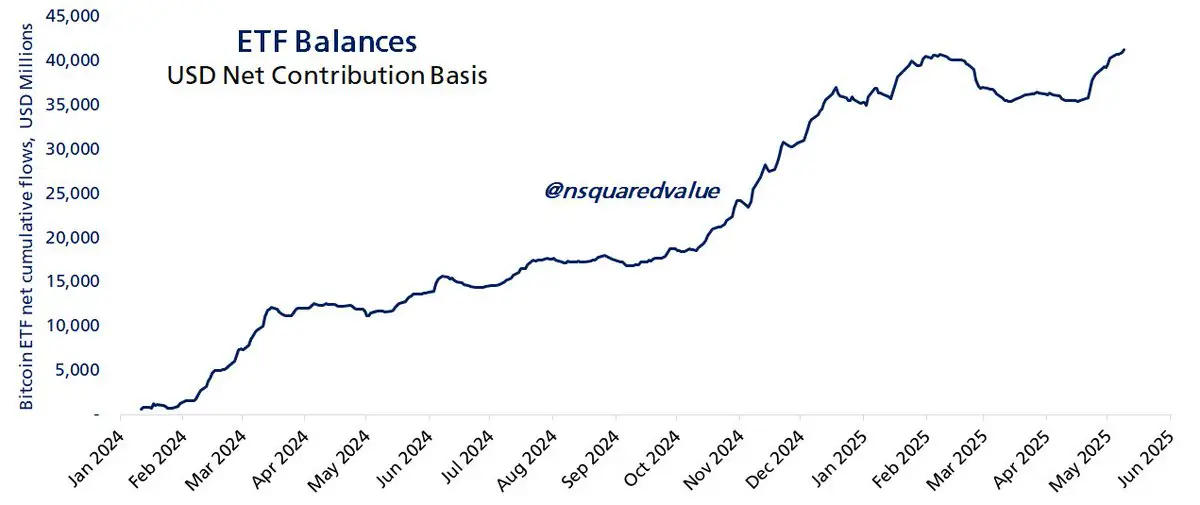

Well, slap my ledger and call me Satoshi—Bitcoin ETF flows have not only rocketed past the previous record (which, embarrassingly, was only set in February this year), but have now barged their way to a dizzying $41.3 billion. Yes, that’s “billion” with a ‘B.’ If money talks, apparently Bitcoin shouts through a megaphone while waving sparklers. 💥

This frenzied cash stampede reveals that both cool-headed institutions and hot-blooded retail investors are still falling head over e-wallet for Bitcoin. All of this, mind you, while the global economy stumbles around like someone who’s just heard about gluten. The hunger for crypto risk is apparently gluten-free, dairy-free, and still very much on the menu.

ETFs: The Grown-Ups Have Entered the Chat

The chart—dutifully shared by the intrepid Mr. Peterson—looks like what would happen if optimism was plotted on a line graph and left unsupervised. Since ETF approval in early 2024, net contributions have been about as persistent as a hangover after New Year’s. Even when Bitcoin gets a bout of the financial flu, investors dig in their heels and keep feeding the ETF beast. If resilience was a sport, these people would win gold medals and then tokenize them.

Current scoreboard:

- Bitcoin ETFs: $106 billion (pocket change, really)

- U.S. Gold ETFs: $175 billion (looking a bit nervous in the mirror)

Peterson, with the gravitas of someone who’s probably had to explain blockchain to their parents, notes, “Bitcoin has reached 60% of gold’s ETF size in just over a year.” Apparently, Bitcoin is not just catching up to gold; it’s practically tailgating it in the passing lane. 🚗💨

Defying Gravity, Logic, and Good Sense

Let’s pause and appreciate: this all happens as the wider economy weaves drunkenly from one crisis to the next. According to Peterson, we’re living through “hard times,” but nobody seems to have told Bitcoin. While the rest of the market clings to its blanket, Bitcoin ETFs are cannonballing into the deep end with bountiful new records and a general air of defiance.

This continued rise can blame:

- Mainstream and institutional investors converting faster than a metric to imperial calculator

- ETFs serving as the “safe-ish” crypto express lane (now with guardrails!)

- The not-so-subtle fact that more money in equals prices up, which seems to surprise absolutely no one—except, oddly, economists

The Road Ahead Is Paved with Wild Guesses

Bitcoin at $103,000? ETF participation through the roof? The analyst crowd is whispering (excitedly, and slightly out of breath) that this run might just be warming up. If Bitcoin keeps its pace, we could soon watch gold’s ETF dominance shrink like a wool sweater in a hot wash, and every traditional asset manager will need a stiff drink or, at least, a long walk.

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Steinbeck’s Take on Upexi’s Solana Gold Rush 🏭💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- PLUME: 60% Down?! 😱

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

2025-05-10 23:15