Markets

What to know:

- Backwardation now weighs upon the market like a somber confession, with futures prices cowering beneath near-term levels, betraying a cautious spirit among the institutional elite.

- This strange curve has a way of emerging whenever traders are forced to abandon their dreams, often heralding moments when markets scrape the very bottom of their weary souls.

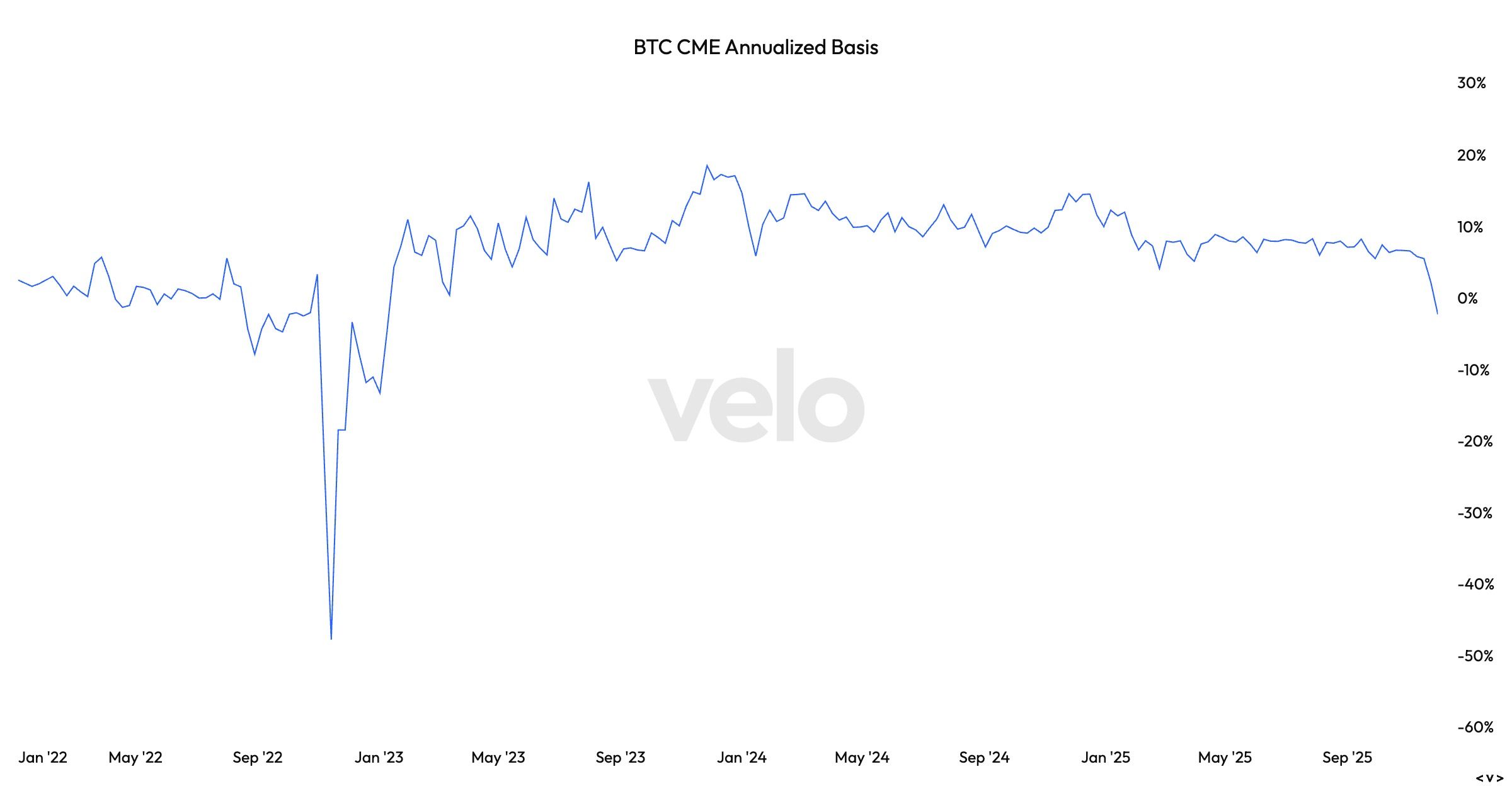

The CME bitcoin annualised basis has slipped to -2.35%-a quiet but chilling descent,

its deepest backwardation since the chaotic days of the FTX collapse in November 2022,

when the basis flirted with a nightmarish -50%. One might almost hear it whisper,

as if confessing its sins in a dimly lit room. 😐📉

Backwardation, in its cruel simplicity, reveals a futures curve where nearer contracts,

like impatient Dostoevskian protagonists, insist upon higher prices than their distant,

brooding counterparts. The market thus speaks: tomorrow shall be poorer than today.

A sentiment we all relate to at some point, don’t we? 😅

And yet this is a curious condition for bitcoin, a creature that normally walks proudly

in contango-its futures elevated by leverage and the eternal optimism of traders who

believe tomorrow will be brighter… or at least funded.

The recent slide into backwardation first flickered around Nov. 19, mere days before bitcoin

found its footing near $80,000 on Nov. 21. In this latest correction, leverage has drained

from the system like hope from a gambler at dawn-traders unwinding longs, institutions stepping

back, and everyone pretending they meant to do that all along. 🙃

Backwardation has a habit of appearing when the market trembles: November 2022,

March 2023, August 2023, and now November 2025-each moment aligned with deep or local lows.

Patterns like these would make even a stoic man mutter, “Again? Truly?”

But let us not mistake backwardation for salvation. It offers no automatic promise of

a bullish awakening. Unlike physical commodities-oil, for instance-bitcoin cannot claim

tight supplies as an excuse. CME futures are cash settled, molded by institutional basis trades,

and entirely capable of sinking deeper into the abyss. 🕳️📉

In this light, backwardation is less prophecy and more lamentation: cautious pricing,

growing uncertainty, and expectations weakened by the slow grind of human fear.

Though much leverage has already evaporated like a guilty conscience,

conditions may worsen should appetite for risk decay further.

And yet-how paradoxical!-this same bleak structure has often marked the moments when

forced sellers at last collapse, panting, having no more to surrender.

Thus bitcoin enters a region haunted by both peril and promise,

a narrow corridor in which despair and opportunity walk arm-in-arm like old friends. 🤷♂️📈

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- 🚀 Ants Gone Wild: $1.24B Korean Crypto Frenzy During Chuseok! 🤑

- Deutsche Telekom: Now Validating Crypto, Still Not Fixing My Wi-Fi 🤷♂️

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- BTC AUD PREDICTION. BTC cryptocurrency

- TRX PREDICTION. TRX cryptocurrency

- Trump’s Crypto Invasion: Blockchain Meets Bollywood Drama! 🎭💰

2025-12-03 20:08