Ah, Bitcoin! The cryptocurrency that has surged a staggering 22.5% in just 30 days, leaving many in the crypto market clutching their pearls and wondering if this wild ride is about to hit a speed bump. But fear not, dear reader! The latest on-chain data suggests that while profits are soaring, panic selling is still as absent as a sensible person at a rave. 🎉

Bitcoin’s Profits: High, But No One’s Jumping Ship Yet!

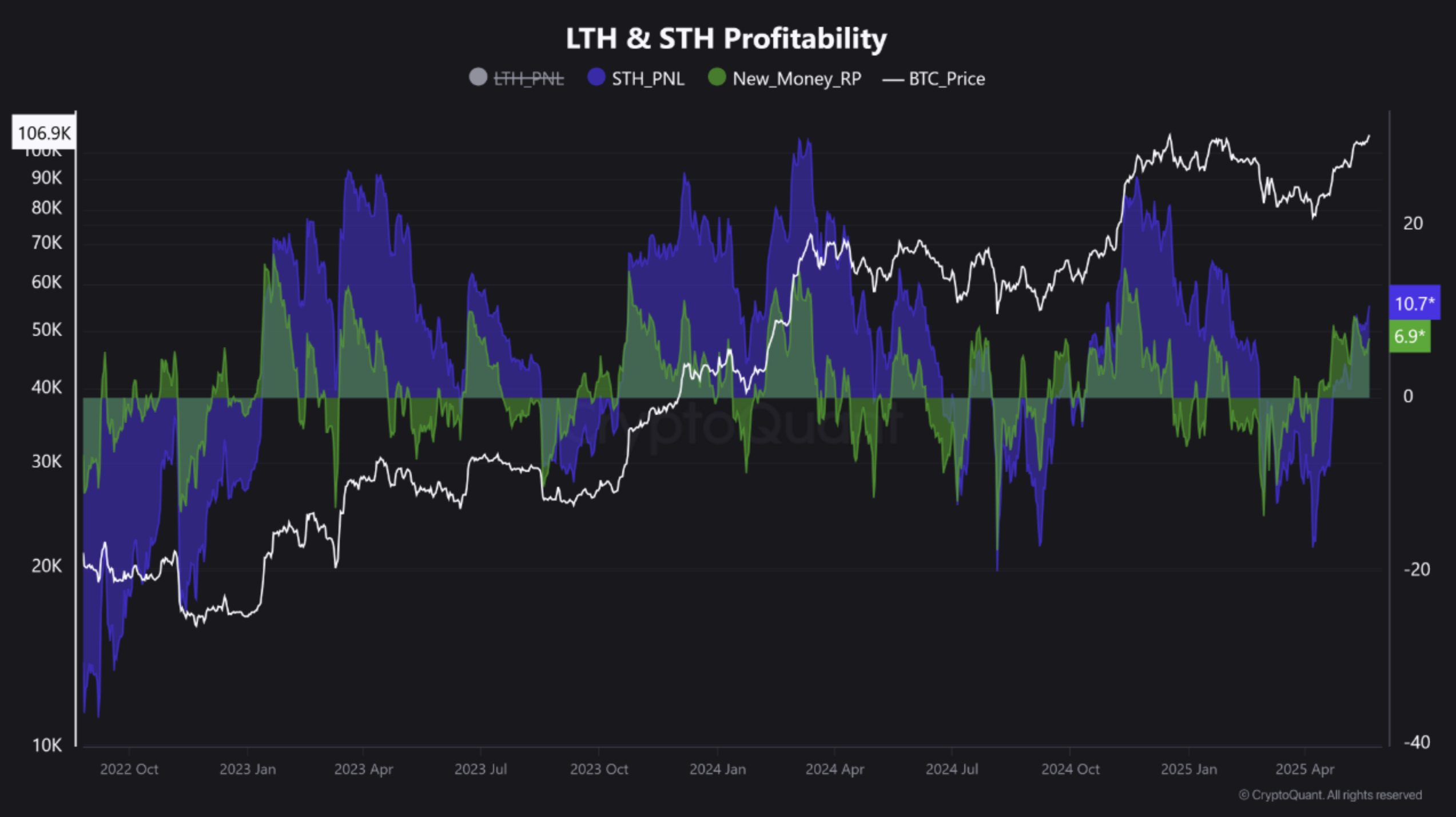

According to the ever-enthusiastic Bitcoin analyst, Crazzyblockk (yes, that’s a real name), new investors—those who have held BTC for less than a month—are basking in unrealized profits of 6.9%. Meanwhile, short-term investors, who have been in the game for less than six months, are enjoying a slightly juicier 10.7%. It seems the profit-to-loss ratio is as lopsided as a three-legged table, with profits far outpacing losses. 🍽️

Crazzyblockk also pointed out that historically, when profits are concentrated like a teenager’s attention span, it often precedes a price correction. But this time, it’s different! (Cue dramatic music.) They noted:

“Past cycles have shown that extreme profit concentration tends to precede volatility; however, current market structure shows no outsized concentration of risk in one participant group.”

In layman’s terms, the profits are spread out nicely, like butter on toast. And while profits are high, losses are low, which means there’s not much pressure from sellers who are about to throw in the towel. Crazzyblockk added:

“While macro conditions and volatility risk remain elevated, and a price correction cannot be ruled out, there is no strong behavioral signal suggesting a high willingness to trigger major distribution or selling.”

Is There More Upside for BTC? 🤔

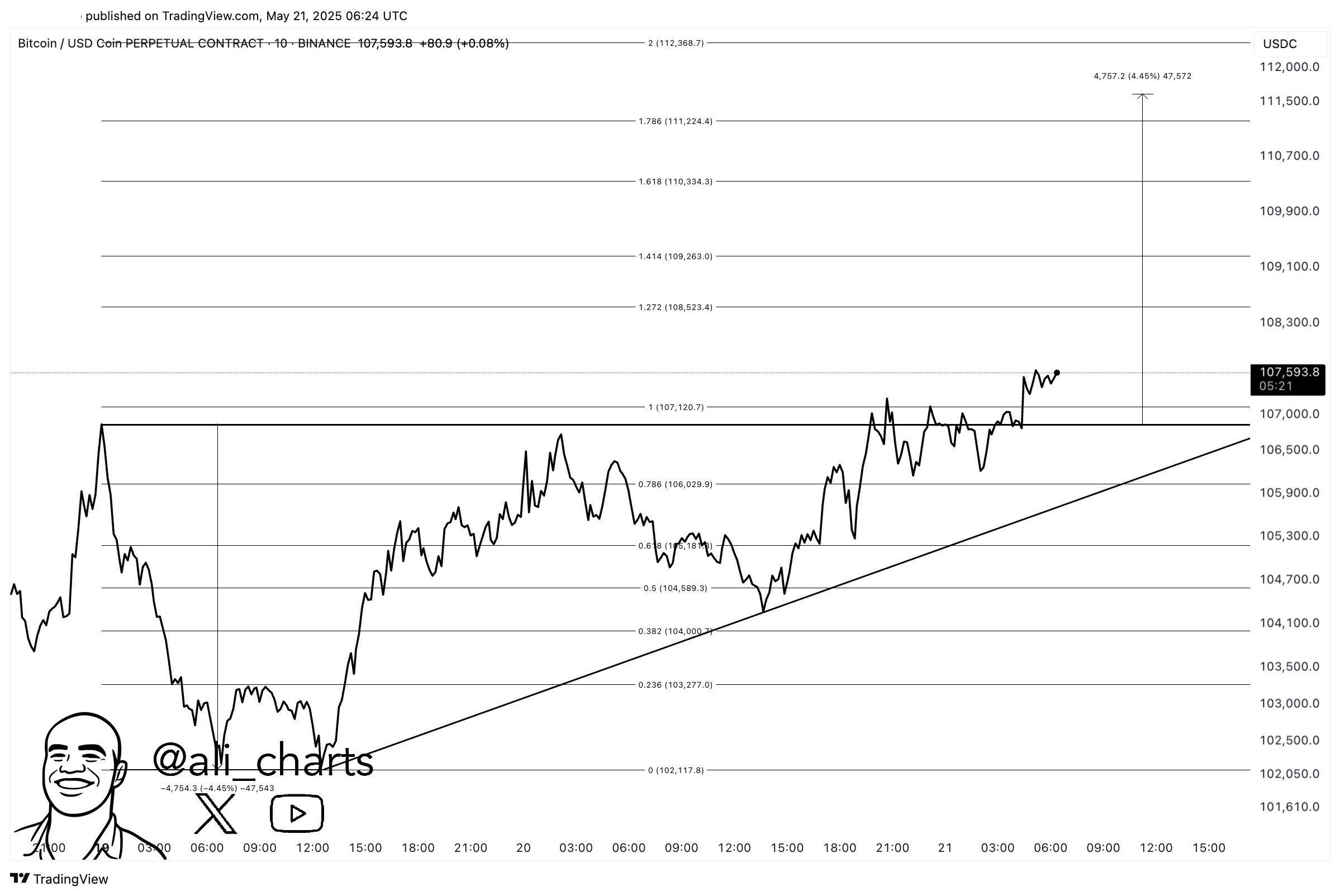

Meanwhile, the ever-optimistic crypto analyst Ali Martinez has thrown his hat into the ring, predicting that Bitcoin could be on the verge of another bullish breakout, potentially reaching a jaw-dropping new all-time high (ATH) of around $111,500. Yes, you read that right! 💸

This current momentum has also attracted retail investors like moths to a flame. According to CryptoQuant contributor Carmelo Aleman, wallets holding less than $10,000 worth of BTC are making a comeback—proof that retail participation is on the rise! 🛍️

However, before we all start planning our lavish vacations on a yacht, there are some warning signs that could put a damper on Bitcoin’s current bullish trajectory. For instance, despite the recent price action that would make even a rollercoaster enthusiast dizzy, Bitcoin’s Demand Momentum is still as flat as a pancake. 🥞

Moreover, the narrative of Bitcoin’s “supply scarcity” is still lacking the punch it needs. Aleman recently emphasized that even with dwindling exchange reserves, BTC is unlikely to face genuine supply scarcity anytime soon. As of now, BTC is trading at $106,528, up a modest 1.8% in the past 24 hours. So, hold onto your hats, folks! 🎩

Read More

- Gold Rate Forecast

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Brent Oil Forecast

- Silver Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Riches or Fool’s Gold? 🤑

2025-05-22 02:53