So, here we are, another day, another crypto analyst warning us that the sky is falling. This time, it’s Dom (@traderview2), a name that’s become synonymous with “I told you so” in the crypto world. On Wednesday, he dropped a bombshell: Bitcoin is teetering on the edge of a structural collapse. “If this continues, it snaps,” he declared, as if he were the only one who could see the writing on the wall. 🤦♂️

Dom’s detailed post paints a picture of a market on the brink. He describes the current conditions as “vital,” which, in crypto-speak, means “if we don’t act now, we’re all screwed.” The recent weekly chart, he says, shows a bearish “liquidity grab”—a fancy way of saying that Bitcoin briefly spiked above the previous high, only to plummet back down, a classic sign of a local top. 📉

But wait, there’s more! The chart has also formed a “three-touch declining strength formation,” which is just a fancy way of saying that the bulls are losing steam. “I think time is ticking for bulls to save this chart, as it needs to happen soon IMO,” Dom adds, because, you know, the market can’t just take a breather or anything. 🕒

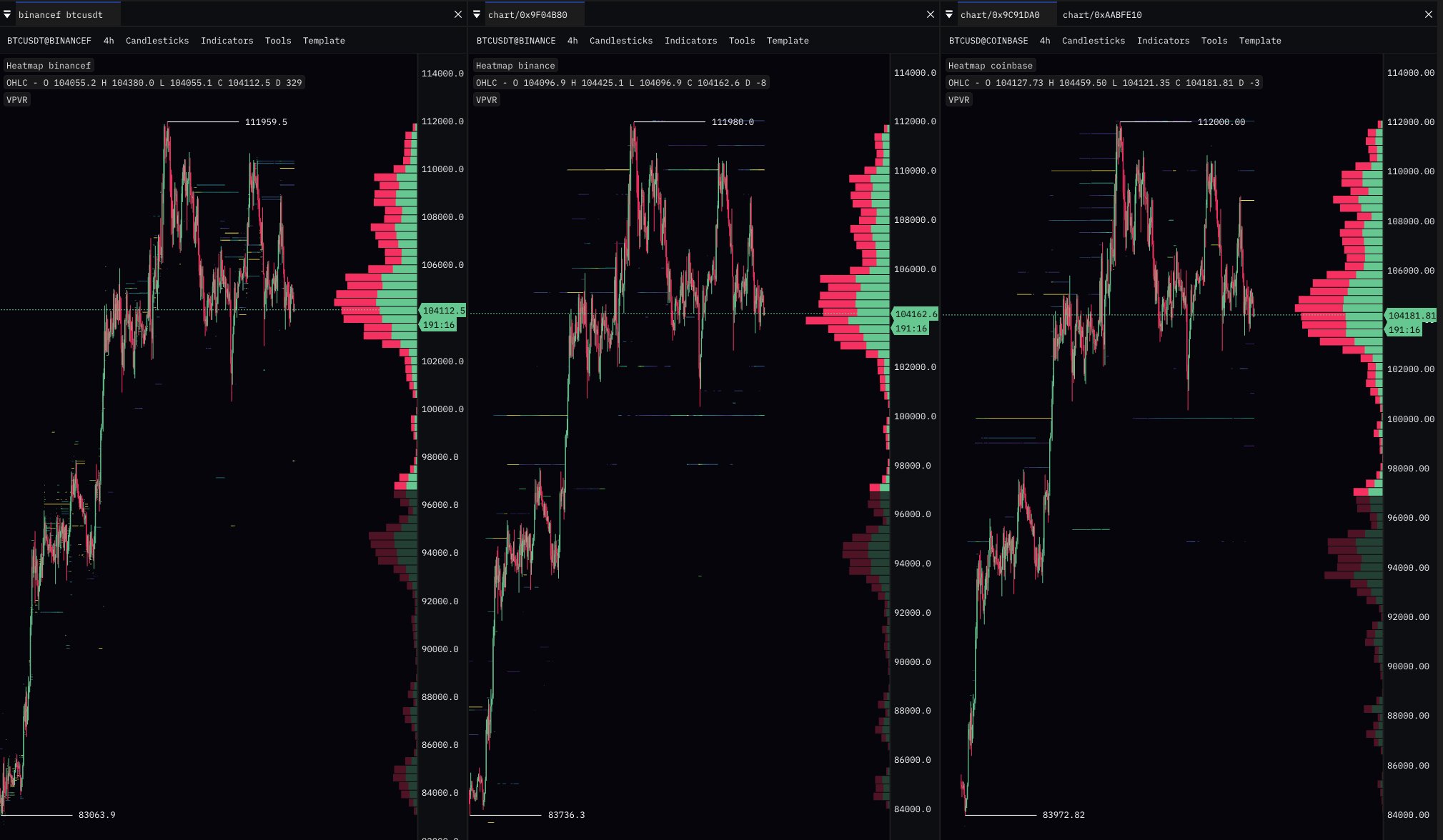

Underneath all this price action, the structural foundation of Bitcoin is looking more fragile than a house of cards. Dom points out that the order books on major exchanges like Binance, Bybit, Coinbase, OKX, and Kraken are alarmingly thin. Over the past three weeks, about 38,000 BTC has been sold into the market, and it’s all been absorbed by passive bids. But here’s the kicker: there’s virtually no support down to $80,000. “There is virtually no support down to 80ks (at least as of now), not even advertisement of support,” he says, as if the market is just waiting for the other shoe to drop. 🥿

The same bearish pattern is playing out in perpetual futures markets. Platforms like Binance, Bybit, OKX, and Hyperliquid have seen consistent taker-side selling, forming what Dom calls a “relentless downtrend of market selling.” With perp books also thin, the pressure may be unsustainable unless conditions change quickly. Drawing a parallel to Bitcoin’s February breakdown from the $90,000 level, Dom notes, “We saw the same dynamic pre-90k breakdown.” The implication is clear: without a shift in market behavior, BTC may be headed toward a similar fate. 🚨

And let’s not forget the seasonal trends. Dom highlights that summer months historically bring weaker market participation and lower liquidity—an environment that exacerbates downside moves and limits the impact of bullish efforts to regain control. It’s like the market is on vacation, and no one’s minding the store. 🏖️

Despite the grim analysis, Dom remains clear on what would invalidate his bearish stance: a recovery of the $108,500 level. “If that level regains, great. I think we can void these signals,” he says. “But for now, bearish outlook for me is the better R/R on a risk-first basis.” In other words, he’s betting on the downside, but he’s not a complete pessimist. 🤞

In a separate reply, Dom acknowledges that a dip to the $96,000–$98,000 region, even with a wick into the $80,000s, would not necessarily break structure. “It surely would not be abnormal and I think structure would still be ok,” he writes, adding that he would reassess the setup if such a move occurs. So, there’s still a glimmer of hope, I guess. 🌟

With order books thinning, taker flow intensifying, and no solid support beneath, Dom’s message is blunt: time is running out. At press time, BTC traded at $104,694, but who knows how long that will last. 🕰️

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Brent Oil Forecast

- ETH Does What Now?! 😱

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Bitcoin’s Next Move Will SHOCK You! $85K or $83K?

- Gary Gensler Throws Shade at Altcoins but Gives Bitcoin a Wink 🚀💼

2025-06-20 12:05