In a unanimous move that raised more than just eyebrows, the central bank committee decided to keep rates unchanged, all while voicing concerns over the relentless march of inflation.

BTC Trends Upward After Fed’s Rate Decision

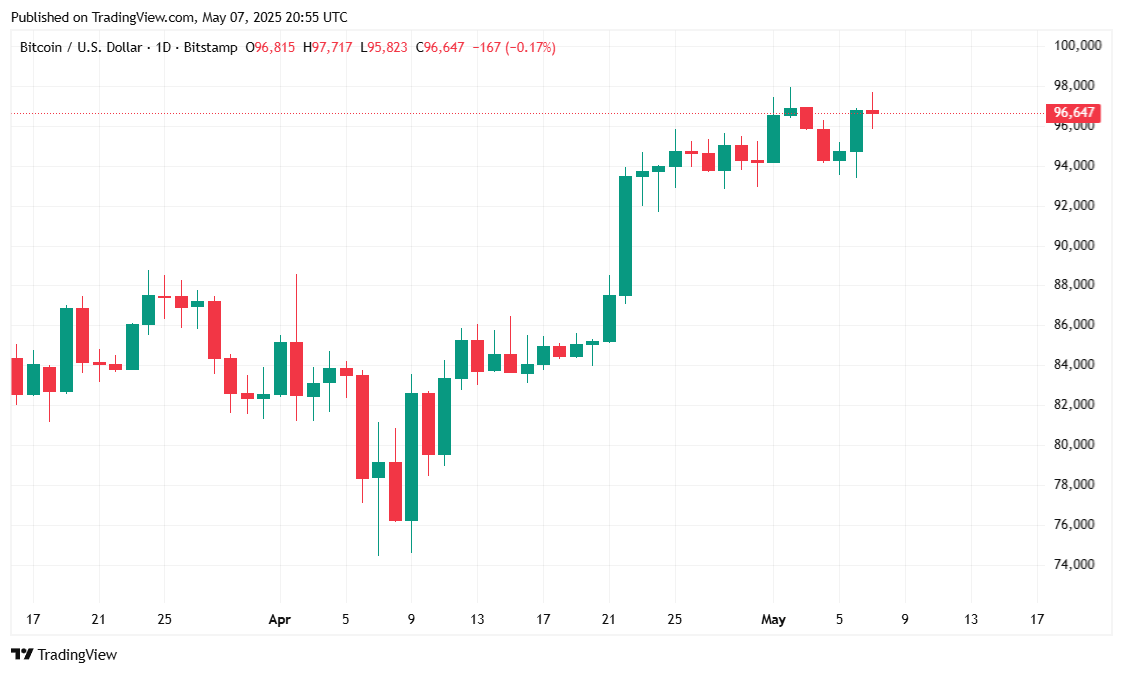

The price of bitcoin (BTC) made a bold leap of 2% after the U.S. Federal Reserve decided to keep its policy rate in the 4.25% – 4.5% range, citing worries over inflation that seem to be playing the part of the villain in this economic drama.

The crypto markets were also feeling the love, up 0.95%, hitting a market capitalization of $2.98 trillion, according to Coinmarketcap. And just to add to the festive mood, traditional market indices – the S&P 500, Nasdaq, and Dow Jones Industrial Average – saw modest gains of 0.43%, 0.27%, and 0.70%, respectively. A real party for all things financial, wouldn’t you say?

Now, economists had been bracing for the Fed’s decision, mainly because U.S. President Donald Trump had made it very clear that he wasn’t a fan of Jerome Powell’s rate-holding tactics. Trump even went so far as to threaten to fire Powell, a move some are calling as unconstitutional as a penguin in the desert. So, credit where credit’s due – Powell stood his ground, keeping the rates right where they were. As for Trump, he was mum on the matter at the time of writing. Perhaps he was busy with other important things? 🤔

“With the Fed hitting pause, it’s clear there’s no quick fix for the economy, and that uncertainty is likely to stick around,” said Pauline Shangett, the chief marketing officer at crypto exchange Changenow, in a rather frank commentary to Bitcoin.com. “That’s when people flock to assets that aren’t at the mercy of political whims.” Oh, the joys of Bitcoin, free from the clutches of politics – or so we hope! 😏

Overview of Market Metrics

Bitcoin climbed 2.05% to reach $96,664.77 at the time of reporting, bouncing between $94,494.88 and $97,625.81. That brought its 7-day gain to a respectable 2.04%, according to data from Coinmarketcap. Not bad for a day at the office!

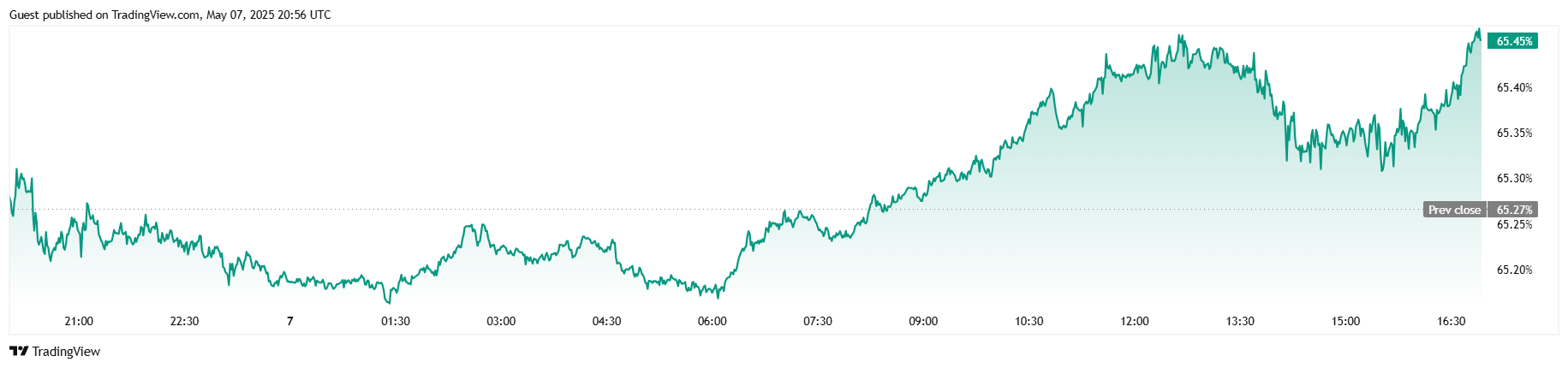

The uptick in price was accompanied by a jaw-dropping surge in trading activity, with 24-hour volume skyrocketing 208.93% to a whopping $71.54 billion. Bitcoin’s market cap followed suit, rising 2.07% to $1.91 trillion. Talk about a growth spurt! Oh, and BTC’s dominance in the crypto space rose 0.44 percentage points to 65.45%. Apparently, people are still fond of the original crypto king. 👑

In the derivatives market, BTC futures open interest rose by 1.93% to $64.37 billion, showing that traders with a penchant for leverage are still very much in the game. Meanwhile, total liquidations over the last 24 hours came in at $273,240. Not exactly a catastrophic figure, but still a healthy reminder of how volatile things can get. The short traders took the biggest hit, with $225,840 worth of their positions wiped out, compared to a mere $47,400 in long liquidations. Guess the bears didn’t get the memo today. 🐻

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Gold Rate Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Whale of a Time! BTC Bags Billions!

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Why NEAR Protocol Might Just See $5: The Great Cryptocurrency Quest! 🚀

2025-05-08 01:04