It appears a gentleman by the name of Arthur Hayes – a former inhabitant of the BitMEX establishment, no less – has been seized by a rather extravagant notion. He posits that Bitcoin might, perchance, ascend to the lofty heights of $200,000. A sum, naturally, quite beyond the grasp of practical men.

Mr. Hayes, in a flight of fancy, links this potential fortune to the rather dull affair of central bank money printing. Apparently, if they resume their penchant for creating currency from thin air, Bitcoin will be most delightfully boosted. One suspects he’s discovered a new form of alchemy.

Bitcoin To Benefit From Yen Intervention and Fed Liquidity

The chatter, you see, revolves around the Japanese yen’s recent… improvement. A mere 1.75% jump to 155.63 per dollar. A tremor, really, but enough to inspire Mr. Hayes. He suspects the Americans might lend a helping hand, employing the remarkably straightforward method of simply printing more dollars. How utterly predictable.

Reports indicate the New York Federal Reserve engaged in polite inquiries with certain banks regarding the yen market. The very picture of clandestine activity, wouldn’t you agree?

Should the Federal Reserve deign to support the yen – and one assumes they wouldn’t do anything for purely altruistic reasons – it would likely involve the creation of new banking reserves. The Fed’s balance sheet, a document of interminable length, would then experience a rather noticeable expansion. Most thrilling.

Very boolish if true for $BTC. This assumes Fed prints $, creates banking reserves. $’s are then sold to buy yen. If the Fed is manipulating the yen, we will see its b/s grow via the Foreign currency denominated assets line item which comes out weekly in the H.4.1 release.

– Arthur Hayes (@CryptoHayes) January 23, 2026

Currently, the aforementioned line item stands at a paltry $19.1 billion. A sum which, apparently, has the power to sway the fate of digital currencies.

Mr. Hayes observes that such liquidity expansions have historically proven… agreeable to Bitcoin. A most insightful observation, one might add.

Despite the absence of any actual intervention, traders are buzzing with anticipation, like bees around a particularly sugary pot.

Hayes’ Bold Bitcoin Price Targets

Mr. Hayes, ever the optimist, suggests that if liquidity makes a triumphant return, Bitcoin could, by March 2026, reach $200,000. A number that sounds quite pleasing to the ear.

He then, with a flourish, suggests a further ascent to $500,000 by year’s end should global money flows accelerate. One almost expects him to take a bow.

However, Bitcoin currently languishes near $89,500, displaying a remarkable lack of enthusiasm for these predictions. Such indifference is, frankly, rather rude.

Bitcoin Price Outlook

Still stubbornly at $89,471, Bitcoin remains unimpressed by the speculative fervour. One begins to suspect it possesses a rather refined sense of irony.

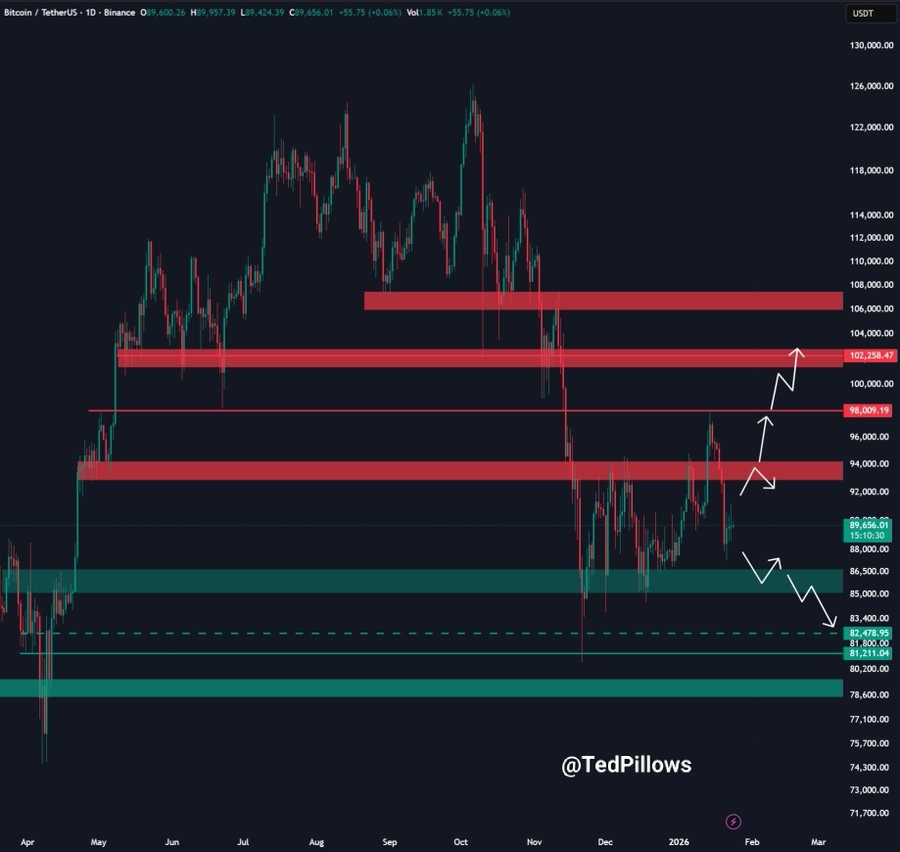

A fellow calling himself TED observes a period of tedious sideways movement, a “no-trading zone,” between key support and resistance levels. A rather uninspired description, if you ask me.

A resistance zone at $91,000 looms. Should Bitcoin conquer this barrier – with “strong spot demand”, naturally – a further advance toward $98,000 and even $102,000 might be contemplated. One shudders at the possibilities.

Should it fall, however, support awaits near $89,000, and then – for the truly unfortunate – around $86,500 to $83,000. A most discouraging thought.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Brent Oil Forecast

- ProShares Dives into XRP Futures ETF: The Countdown Begins! 🚀

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- Is Jack Ma’s Alibaba Secretly Betting Big on Ethereum? Find Out! 🚀

2026-01-24 14:06