Ah, the splendid spectacle of US-based spot Bitcoin exchange-traded funds! They have captured the hearts and wallets of investors, drawing a staggering $388.3 million on a mere Wednesday. One can only marvel at the audacity of such numbers, as this marks the eighth consecutive day of fresh capital flowing in, culminating in a jaw-dropping total of $2.4 billion in Bitcoin ETF inflows. Truly, a financial opera worthy of the grandest stage!

Leading this investment waltz is none other than BlackRock’s iShares Bitcoin Trust (IBIT), pirouetting gracefully with $278.9 million in inflows. Following closely, like a devoted understudy, is Fidelity’s Wise Origin Bitcoin Fund (FBTC) with a respectable $104.4 million. The Bitwise Bitcoin ETF (BITB) has also joined the fray, adding a modest $11.3 million. Yet, alas, some Bitcoin ETFs, such as those from ARK Invest and Valkyrie, seem to have forgotten their lines, reporting no inflows at all. How tragic! 🎭

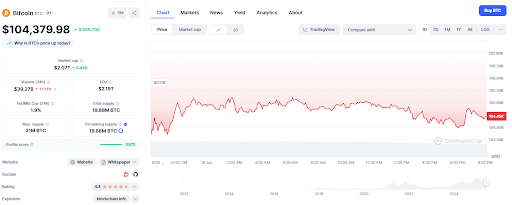

Now, let us turn our gaze to the ever-resilient Bitcoin price, which remains steadfast amidst the geopolitical tempest swirling between Israel and Iran. Despite the brief flutter of panic, Bitcoin has maintained its composure, oscillating gracefully between $104,000 and $105,000. As of this very moment, it is trading at a delightful $104,379, according to the ever-reliable CoinMarketCap. One must applaud its poise! 🕺

“Despite the initial panic, Bitcoin has remained in the $104K-$105K range, aided by consistent ETF inflows and a lack of follow-through in military actions,” proclaimed the wise sages at crypto analytics platform Santiment in a recent missive on X. They further noted that this behavior mirrors Bitcoin’s past responses to conflicts, such as the melodrama of Russia’s invasion of Ukraine in 2022 and the ongoing Israel & Palestine saga of 2023. How history does repeat itself, like a well-worn play! 🎬

However, not all are basking in the glow of inflows. Grayscale’s Bitcoin Trust ETF (GBTC) has chosen a different path, withdrawing funds from the market with a rather ungracious $16.4 million outflow on Wednesday. Its low-fee Mini Trust has also joined the exodus, recording $10.1 million in outflows. Oh, the irony! 😏

Since the fateful day of April 17, spot Bitcoin ETFs have amassed a staggering $11.2 billion in new money. In total, a magnificent $46.3 billion has graced the coffers of 11 principal US Bitcoin ETFs, with BlackRock’s IBIT leading the charge at $50.6 billion and Fidelity’s FBTC trailing behind at $11.5 billion. Meanwhile, Grayscale’s GBTC has seen a rather unfortunate $23.2 billion flow out during this same period. Such is the fickle nature of fortune!

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Silver Rate Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- ZK Price: A Comedy of Errors 📉💰

- Web3 Wallet Vanishes $908K in a Phishing Fiasco – Don’t be the Next Victim! 💸🕵️♂️

2025-06-19 22:48