So apparently, a bunch of boring financial stuff happened, and Bitcoin decided it was time to put on its big-boy pants again. Who knew?

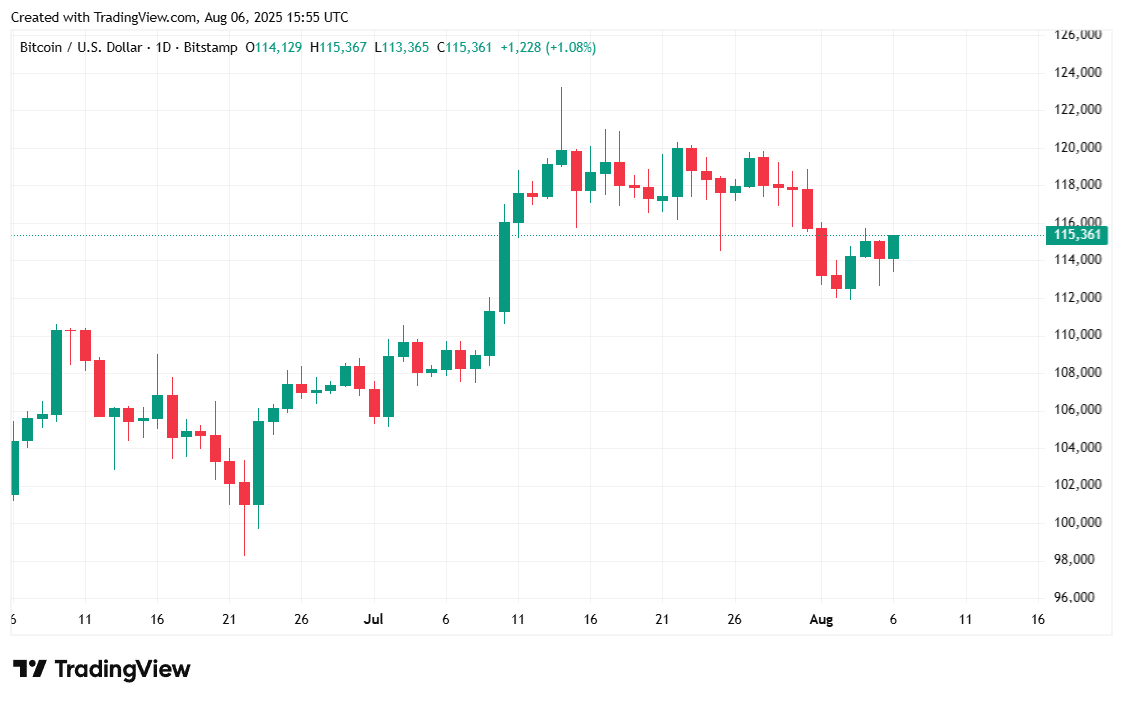

Let’s break this down like we’re explaining it to your weird uncle who still thinks Bitcoin is a new type of toaster. 🍞 Positive earnings reports from companies like McDonald’s (yes, the same place you order fries from while crying in your car) and Apple’s decision to toss $100 billion into the U.S. economy-because why not?-seem to have cheered up both stocks and crypto markets. Bitcoin, which had taken a nosedive all the way to $112K, rebounded like a kid pretending they didn’t just trip in front of their crush. It’s now back above $115K, where it’s been happily hanging out like it owns the place.

Meanwhile, the SEC-the government’s designated fun-police squad-issued some guidance that basically says staking cryptocurrencies doesn’t count as selling securities. Cue the collective sigh of relief from crypto enthusiasts everywhere. Ether (ETH) and Solana (SOL) can breathe easy now, even though Bitcoin itself isn’t involved in staking. But hey, when one cryptocurrency gets good news, they all throw a party. 🎉 It’s like when your roommate gets promoted, and suddenly everyone wants to eat steak for dinner.

And speaking of parties, Bitcoin may not be invited to corporate America’s annual gala, but its investors definitely are. When McDonald’s posted Q2 revenue of $6.84 billion (beating estimates faster than you can say “Big Mac”), and Tim Cook decided to play Monopoly with real money by investing $100 billion, the ripple effect reached BTC too. The result? A 2% jump in price today. Not bad for something that technically doesn’t even exist in physical form. 👀

Now, let’s talk numbers because nothing screams “exciting” quite like statistics.

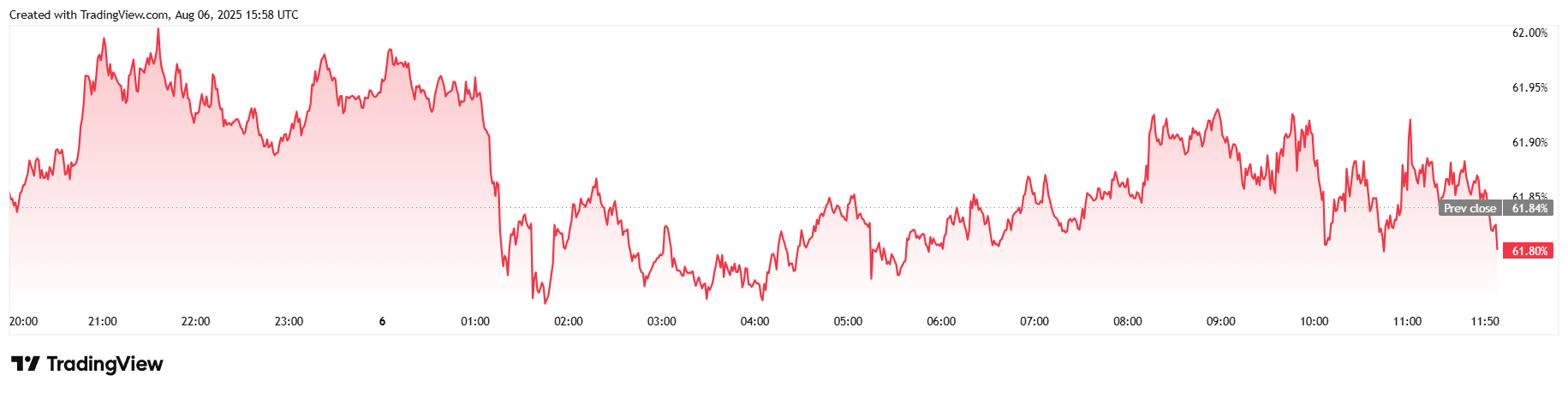

At the time of writing, Bitcoin was trading at $115,169.24, which is up 2.13% since yesterday but still down 2.32% for the week. Its price has been doing the cha-cha between $112,707.71 and $115,322.38 over the past 24 hours. Meanwhile, trading volume dropped by 6.77% to $56.38 billion, but market capitalization rose by 2.25% to $2.29 trillion. Bitcoin dominance stayed mostly flat, sitting pretty at 61.80%. And if you’re into futures, total open interest dipped slightly by 0.68% to $79.25 billion, with liquidations totaling $23.19 million. Short positions got wrecked harder than my New Year’s resolutions, accounting for $17.91 million of those losses.

Look at that chart! It’s like Bitcoin is auditioning for a role in an action movie. “I’ve fallen, but I’ll rise again!” 📈

And here’s another chart, because apparently two charts make everything twice as convincing. Or maybe they just wanted to fill space. Either way, it looks official, right?

So there you have it: Bitcoin is back, corporate giants are flexing their wallets, and regulators are finally giving us some clarity-or at least pretending to. Now go forth and impress your friends with your newfound knowledge of crypto metrics. Or don’t. Honestly, they were probably just going to ask you how to mine Dogecoin anyway. 🐶✨

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

2025-08-06 20:23