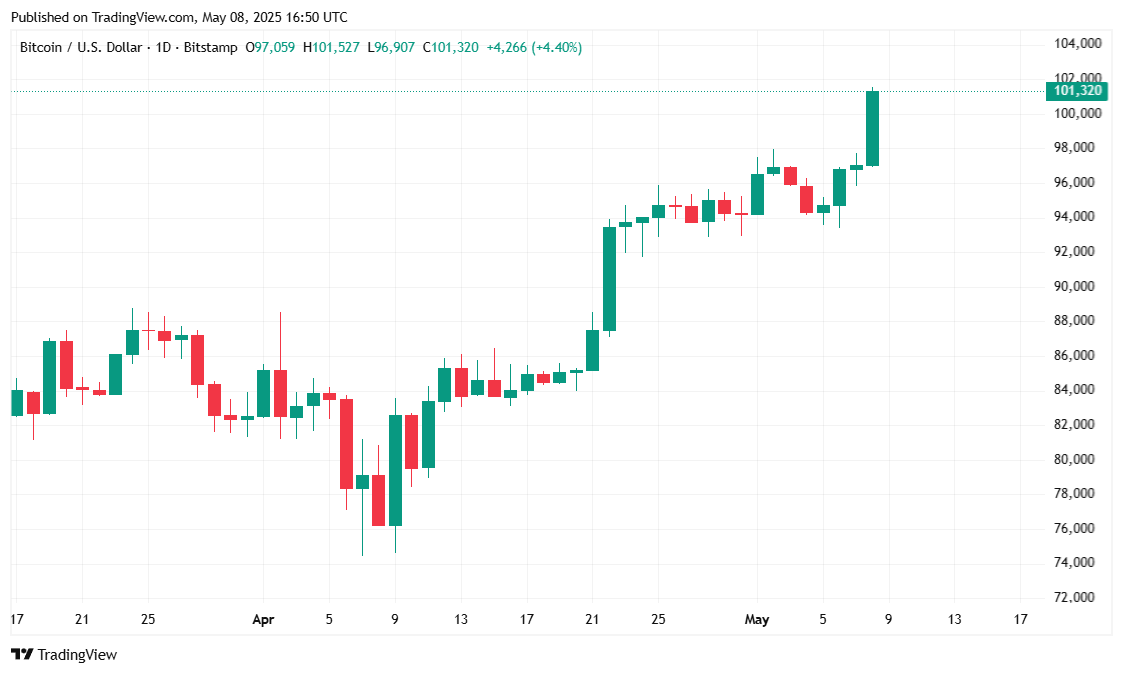

Ah, yes, the sweet, familiar sound of Bitcoin crossing the six-figure line once again. This time, we hit it on Thursday morning like a caffeinated squirrel running through a maze of institutional money.

BTC Breaks the $100K Mark—And No, It’s Not a Dream

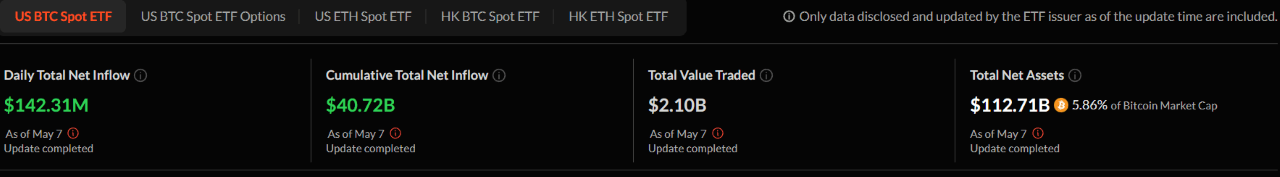

Bitcoin ( BTC) smashed through the $100K barrier once again this Thursday, thanks to net cumulative inflows for spot BTC exchange-traded funds (ETFs) hitting a cool $40.72 billion. The last time this happened in February, the flow was similarly impressive, just shy of $40 billion.

But wait, there’s more! It’s not just ETFs buying in; even companies with far more serious plans are stockpiling Bitcoin like it’s the next big thing. Case in point: Metaplanet, a Japanese treasury firm, just grabbed a hefty 555 BTC, bringing its total to a solid 5,555 BTC. They’re planning to hit 21,000 BTC by the end of next year. Because why not aim for the stars? Meanwhile, Michael Saylor’s Strategy firm is now holding a mind-boggling 555,450 BTC worth over $56 billion. We’re just getting started here.

Speaking of stateside developments, New Hampshire’s bold move to become the first U.S. state to establish a Bitcoin reserve has been followed by Arizona, making it clear that even politicians are now jumping on the digital currency train. And let’s not forget Vivek Ramaswamy’s Strive Asset Management, which is currently in the process of launching the first publicly traded Bitcoin treasury asset management company. Yes, because who doesn’t want a piece of that Bitcoin pie?

“The dominant story for Bitcoin has changed again,” said Geoffrey Kendrick, head of digital assets research at Standard Chartered Bank, with what I can only assume is a smirk. “It’s all about the flows now, and trust me, the flows are coming in hot.”

Market Metrics—The Numbers Don’t Lie

At the time of this writing, Bitcoin is comfortably trading between $95,829.33 and $101,517.39, with the current price resting at $101,167.65—up a modest 4.66% in 24 hours and boasting a weekly gain of 3.91%, according to Coinmarketcap. And if you think that’s impressive, just wait. This surge is a clear sign of renewed institutional confidence, even with the market’s wild, unpredictable swings.

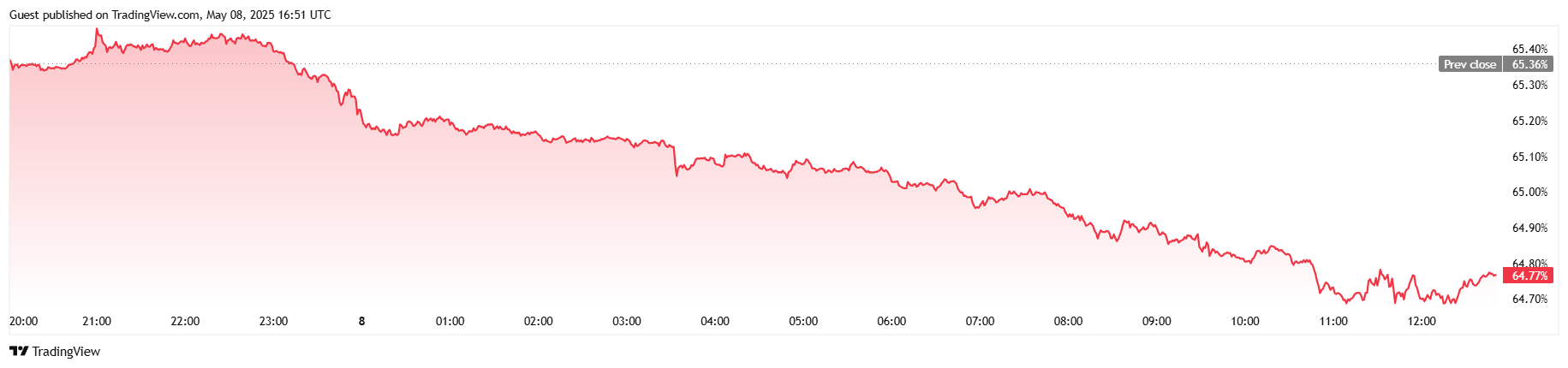

With the price surge came a 41.12% increase in trading volume—$62.38 billion, to be exact. Not to be outdone, Bitcoin’s market cap surged by 4.56%, hitting a whopping $2 trillion. This is the kind of number that makes every crypto enthusiast feel a little more validated in their investment strategy. However, a slight dip in BTC dominance by 0.91 percentage points to 64.77% suggests that some capital is rotating into altcoins. It’s like Bitcoin is the headliner, but there’s room for a few opening acts.

Futures markets are alive with activity, as open interest rose 6.39% to $68.88 billion. If you’re into leverage and speculation, this is your time to shine. But beware—there’s been a decent chunk of liquidations, with $2.47 million wiped off the board over 24 hours. Looks like some overenthusiastic bulls were caught off guard by the market’s temperamental moods.

“I think a fresh all-time high for Bitcoin is coming soon,” Kendrick said, probably while adjusting his crypto-monitoring glasses. “I apologize if my $120K Q2 target turns out to be too conservative.”

Read More

- ZEREBRO PREDICTION. ZEREBRO cryptocurrency

- Cardano Bulls Unleash Secret Weapon to Spark Price Surge!

- DOT PREDICTION. DOT cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- AXS PREDICTION. AXS cryptocurrency

- SEI PREDICTION. SEI cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- Why Consensus 2025 Could Make or Break Pi Network: The Scoop You Can’t Miss!

- You Won’t Believe How 3.7 Million Cryptocurrencies Met Their Comedic Doom!

2025-05-08 22:03