- Well now, Bitcoin‘s been wrestling with a stubborn old fence at $106K, and the RSI’s just about ready to burst its buttons, while the OBV’s been taking a leisurely stroll, showing us a bit of a lull in the buying frenzy.

- Those hefty long positions between $101K and $106K are like a pack of wild horses; if BTC takes a tumble below that key support, we might just see a stampede of liquidations!

It seems our dear Bitcoin [BTC] is hinting at a change of heart, as the latest gossip from the data folks reveals a swell of long positions huddled together like a bunch of cowpokes between $101K and $106K.

Now, while a price dip could send some folks running for the hills, the on-chain indicators are whispering sweet nothings about fresh buying from both the little guys and the big shots. 🤑

This newfound confidence might just mean the market’s gearing up for a bullish reversal, or at least a good ol’ fashioned hoedown!

Bitcoin wallets enter buy mode

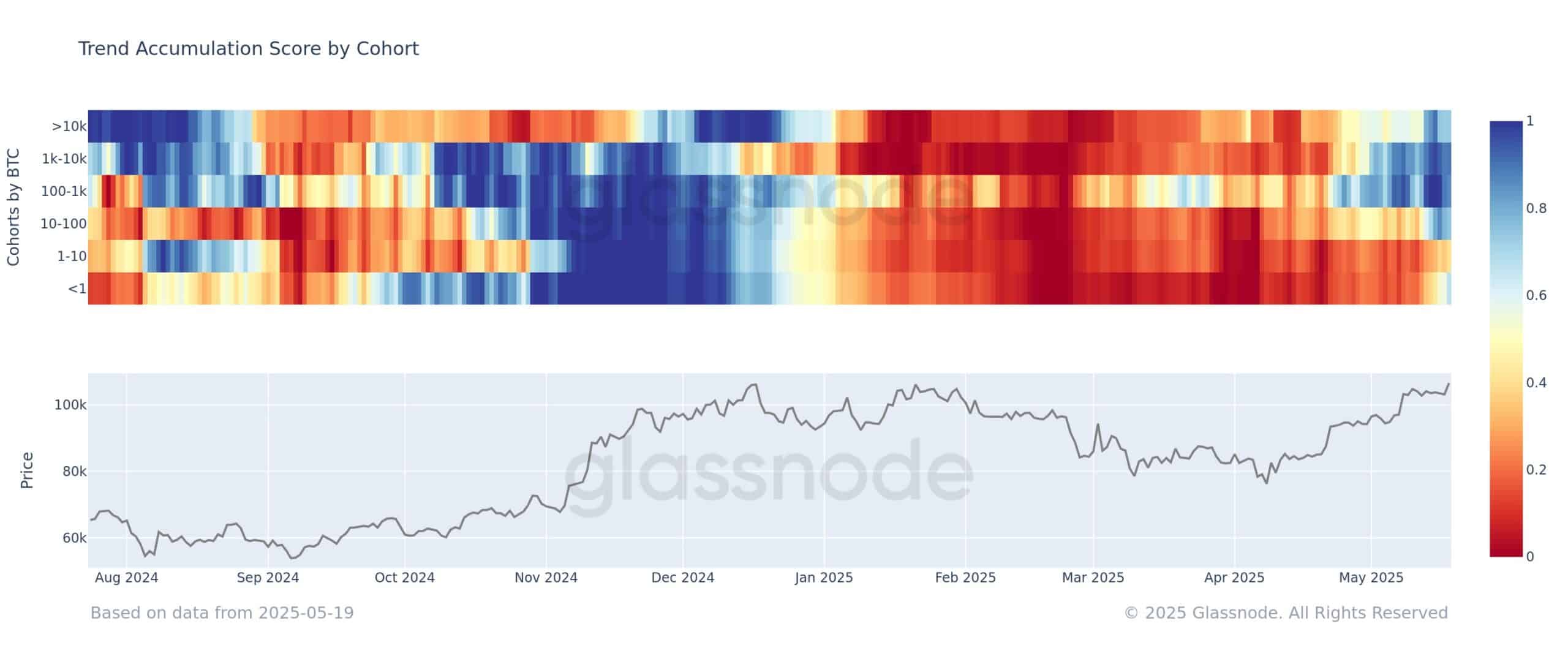

According to the wise folks at Glassnode, there’s been a noticeable shift in the market’s behavior, with accumulation trends spreading like butter on warm bread across nearly all wallet sizes.

The smaller fry, those with less than 1 BTC, have flipped their previous selling habits and are now gently scooping up coins, boasting an accumulation score of about 0.55. Ain’t that a sight for sore eyes?

Meanwhile, the big guns—those holding between 100–1,000 BTC and 1,000–10,000 BTC—are showing even more enthusiasm for accumulation. It’s like a gold rush out there! 💰

The only group still playing hard to get is the 1–10 BTC crowd, but even they are starting to feel the itch to join the party, signaling a broader resurgence in confidence toward Bitcoin’s price action.

Clustered long positions could amplify downside volatility

Now, there’s a hefty pile of long positions between $101K and $106K, creating a high-risk zone that could make even the bravest cowboy sweat a little.

According to the folks at Alphractal, this setup makes the market as jumpy as a cat on a hot tin roof, especially if Bitcoin’s price decides to dip below the $100K mark. Yikes!

On the flip side, the chances of short liquidations on upward moves seem as slim as a snake’s belly in a wagon rut. With long positions stacked high, any sign of weakness in BTC could lead to a quick unraveling and a wild ride of forced selling and volatility.

Price stalls near resistance

As we gaze upon the daily chart, BTC’s showing signs of fatigue just shy of the $106K mark. It flirted with $106,813 but couldn’t quite seal the deal, slipping back to $105,504 as we speak.

At this very moment, the RSI is hanging around 69.42—just a hair below the overbought threshold—indicating that the bullish momentum might be running out of steam. 🐢

Meanwhile, the OBV has flattened out at around -86.6K, suggesting a pause in the buying frenzy. If Bitcoin can hold its ground above $105K, a breakout toward $110K could be on the horizon. But beware! A dip below $101K could unleash a wave of long liquidations and send us all into a tailspin of downside volatility.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

- Crypto Courtroom Bombshell: The Surprising Maneuver That Could End It All

- Crypto Drama: Coinbase Ditches MOVE—Scandal, Swoon & a $100M Hangover 🍸

- Crypto Dinner: Where Politics Meets Meme Coins and Laughter! 😂🍽️

2025-05-20 12:16