Oh, Bitcoin, you mysterious little coin. Just when we thought you had stabilized, your supply on exchanges suddenly decided to go on a diet, hitting its lowest point ever. It’s like watching that one friend who swears they’re on a “health kick” but really just skipped lunch. 🍔🚫

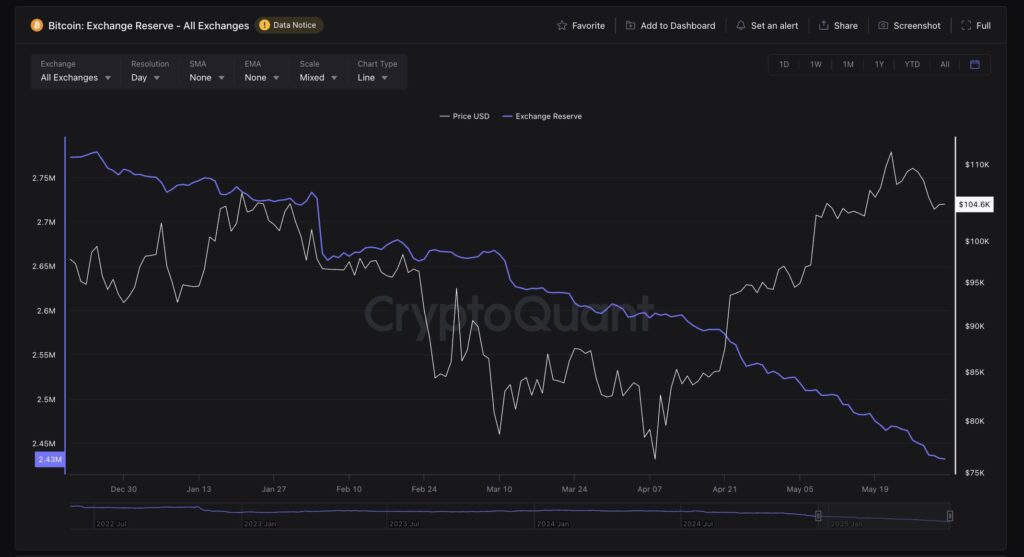

According to the ever-reliable CryptoQuant, the total amount of Bitcoin lounging on centralized exchanges dropped below 2.5 million BTC as of late May 2025. Meanwhile, Bitcoin said, “Hey, I think I’ll hit an all-time high of over $111,500,” like a diva claiming the spotlight. And just like that, we’re all supposed to anticipate a “volatility spike,” which sounds less like a financial prediction and more like a fancy way to say “stuff’s about to get wild.” 🎢

This chart of chaos shows a fascinating dance: while the reserves (blue line) are slinking downward, the price (white line) is head-bobbing upward—kind of like a rollercoaster with a mind of its own. It’s as if Bitcoin is playing hard to get, hoarding its coins while teasing us with rising prices. Typical 💁♂️.

Historically, when Bitcoin’s hiding in the shadows, the price goes on a spree—like a teenager sneaking out past curfew. Many analysts think this dwindling supply means the market might just get spikier than a cactus in a humidity chamber, with wild rides in both directions. Buckle up! 🌵🎢

Big players are also getting in on the fun, hoarding Bitcoin like it’s the last slice of pizza. Strategy, for example, bolstered its stash by acquiring 7,390 BTC in May alone—totaling around 576,230 BTC—at an average price of $69,726. Other companies like GameStop and some mysterious Japanese outfit named Metaplanet are stacking up, too. Because nothing says “trust the market” like Wall Street and videogame retailers pooling their coins. 🎮💸

Meanwhile, spot Bitcoin ETFs pulled in over $5.23 billion in just a month. Governments are also in a competitive race—UAE and Pakistan are busy stacking, and U.S. lawmakers are apparently considering a “national Bitcoin reserve.” It’s like the backstage of a bizarre international heist, only with more spreadsheets. 🏦🌍

On the technical side, Bitcoin is playing the ultimate game of “wait and see.” Momentum indicators are as indifferent as a cat ignoring you. The relative strength index is at 52—literally dead center—while the moving averages are hinting at a slight bearish twist. Basically, the crypto world is in that awkward phase where no one knows if the party’s just starting or if it’s time to go home.

Bitcoin is currently enjoying a luxury suite above the 200-day EMA and SMA, which are both climbing happily upward. The rally could push us towards $110,000 or even higher if Bitcoin manages to hold its short-term support of around $106,000. But beware! If the coin can’t keep support at $98,000 or dips below $94,000, it might be time to start panic-buying snacks for the impending rollercoaster ride. 🎢

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

2025-06-02 08:34