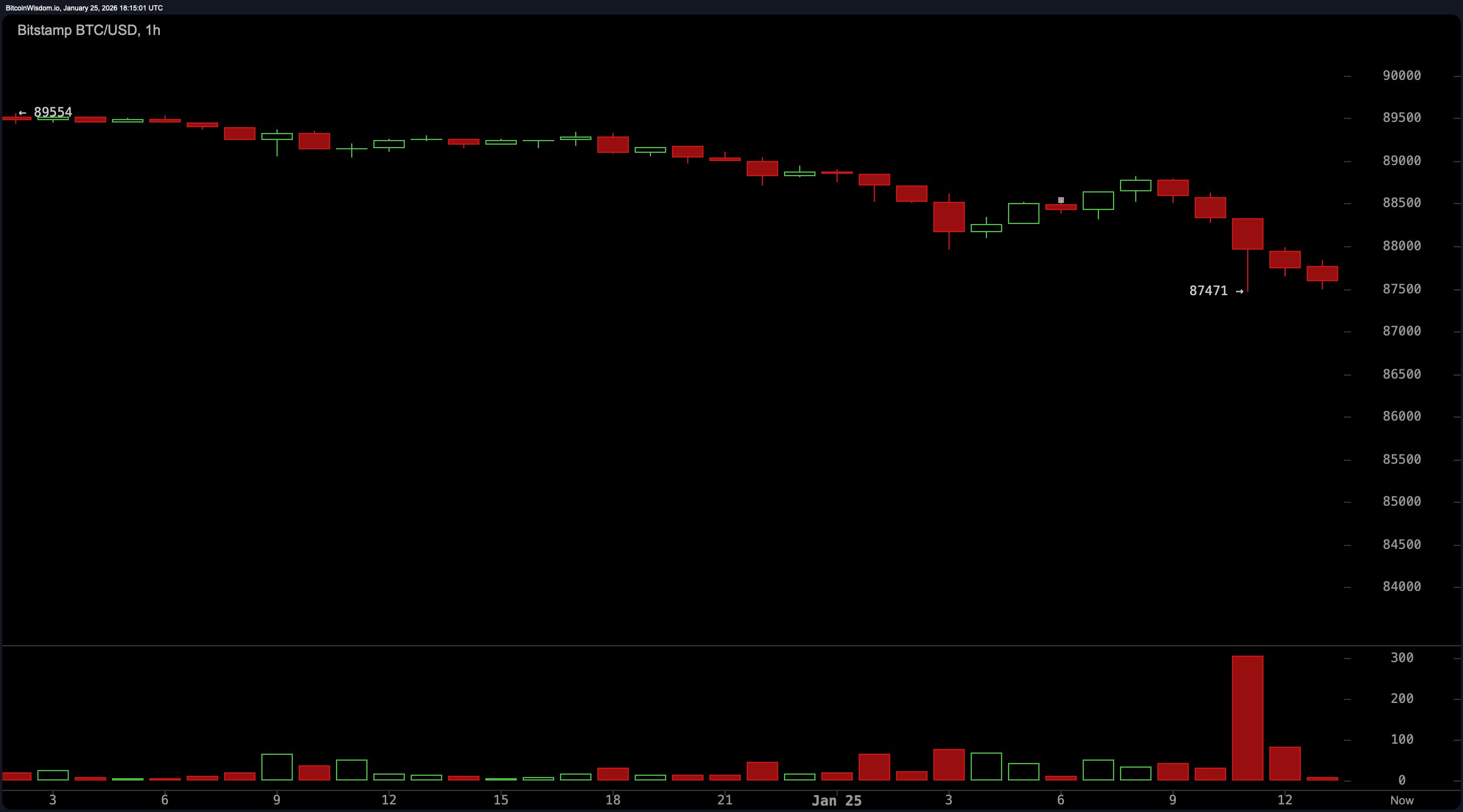

Bitcoin, that sly, silver-winged cipher, drifted Sunday into a more desolate hemisphere of numbers, slipping beneath the 88,000 threshold and kissing a low of 87,471 per unit. Around noon EST, the market settled into a crisp, stair-stepped descent, a staircase with ever-lower rungs and even lower landings.

Thin Liquidity, Heavy Swings: Bitcoin Dips Under 88K as Liquidations Pile Up

The crypto economy weighs in 1.75% lighter than yesterday, a gleaming total of $2.96 trillion dwindling like a mirage under a noon sun. Selling gathered momentum once bitcoin breached the 88,250 realm, a beacon that had offered a brief foothold earlier in the morning.

Bitcoin is off 1.7% on the day and down 7.6% over the past week against the dollar. Yet, year-to-date, BTC has dallied inconspicuously, up a mere 0.30% since Jan. 1. After slipping under 88,000, the momentum of decline quickened, with several sharp drops signaling that the sellers are very much at the wheel, not a languid, sentimental volume fade.

Trade volume remains alarmingly thin at $25.11 billion, a threadbare string that can snap into jolts. Volume plays a leading role in Sunday’s drama, as the boldest burst aligned with the descent into session lows. That pattern whispers of firm distribution and possible short-term seller fatigue, often followed by a modest bounce or a cooling-off interlude.

For the moment, that glint of optimism sits on ice. BTC touched an intraday low of 87,471 and, as of 1 p.m. EST, hovers just above the 87,700 range. Coinglass data shows 149,139 traders were liquidated across the broader crypto derivatives market, with $343.9 million erased in the fray.

About $78.36 million of those liquidations came from BTC longs, while $90 million were tied to ETH longs. Many have traced bitcoin’s slide to geopolitical and macro jitters, along with remarks from U.S. President Donald Trump, who over the weekend spoke of Canada as “systematically destroying itself.”

Still, bitcoin’s Sunday descent-while markets await a Monday Strategy purchase-has become a familiar refrain, a lovably dreary chorus that repeats itself week after week. The tape tells a familiar story: thin liquidity, jittery traders, and sellers pressing their advantage.

Until volume firms up or a clear catalyst disrupts the rhythm, bitcoin seems content to churn rather than charge. As recent Sundays have shown, optimism alone hasn’t managed to rewrite the script.

FAQ ❓

- Why did bitcoin drop below $88,000?

Bitcoin fell as selling pressure intensified after losing short-term support near $88,250 amid thin weekend liquidity. - How much was liquidated during the sell-off?

Roughly $343 million in crypto derivatives positions were liquidated, affecting nearly 150,000 traders. - What role did trading volume play in the decline?

Low volume around $25.11 billion amplified price swings and intensified the move into session lows. - Is bitcoin’s Sunday decline becoming a trend?

Recent weeks show bitcoin has repeatedly weakened on Sundays, even when positive catalysts were anticipated.

Read More

- Silver Rate Forecast

- EUR UAH PREDICTION

- Gold Rate Forecast

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- USD THB PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BCH PREDICTION. BCH cryptocurrency

2026-01-25 22:44