Ah, the sweet smell of a rebound! In the ever-turbulent world of digital assets, a cocktail of U.S. labor market fragility, ominous trade war whispers, and wild speculations about rate cuts has reignited the bullish flames. And now, with the U.S. inflation data looming just around the corner, traders are sitting on the edge of their seats, eagerly waiting for the next move in this high-stakes game.

Crypto Market Bounces Back After Economic Jitters

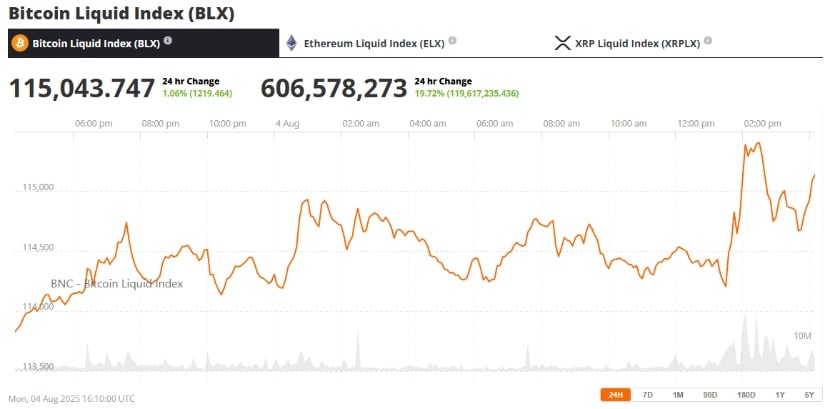

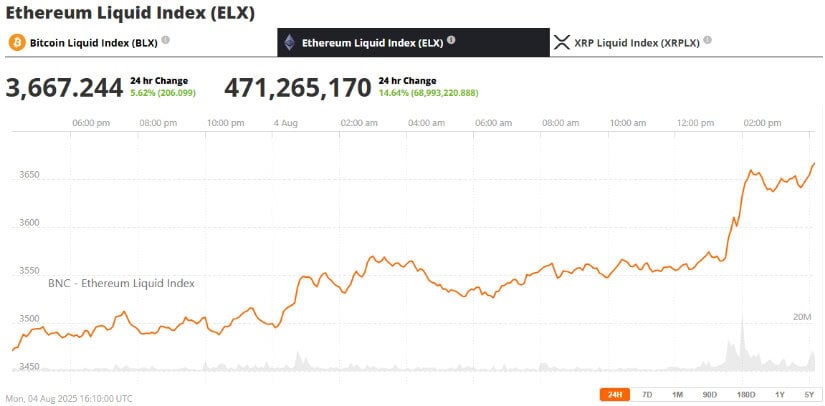

Just when you thought the crypto world might crash and burn, a sharp decline in the middle of the week—sparked by lackluster U.S. non-farm payroll data and escalating trade fears—was quickly wiped away like a bad dream. XRP soared 6.5%, Ethereum rose by 2.7%, and Bitcoin? Oh, Bitcoin dusted itself off and swaggered back up to $115,043. No biggie.

Min Jung, an analyst from Presto Research, pointed out the obvious: “The sell-off was driven by bad labor data, throwing cold water on both crypto and traditional markets.” Sure, but did that stop the brave-hearted? Nope. The market rebounded quicker than you can say “FOMO.”

Jeff Mei, COO at BTSE, offered his sage advice: “Whenever the market dips, the long-term investors pounce like hawks. That’s why we never see deep, prolonged downturns.” Oh, Jeff, you sweet optimist, always looking for the silver lining in the storm clouds.

Inflation Data in Focus: CPI Could Define Market Direction

The next big moment? The U.S. Consumer Price Index (CPI) report hitting next week. It’s the Holy Grail for traders, as they believe it might spark a shift in policy. Rumor has it, the Federal Reserve may even cut rates come September. Wow, who saw that coming?

Some analysts are quietly whispering that a soft inflation reading could fan the flames of a crypto rally. Because, of course, when in doubt, let’s pump up the digital asset market some more! Futures markets are betting a whopping 89.1% chance that the Fed will cut rates next month. Betting odds in crypto? Who knew!

Vincent Liu, CIO of Kronos Research, joined the cheer squad: “The stars are aligning for crypto. Whale accumulation? Rate cut anticipation? It’s all coming together like a bad soap opera.”

XRP and Ethereum Take the Lead

And then there’s XRP, still flaunting its shine. A 6.5% jump? You bet. Why? Because everyone’s talking about an XRP ETF, which now has a 64% chance of approval—before Litecoin. You heard it here first, folks!

Ethereum? It’s casually flirting with $3,667, just 25% away from its all-time high of $4,878. The whole crypto world is betting on ETH revisiting those heights, especially as Layer-2 and DeFi continue to climb. It’s like a never-ending comeback tour for this digital superstar.

Meanwhile, Ethena (ENA), an Ethereum-based DeFi protocol, took the spotlight with a 10.8% surge, followed by Stellar, Injective, and, yes, that meme coin, BONK. Because who doesn’t love a good meme coin?

On a geopolitical note, former President Trump’s renewed trade war, complete with tariffs up to 41% on major U.S. trading partners, initially spooked the market. But, oh, what a twist! This might just be helping Bitcoin position itself as the digital safe haven we never knew we needed.

While traditional assets like the S&P 500 stumbled—falling 3.33%—investors flocked to crypto as if it were the last lifeboat on the Titanic. Bitcoin? The “digital gold” that saves the day during political chaos. Who would’ve guessed?

Institutional Interest and On-Chain Developments Support Growth

Institutional investors are starting to take crypto seriously. Citigroup, JPMorgan, and Goldman Sachs are all jumping on the blockchain bandwagon. Meanwhile, whales on Bitfinex are gobbling up 300 BTC daily. It’s like they’ve discovered the Fountain of Youth.

Oh, and don’t forget the recovery of the Satoshi Nakamoto statue in Switzerland. Yes, really. The very statue that inspires communities and reinforces trust in blockchain transparency. Truly, we live in strange times.

Market Sentiment Turns Neutral as Buyers Re-Enter

The Crypto Fear & Greed Index? Sitting at a cozy 52. No longer terrified but not exactly euphoric—just somewhere in the middle. With the global crypto market cap back at a cool $3.6 trillion, the next psychological target is $3.7 trillion. Ah, the sweet taste of numbers.

Michael Saylor, ever the optimist, declared, “Winter is not coming back.” And with that, we can all rest easy. The digital asset space is stabilizing—until the next big data drop comes along, that is.

So, here we are. The market is cautiously optimistic. The next few weeks will determine whether Bitcoin, Ethereum, and XRP can keep up this momentum or fall prey to the capricious winds of macroeconomic forces. But for now, hold tight, keep your eyes on that CPI data, and maybe buy a few extra snacks for the ride.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

2025-08-05 01:12