Ah, the grand spectacle of the Bitcoin market! It appears that the short-term holder whales, those fickle creatures of the deep, have been indulging in a veritable feast of profits, far surpassing their long-suffering counterparts, the diamond hands, in this latest rally. One cannot help but chuckle at the irony of it all! 😂

New Bitcoin Whales: The Profit-Taking Prodigies

In a recent missive on the platform known as X, the astute observer Axel Adler Jr. has illuminated the curious behavior of these two distinct factions of Bitcoin whales: the short-term holders (STHs) and the long-term holders (LTHs). The former, those who flit about like butterflies, have held their precious coins for less than 155 days, while the latter, the stoic guardians of wealth, have weathered the storms of time.

But what, dear reader, is a whale? In this peculiar realm, it is not a creature of the sea, but rather an investor with a balance exceeding 1,000 BTC. Thus, we find ourselves amidst the grandiose STH and LTH whales, the titans of their respective domains.

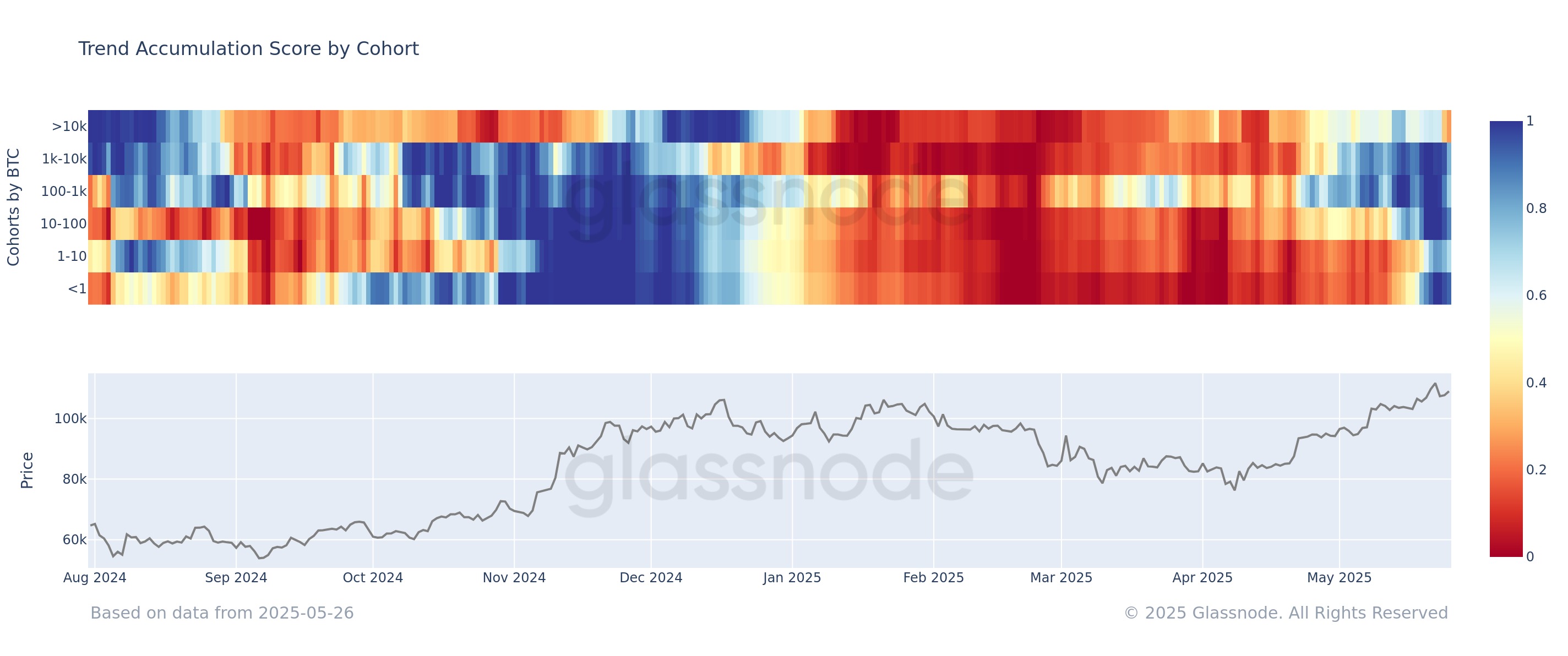

Behold! Here lies the chart shared by our analyst, a testament to the trends of profit realized by these groups over the past months:

As the graph reveals, both factions have dipped their toes into the waters of profit-taking. Yet, it is the new whales, those who have recently plunged into the market, who have dominated this selling spree. How different it is from the harmonious balance of January, when profits were shared more equitably among the cohorts!

Historically, the STHs have been like moths to a flame, reacting to market events with a fervor that is both admirable and tragic. In contrast, the LTHs stand firm, resilient against the tides of fortune. Thus, it is no great surprise that these whales have succumbed to the siren call of profit in this recent rally. However, let us not forget, the heights of profit-selling have yet to reach the dizzying peaks of January.

These whales, a diverse assembly, can be further categorized into the regular-sized (1,000 to 10,000 BTC) and the ‘mega’ whales (10,000+ BTC). According to the wise sages at Glassnode, the behavior of these groups has been anything but consistent of late.

As the chart illustrates, the Bitcoin Accumulation Trend Score, that enigmatic indicator of whether investors are hoarding or relinquishing their coins, has hovered near 1 for the whales. A sign, perhaps, that these grand entities are in a state of strong accumulation. Meanwhile, the smaller cohorts mimic this behavior, yet the mega whales have chosen a different path, opting for distribution instead. How delightfully chaotic! 😏

BTC Price

As I pen these words, Bitcoin dances around the figure of $109,800, a rise of approximately 6% in the past week. What a time to be alive in this digital age!

Read More

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Whale of a Time! BTC Bags Billions!

- Why NEAR Protocol Might Just See $5: The Great Cryptocurrency Quest! 🚀

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- What the Heck? Cardano Predicts $500K Bitcoin & XRP Jumpstart! 🚀🤔

- Dogecoin’s Journey to $5: The Hilarious Truth Behind the Hype! 🚀💰

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

2025-05-27 01:19