Imagine an intergalactic showdown where a digital enigma called Bitcoin awkwardly shuffles sideways at $93K, while gold, that shiny old diva, sashays upward whispering sweet nothings about $4,000 per ounce.

Store of Value Smackdown: BTC Resists Gravity as Gold Moonwalks Higher

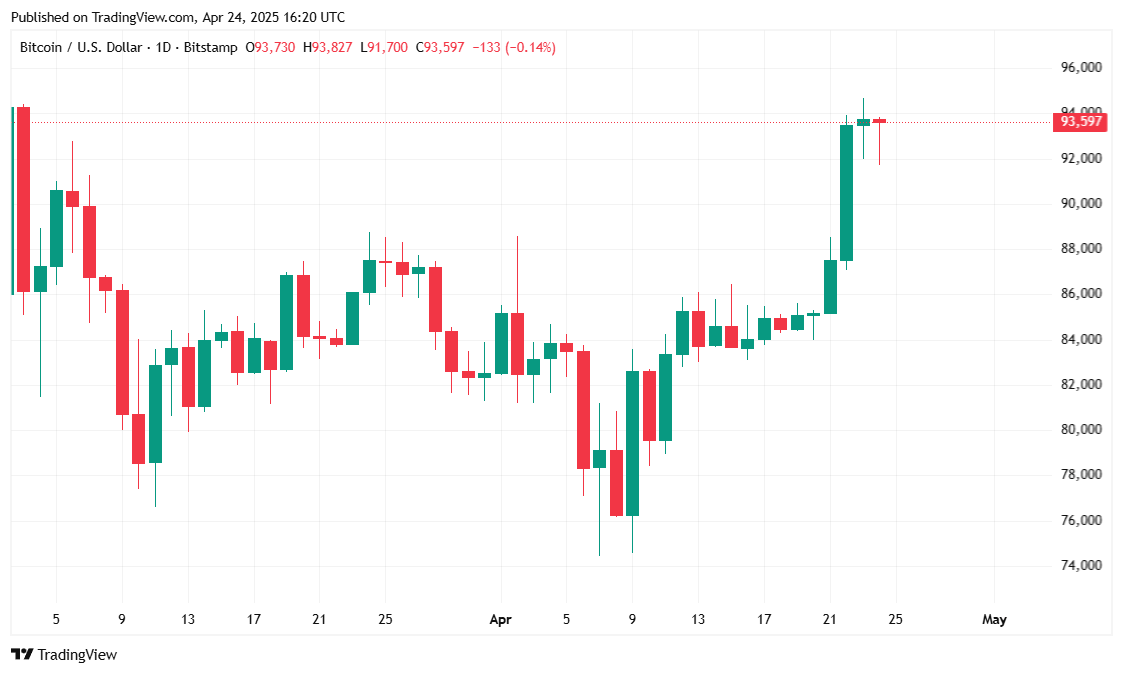

Bitcoin, the cosmic jester of finance, has been practically hibernating around $93,000 for 24 hours—nodding up and down as if trying to decide whether to buy a latte or just meditate on its existence. Meanwhile, gold, the grandpa of shiny things, surged last week and is now hanging out above $3,300, humming confidently about $4,000 next year, as if it’s betting investors will abandon those boring old Treasuries and the U.S. dollar faster than you can say “Where’s my gold?”

Market Metrics: The Nitty-Gritty Without the Boredom

Right now, Bitcoin trades at $93,531.90 (because why round numbers when you can dazzle with decimals?). Up a modest 0.42% in the last day and a respectable 10.47% over the week, it flits between $91,696.71 and $94,212.90 like a caffeinated squirrel contemplating its next move.

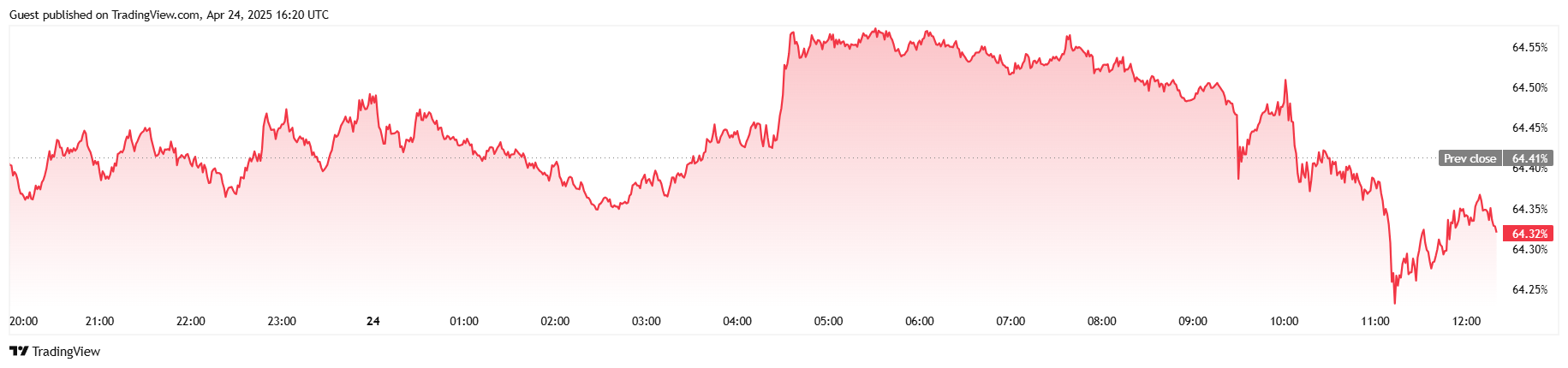

After a brief fit of frenzy, 24-hour trading volume took a nosedive of 41.03% to a casual $31.82 billion. Market cap, however, casually inched up 0.49% to $1.85 trillion like a slightly smug cat who just knocked something expensive off a shelf. Meanwhile, Bitcoin’s market dominance decided to dip just a tad by 0.17% to 64.32%, possibly because altcoins want some attention too and are waving their hands frantically in the back.

On the derivatives dance floor, Bitcoin futures open interest twirled upward by 0.66% to $64.67 billion, proving that traders are still convinced this party isn’t over. Liquidation losses are barely a blip—just $1.57 million in the last day—with short sellers eating almost all of that, proving bulls are still wearing their party hats.

Digital Dreams or Bullion Dreams?

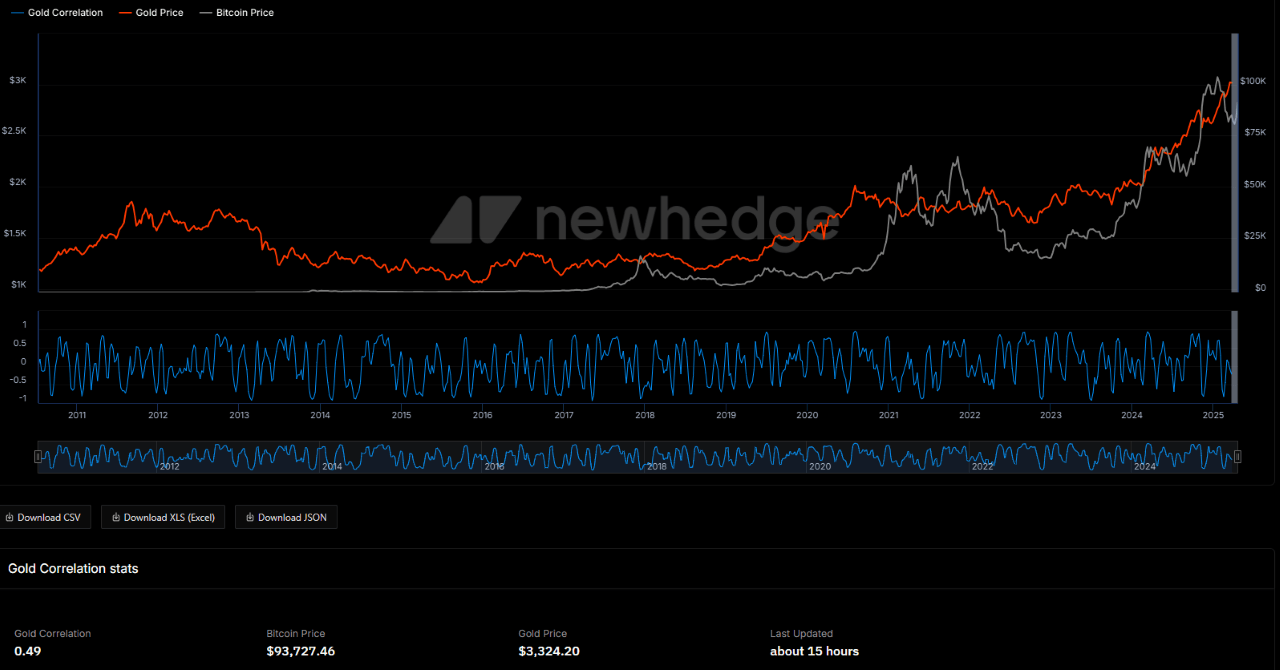

Thanks to President Trump’s tariff roulette, foreign investors are jitterbugging out of U.S. treasuries and the dollar, leaving gold to bask in the spotlight as the “safe haven” of choice. Bitcoin, the quirky digital offspring intended as fast cash, now insists it’s the new digital gold, trying (and sometimes succeeding) to steal the old-timer’s thunder. For now, though, gold’s holding the title with a smirk.

According to CNBC’s crystal ball and J.P. Morgan’s financial sorcery, gold could waltz to $3,675 per ounce by year’s end and charm its way past $4,000 by mid-2026. Bitcoin, ever the show-off, has its own prophecy: a wild $200,000 sprint by year-end. With their correlation sitting cozy at 0.49, expect these two shiny contenders’ dance-off to get even more theatrical as they battle for the ultimate safe-haven crown.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- PLUME: 60% Down?! 😱

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

2025-04-24 20:27