So Bitcoin’s out there breaking records, flying high—like your neighbor’s drone that you secretly wish would crash. 🚁 Institutions are piling in, supply’s drying up, everyone’s excited. Bitcoin (BTC) is strutting around at $111,500, up 4.2% in 24 hours. Mazel tov, Bitcoin! 🎉

But then you look at Strategy stock (MSTR). Flat as a pancake. $403. Not even a twitch. It’s like watching someone try to parallel park for ten minutes and still end up crooked. Remember when MSTR and Bitcoin were best buddies? Yeah, not anymore. That friendship’s over—probably blocked each other on social media.

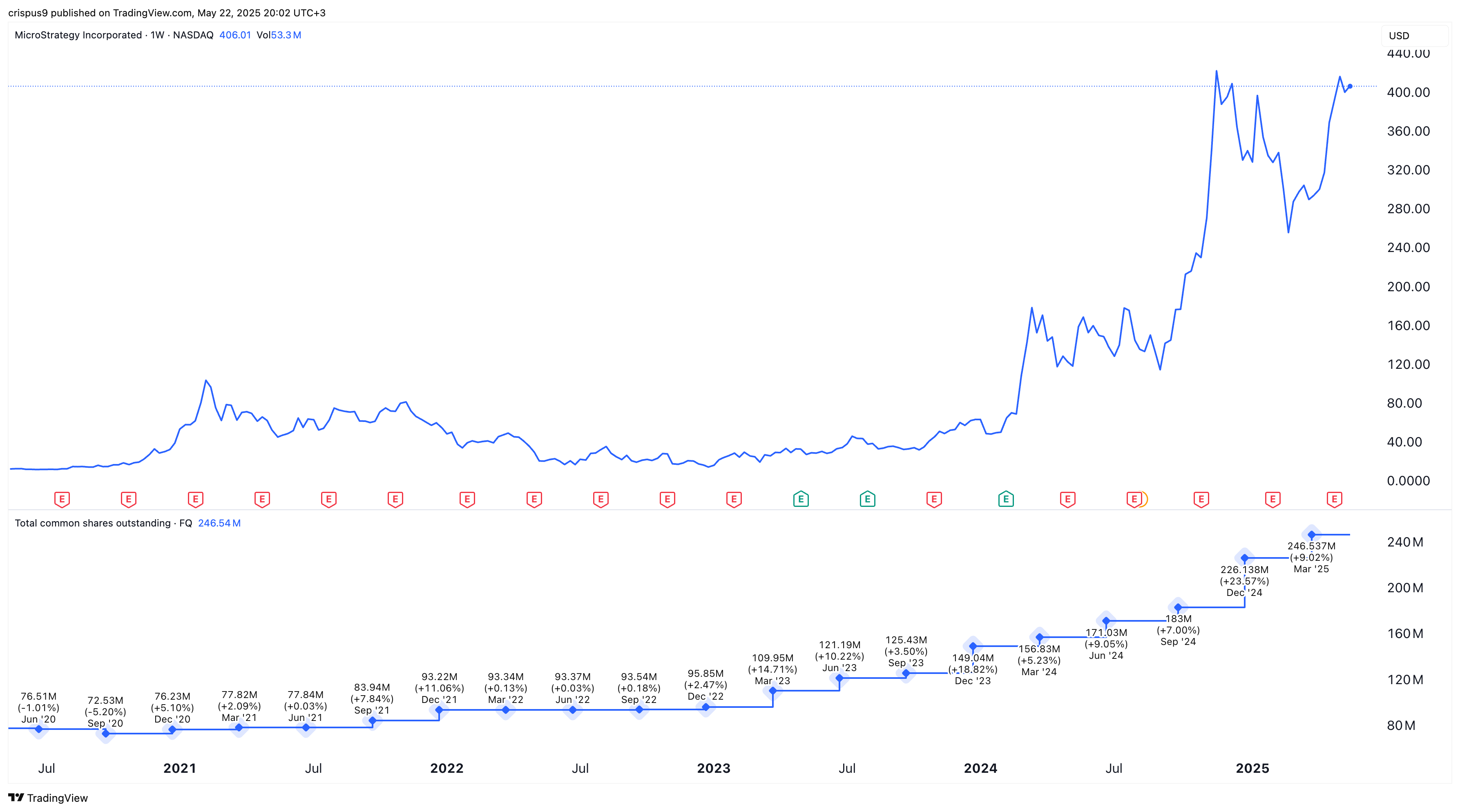

Why the cold shoulder? Well, first off, investors are getting nervous about dilution. Strategy keeps borrowing to buy more Bitcoin, and the number of shares has exploded from 75.5 million in 2020 to 246 million now. That’s not dilution—that’s a flood! You need a life raft just to keep up.

And it’s not stopping! They’re selling $2.1 billion in preferred stock to buy even more Bitcoin. Because apparently, you can never have too much of a good thing—unless it’s fruitcake or reality TV.

Long term? They want to raise up to $84 billion—yeah, with a B—which is 76% of their market cap. Most of it goes to Bitcoin, some to “corporate initiatives.” Translation: probably more meetings and fancy coffee machines.

MSTR stock is lagging behind Bitcoin because investors are scratching their heads over the valuation and those lovely mounting losses. They’ve got 576,230 coins worth over $64 billion, but the market cap is $110 billion. Some analysts think eventually the stock price will catch up with the Bitcoin stash. Eventually. Maybe. If the stars align and Mercury isn’t in retrograde.

Meanwhile, losses are piling up like laundry after a long weekend. Last quarter: $6 billion in operating expenses, $4.1 billion net loss, revenue down 3.6% to $111 million—missed expectations by a mile. Investors are skeptical, short-sellers are circling like seagulls at a beach picnic. Jim Chanos is shorting MSTR, calling out “artificial” price inflation. Andrew Left says it’s like a pyramid scheme—because nothing says confidence like being compared to a pyramid scheme.

MSTR stock price analysis

The daily chart? Sideways action—like my uncle trying to dance at weddings. Still above the 50-day and 100-day moving averages though, so there’s hope! There’s a bullish pennant pattern forming (sounds fancy), and before that, a double-bottom with support at $237 and neckline at $343.

If crypto sentiment keeps improving, maybe—just maybe—we’ll see a breakout to the all-time high of $542. That’d be a 33% jump from here. But hey, don’t hold your breath. Or do—just don’t blame me if you pass out.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Silver Rate Forecast

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- USD GEL PREDICTION

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

2025-05-22 21:27