If you’re looking for stability, you’d probably be better off giving your savings to that uncle who sells artisanal kombucha out of a van. Instead, you’re here to check on Bitcoin, which, at the moment, is floating just above $108,000, like one of those novelty balloons your dentist gives you after a root canal: festive, fragile, and likely to pop at any moment.

The drama—as always—unfolds in slow motion, with the ‘bulls’ supposedly defending two support levels: $106,738 and $98,566. (Really, those are just random numbers with the same ring as lottery tickets, but let’s not ruin the magic.) Should BTC slip through these floors, things could get so ugly even your Coinbase app will avert its eyes.

The $106k and $98k Securo-Bubble Wrap

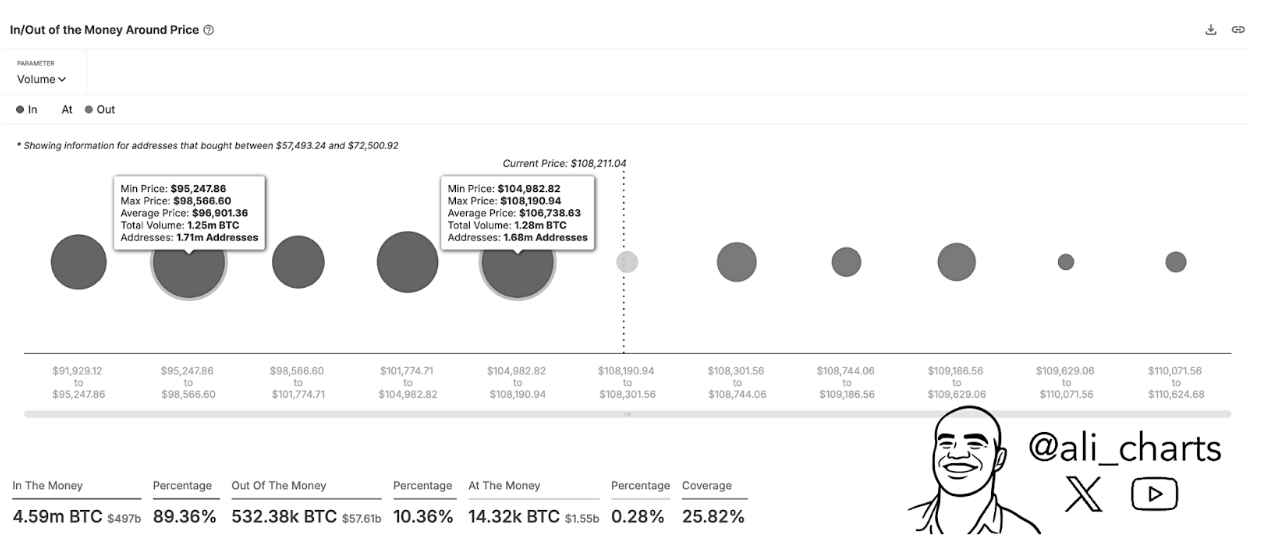

Over on X—formerly known as Twitter, formerly known as “a way to disappoint your parents on the internet”—crypto analyst Ali Martinez is arm-wrestling with statistics pulled from Sentora, some platform that sounds both medical and made up. The so-called “In/Out of the Money Around Price” tells us that Bitcoin’s real estate hot spots now hover between $104,982 and $108,190 (the “Upper Middle Class” neighborhood) and $95,248 to $98,566 (the “Still Good School District, But Watch for Potholes” area).

Apparently, 1.68 million addresses have thrown a combined 1.28 million BTC at those upper levels. That’s a lot of believers—or at least a lot of people who forgot their passwords after 2017. Drop below these, and you’ll hit the next batch: 1.71 million addresses and 1.25 million BTC, where everyone prays the elevator stops falling.

Right now, Bitcoin’s rally is like a party where everyone’s standing under a sprinkler: it’s exciting until the water pressure drops. If sellers crash through these “pockets of demand,” we’re in no-buyer-land. It’s sort of like hosting an NFT launch these days—lots of echo, not much turnout.

But wait! There’s less desperation than you’d think. Big holders have actually slowed their mad dash for the exits. Data shows Bitcoin’s enjoying its fifth week of net outflows from centralized exchanges. Over $920 million has shuffled into self-custody or Spot ETFs—because nothing says ‘security’ like assuming Larry Fink is your friend now.

Can Bitcoin Find Its Self-Worth Above Weekly Resistance? 😬

Of course, even with all this “support,” Bitcoin hasn’t exactly broken out the champagne. According to another analyst, the serious-sounding Rekt Capital (honestly these names), Bitcoin needs to clamber over a weekly resistance band camped out just beneath $109,000. Right now, it’s trying to break the $108,890 ceiling, but the candlesticks aren’t cooperating; they’re currently doing the financial equivalent of tripping up the stairs at the Oscars.

If Bitcoin manages to slam the door on $108,890 for a weekly close, we’re apparently on our way to new all-time highs. If not, expect the price action to channel your last three relationships: erratic, retrace to old levels, and eventually result in regret. Latest trade? $108,160. Don’t spend it all in one block.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- SUI ETF? Oh, the Drama! 🤑

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Why Bitcoin Will Soon Be the Price of Your Childhood Dream and More

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- USD MXN PREDICTION

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

2025-07-06 15:41