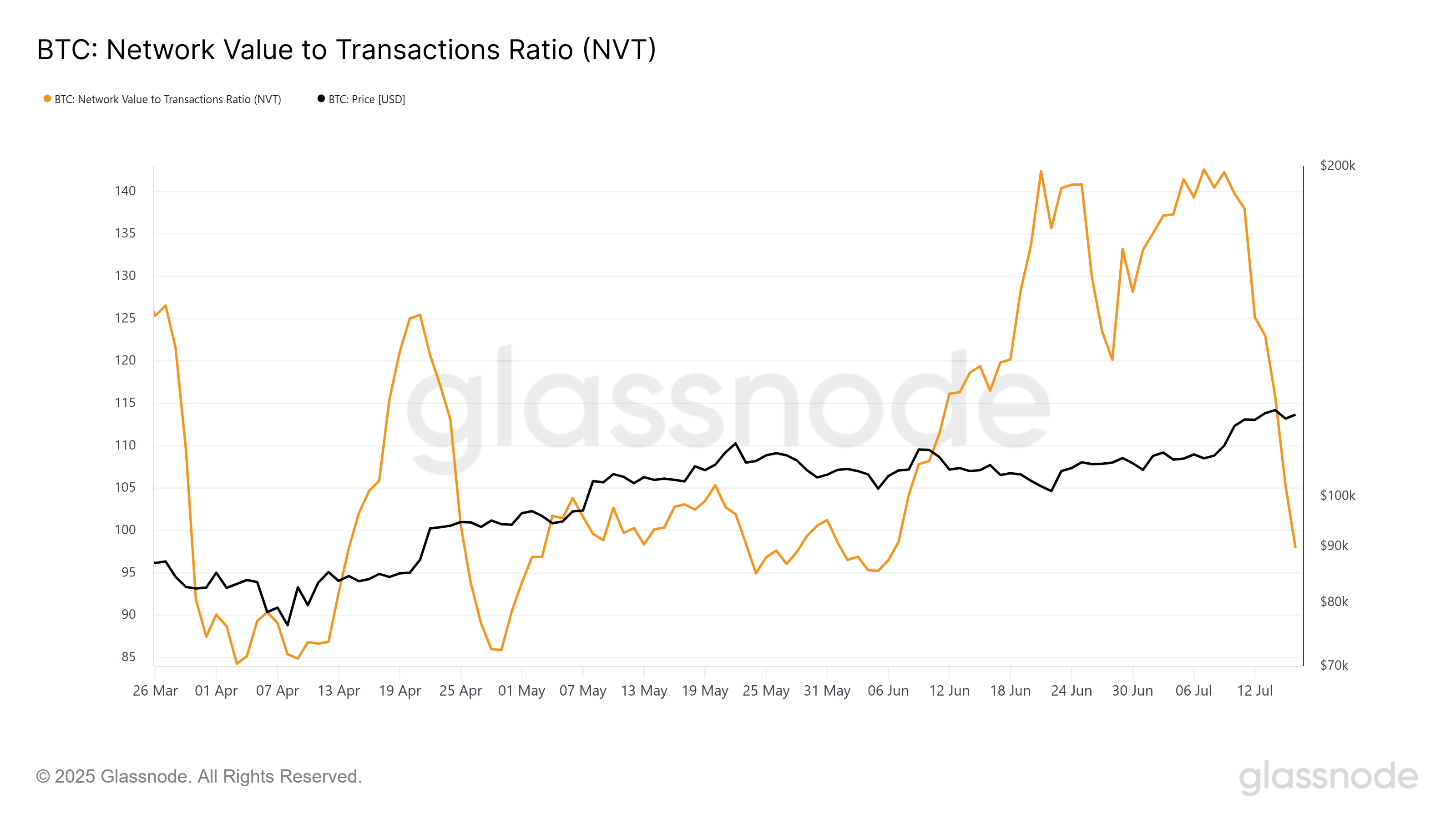

The Network Value to Transaction (NVT) Ratio, a metric that measures the relationship between the network’s value and transaction activity, spiked earlier this month, much like it did in June. A rising NVT Ratio often suggests that the network’s value is outpacing transaction activity, a classic sign of an overheated market. 🌋

And indeed, Bitcoin’s recent dip was a clear indication that the market was taking a breather. However, the NVT Ratio has now returned to a monthly low, suggesting that Bitcoin may have the room to rally once more. 🚀

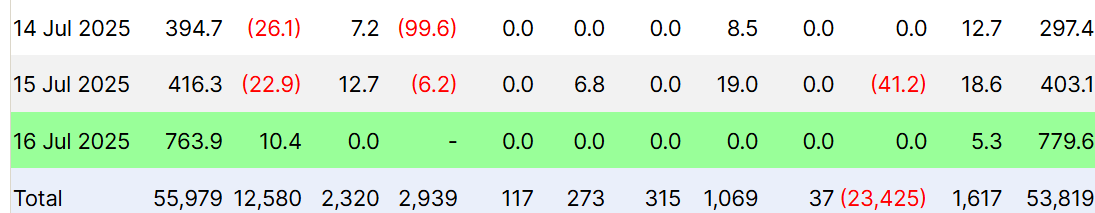

This week, spot Bitcoin exchange-traded funds (ETFs) have seen over $1.5 billion in inflows, a significant portion of which occurred in the last 48 hours, during Bitcoin’s dip. The influx of institutional money is a clear sign that investors remain bullish, even as the market cools. 💼

These ETF inflows are a testament to the resilience of institutional investors, who are not only holding their ground but also adding to their Bitcoin positions. If this trend continues, it could provide the necessary stability to push Bitcoin’s price higher. 📊

BTC Price Inches From The All-Time High, But Is It a Mirage?

Bitcoin is currently trading at $118,325, with a formidable resistance at the $120,000 level. This resistance is a critical hurdle for Bitcoin to overcome if it hopes to reclaim its all-time high of $123,218. The 4.1% gap to reach the ATH is a tantalizing prospect, but Bitcoin must first secure a foothold above $120,000. 🏔️

If Bitcoin can maintain its position above $120,000 and break through the $122,000 barrier, it may continue its ascent toward new all-time highs. The current market conditions and ETF inflows support a bullish outlook, with a strong possibility of breaking the resistance. 🌟

However, the specter of profit-taking looms large, and any significant selling pressure could send Bitcoin tumbling back to $115,000, erasing recent gains and casting doubt on the bullish thesis. In such a scenario, Bitcoin may be forced to retest lower support levels, a humbling reminder of the market’s capricious nature. 🌪️

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Brent Oil Forecast

- Ethereum’s Drama: Why ETH Is Dancing, Whales Are Shopping, and Bitcoin Is Jealous 🐋🔥

- Pakistan’s Hilarious Bitcoin Mining Adventure: Can It Save the Day?

- ETH Does What Now?! 😱

- Gary Gensler Throws Shade at Altcoins but Gives Bitcoin a Wink 🚀💼

2025-07-17 12:47