Who needs job security when Bitcoin is on a tear? Despite jobless claims jumping in late April, the market is having none of it, as both traditional and crypto assets soared early Thursday morning.

The Markets Keep Dancing: Bitcoin Hits $97K While Jobless Numbers Drag Their Feet

The U.S. Department of Labor released new data showing that unemployment claims rose sharply to a seasonally adjusted 241,000 for the week ending April 26, an increase of 18,000 from the previous week. But don’t worry, Wall Street hardly noticed, and neither did Bitcoin, which surged past $97K like it was nothing. Traditional markets followed suit, proving once again that the economy is a fickle beast, unable to dictate what the real players are up to.

According to Reuters, the jump in jobless claims wasn’t enough to panic investors, since the spike was merely a result of spring break in New York. So, no need to cry over spilled numbers – it’s just a seasonal thing, or as they say in the business, “Nothing to see here, folks!”

Meanwhile, Bitcoin’s meteoric rise was in sharp contrast to the behavior of gold, which decided to take a nap and slipped down to $3,216, a 2.17% drop. Geoffrey Kendrick, the wise sage from Standard Chartered Bank, repeated his mantra: “Bitcoin is a better hedge than gold when the U.S. repositions its strategic assets.” Of course, you might say, “But Geoffrey, can I hold Bitcoin in my hand?” and he’d probably just shrug and hand you his phone.

Market Metrics Overview: The Bitcoin Odyssey

Bitcoin climbed a solid 3.37% in the last 24 hours, hitting $97,178.85 at the time of writing. Trading between $93,762.50 and $97,437.96, it had one of its best days this week, marking a 7-day rise of around 4.05%. Truly a thing of beauty.

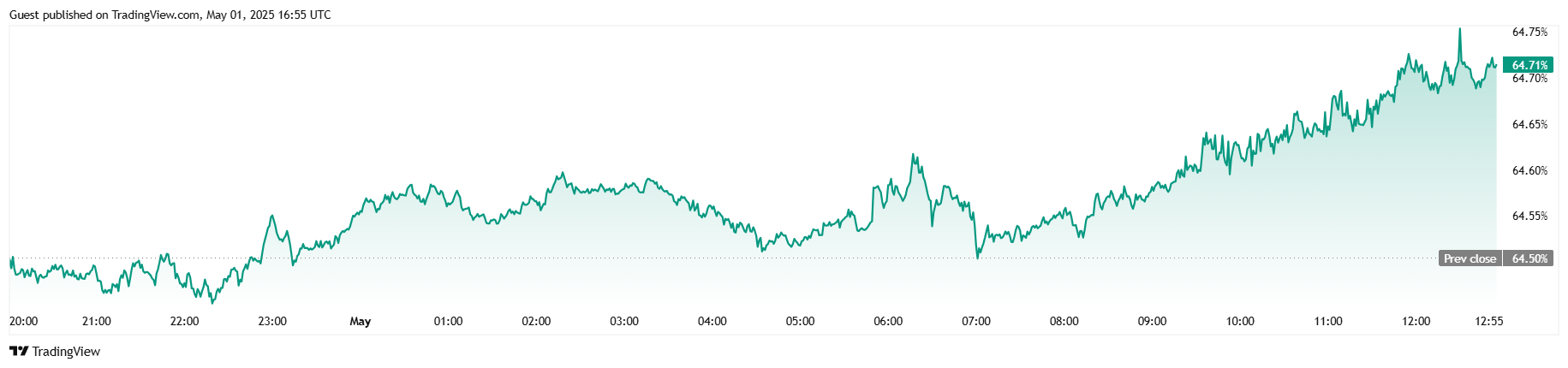

And as Bitcoin soared, so did trading volume, which shot up by 7.45% to $31.20 billion. The market cap ballooned to $1.92 trillion, marking a 3.40% increase since yesterday. Bitcoin’s dominance in the broader crypto market has reached 64.72%, a modest gain of 0.085 percentage points. It seems that when Bitcoin moves, everyone else just gets dragged along for the ride.

As if that wasn’t enough, the derivatives market followed the mood. According to Coinglass, Bitcoin futures open interest jumped by a hefty 8.96% to $67.93 billion in just 24 hours, signaling that traders are more confident than ever. Liquidations? Oh, they happened, but the shorts took the biggest hit, losing $860,900 compared to just $31,940 from long positions. Looks like the bears are going to hibernate for a while.

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Brent Oil Forecast

- XRP: The Calm Before the Storm?

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Silver Rate Forecast

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Bitcoin’s Unyielding Spirit: Hodlers Laugh at the Dip 🤑

2025-05-01 21:06