Ah, Bitcoin! That magnificently tempestuous child of modern finance, forever leaping between grandeur and despair like a caffeinated ballerina with commitment issues. Having recovered its composure with all the grace of a society lady after fainting at the Opera, the celebrated coin has sidled once more up to the hallowed $110,000 mark. Yet, dear reader, before you begin composing sonnets in its honor, let us cast a Wildean eyebrow upon the Open Interest data—because nothing says “sustainable rally” quite like a room full of gamblers shaking out their pockets, does it? 😉

Bitcoin’s Bullish Revival: Or How I Learned to Stop Worrying and Love the Volatility

Picture it: Tuesday. Bitcoin, having briefly dallied in the sordid depths of the $105,000 range, finds itself suddenly buoyed by a rush of enthusiasm, much like a Victorian dandy discovering a tailor’s new collection. It ascends in fashionable haste, reclaiming $109,000, before flirting shamelessly with $110,000—so close to the all-time high one might expect it to demand champagne and adulation.

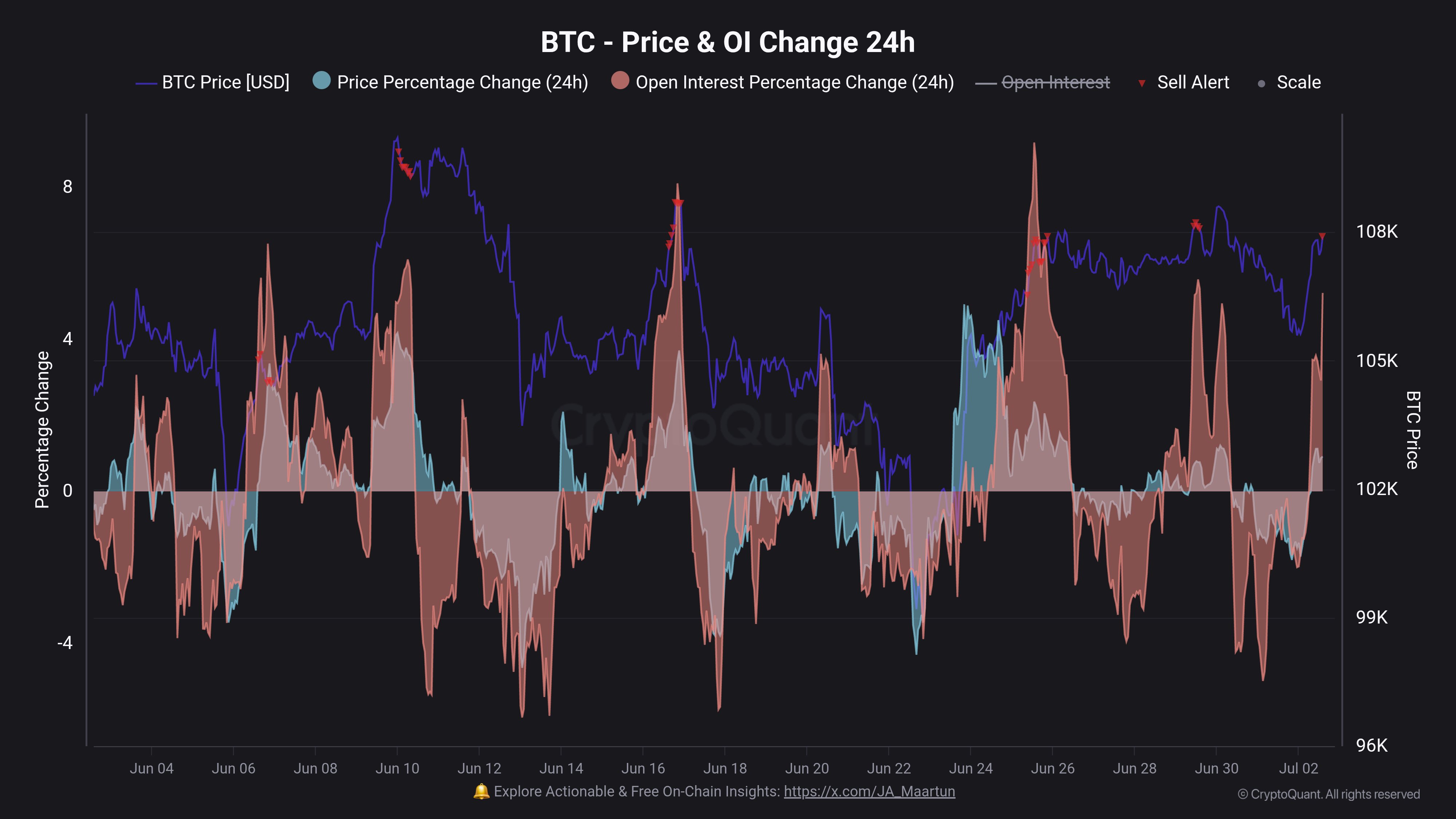

A visual aid, for those who find numbers as dreary as a damp afternoon in London:

Over the past day, Bitcoin eked out a modest 2% recovery. One might wave a delicate lace handkerchief at such a figure—but it has nudged our mercurial hero tantalizingly close to that all-time high. Will this particular soirée end in triumph or tears? The answer, naturally, lies among a cadre of assorted influences, but today’s house special is a spiky little amuse-bouche called “Open Interest.” 🍸

Open Interest: Where Leverage Dons a Mask and Joins the Masquerade

As discerned by the eagle-eyed Maartunn (CryptoQuant’s answer to Lord Henry with Wi-Fi), the latest Bitcoin rally has been accompanied by a dramatic leap in Open Interest. For the uninitiated: Open Interest measures the number of Bitcoin positions still clinging bravely to life in the derivatives market—rather like party guests who simply refuse to take the hint.

A rise in this metric suggests that brave (or foolhardy) souls are busy flinging open new positions, their confidence in leverage matched only by Wilde’s faith in the green carnation. Such exuberance may well lead to increased volatility—each trader hoping to waltz away with profit, yet only a few finding partners. 💃

Conversely, a tumble in Open Interest means that positions are being closed—either by free will, or, more amusingly, by the cold, unsentimental swipe of forced liquidation. This exodus of leverage can render Bitcoin as docile as a teacup poodle, at least for a short, blissful interval.

For your further amusement, a chart showing the wild fluctuations in Open Interest over the past month (suitable for framing, or perhaps for cautionary tales about hubris):

Here we find, my dear friends, a spike so sharp one might hang a velvet jacket upon it. As Bitcoin’s price pirouetted upwards, Open Interest did its best impersonation of a champagne cork. It is not an unfamiliar spectacle; speculative surges are as perennial as Wildean witticisms whenever price action struts onto the stage. 📈

Yet, the sheer bravado of this particular leap is worth a second glance—if only for the comedic potential when it comes tumbling down. Recent history suggests that such dramatic spikes have marked Bitcoin’s brief flirtations with market tops. Will history repeat itself? Or will this time be different? Well, to quote myself: consistency is the last refuge of the unimaginative.

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Silver Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Web3 Soccer Meets Blockchain: FIFA Rivals Kicks Off This June!

2025-07-04 07:43