Well, folks, here we are! Bitcoin ETFs have managed to pull off the second-largest outflow in history, a jaw-dropping $870 million. Meanwhile, Ether ETFs were not far behind, hemorrhaging another $260 million. But hey, don’t despair! Solana, the little engine that could, just keeps chugging along with a modest but steady inflow. Isn’t that just delightful?

Bitcoin ETFs Record Second-Largest Outflow Ever

Some days, the crypto market is like a calm ocean, with not a ripple in sight. And then there’s Nov. 13. It was as if a rogue wave hit, sweeping away over a billion dollars from Bitcoin and Ether funds in one fell swoop. And guess who just floated to the surface like a bloated life raft? None other than Solana, doing its best “look, ma, no hands!” routine.

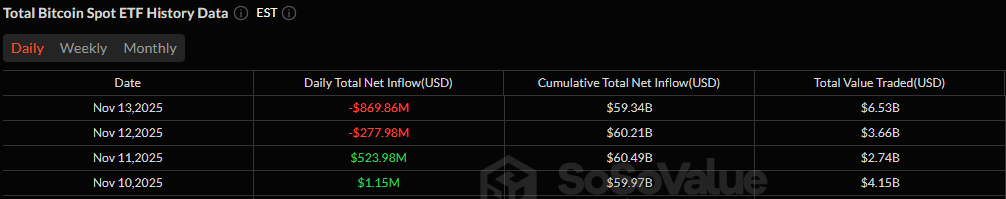

Bitcoin ETFs had a rather tragic Thursday, seeing a staggering $869.86 million in outflows. Yes, that’s right, the second-largest daily exit ever. A full ten funds saw their investors fleeing faster than rats off a sinking ship. The big losses were led by Grayscale’s Bitcoin Mini Trust, which bled out $318.20 million, with Blackrock’s IBIT not far behind at $256.64 million. Meanwhile, Fidelity’s FBTC was a little more reserved with a “mere” $119.93 million outflow.

The ripple effect was felt across the ecosystem: Grayscale’s GBTC lost $64.50 million, Bitwise’s BITB lost $47.03 million, and Invesco’s BTCO was down $30.80 million. ARKB, HODL, EZBC, and BRRR also had their tiny but still notable contributions to this financial bloodbath. But wait, there’s more! Trading hit a whopping $6.52 billion in volume, and net assets plummeted to $130.54 billion, confirming the severity of this sell-off.

Meanwhile, the poor Ether ETFs were caught in the same tidal wave of despair, suffering $259.72 million in outflows across four major funds. The biggest loser was Blackrock’s ETHA with $137.31 million. Grayscale’s ETHE didn’t do much better, losing $67.91 million, and the Ether Mini Trust took another hit of $35.82 million. Fidelity’s FETH added $14.52 million to the tally. Ether, anyone? It’s looking like a great time to sell! 😅

Read More: Solana Delivers Again as Bitcoin and Ether ETFs See Heavy Outflows

But fear not! Solana, the underdog, continues to defy the odds. Despite the carnage surrounding it, Solana ETFs saw a modest but promising inflow of $1.49 million. So yes, while Bitcoin and Ether get pummeled, Solana keeps doing its thing, looking like the only asset with a bright future in this chaos. Take a bow, Solana! 🙌

Thursday’s flows tell a clear story: the capital is fleeing from Bitcoin and Ether ETFs faster than you can say “financial crisis,” but Solana? It’s still getting some love, even on the roughest days. Bravo! 🎉

FAQ💸

- Why did Bitcoin ETFs see such massive outflows?

Bitcoin ETFs faced $870 million in redemptions as investors aggressively rotated out of major crypto products. Who knew crypto could be this dramatic? - What happened with Ether ETFs? Ether ETFs followed the same trend, posting $260 million in outflows during the risk-off session. The hits just keep on coming!

- Why is Solana still seeing inflows? Solana ETFs remained resilient, adding fresh capital despite the broad sell-off in BTC and ETH funds. Can Solana do no wrong?

- What do these flows signal for the market? The sharp exits highlight growing caution in major assets while interest shifts toward alternative Layer-1 exposure. It’s like everyone’s suddenly had enough of the heavyweights and wants to try something new.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- USD THB PREDICTION

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

2025-11-14 17:39