Let us pause for a moment to contemplate the inscrutable perfection of Bitcoin—now, according to people with suspiciously upbeat Twitter bios, worth a jaw-dropping $113,788 as of Thursday. Yes, that’s not a typo, and yes, anyone who bought pizza with Bitcoin back in 2010 is almost certainly in therapy. Up 3.5% for the day and breaking out of its previous “sidestep shuffle,” Bitcoin is apparently taking dance lessons while the rest of us are still Googling “how to buy crypto.” 🕺💸

Adding to the mix—like a chef who’s lost control of the spice rack—President Trump hopped onto Truth Social to shout energetically (and in ALL CAPS, obviously) about digital assets and stock market records. He accompanied this with another request for the Federal Reserve to slash interest rates, presumably to keep the stock market lurching along like a caffeinated kangaroo.

“Tech Stocks, Industrial Stocks, & NASDAQ, HIT ALL-TIME, RECORD HIGHS!” he posted, leaving us wondering—does he have a CAPS LOCK key, or did he just hit it so hard it never turns off?

Trump, not one for half-measures, also fired a few verbal arrows at Jerome Powell, the stoic Fed Chair he’s described as a “loser,” “stupid,” and probably, off camera, “someone who puts ketchup on steak.” Trump announced that Powell’s removal “cannot come fast enough,” which, legally speaking, has as much precedent as the president declaring himself King of the Moon.

While no American president has ever managed to eject a Fed chair mid-term, the mere idea was enough to send both legal scholars and markets into a blind panic of speculation, hand-wringing, and possibly a spike in sales of antacid tablets.

Now, despite earlier drama this year—brought to you by Trump’s tariff policies and the general spirit of “let’s see what happens”—crypto and stocks have rebounded sturdier than a Weeble (yes, they wobble, but don’t fall down). Institutional investors are piling into digital assets like parents at a Black Friday sale, with a particular love affair developing for Bitcoin ETFs.

Spot Bitcoin ETFs Attract Big Inflows

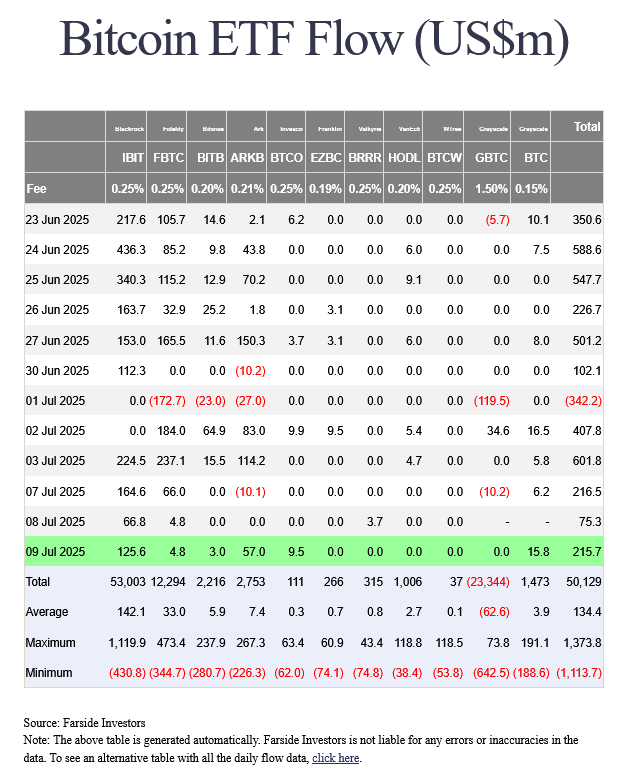

On the topic of ETFs: U.S. spot Bitcoin ETFs have now sucked up more than $50 billion in net inflows since launching in January 2024. BlackRock’s iShares Bitcoin Trust ETF (IBIT) is on a record-breaking bender, pulling in $53 billion—less an ETF manager, more a very tidy vacuum cleaner. Fidelity’s offering comes next with a comparatively modest haul of $12.29 billion, enough to buy all the avocados in California and perhaps still have some left over for hummus.

Meanwhile, Grayscale’s Bitcoin Trust ETF (GBTC) has been bleeding money at a rate that would make a vampire swoon: $23.34 billion out the door, according to Farside Investors. Ouch.

IBIT, on the other hand, has now cornered 700,000 BTC, or a cool 55% of all the Bitcoin parked in such funds. BlackRock is rumored to be making more off IBIT than it does from its flagship S&P 500 ETF, prompting their accountants to break out the expensive calculators.

Massive inflows keep flowing—Farside says so, and they sound trustworthy.

Recall that the Federal Reserve started hiking interest rates in 2022, leading to the kind of economic “fun” not seen since disco reigned supreme. This initially crushed crypto and equities, only for both to bounce back with the energy of a toddler fed chocolate milk. Rates have since been trimmed a smidge in 2024, but Fed officials remain as cautious as a cat meeting a Roomba.

Trump’s latest attempt at turbo-charging the rate-cutting train may or may not work; Powell might dig in, or he might just invest in noise-canceling headphones. What’s sure is markets will keep doing what they do best—being unpredictable while making us feel slightly queasy. As for Bitcoin? The more chaos, the bigger the grin on its face (not that coins have faces, but let’s not spoil the metaphor). So if you were wondering whether it’s time to buy, the crowd’s yelling “BULL RUN!” louder than a stadium full of sports fans at free nacho night. Bitcoin leads, altcoins invariably follow, and—if the crystal ball gazers are right—$200,000 price targets for 2025 are already floating through investment circles like confetti at a very optimistic parade. 🥳🚀

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

2025-07-10 22:09