Ah, Bitcoin Cash.

BTC

$107 660

24h volatility:

1.4%

Market cap:

$2.14 T

Vol. 24h:

$22.67 B

On this cursed July 4, even as the world spun in delirium and unknown coins plunged like lost souls into the abyss, the price of Bitcoin Cash clung obstinately to $488. It was a stubborn dog in a thunderstorm. Did the network demand grant such fortitude, or was it mere caprice of fate? Now the question: do the bulls dare dream of $500, or is such hope sheer Dostoevskian delirium? 🤔

BCH and Its Rivals: Losers’ Ball in the Crypto Ballroom

Imagine Friday’s fever—the great market selloff! BCH, with an air of reluctant dignity, dropped merely 1.63%, as if saying, “Well, I, too, must fall, but not as far as those wretches over there.” Compare, if you must, the disarray:

Cardano—

ADA

$0.57

24h volatility:

3.0%

Market cap:

$20.66 B

Vol. 24h:

$523.13 M

,

SUI, or should I say ‘Sigh’—

SUI

$2.87

24h volatility:

3.7%

Market cap:

$9.91 B

Vol. 24h:

$824.71 M

,

and poor Hyperliquid—

HYPE

$38.02

24h volatility:

5.1%

Market cap:

$12.70 B

Vol. 24h:

$189.03 M

. All of them tumbled and flailed, losing between 4.7% and 5.3% like a gambler on his last ruble. BCH alone seemed to smirk.

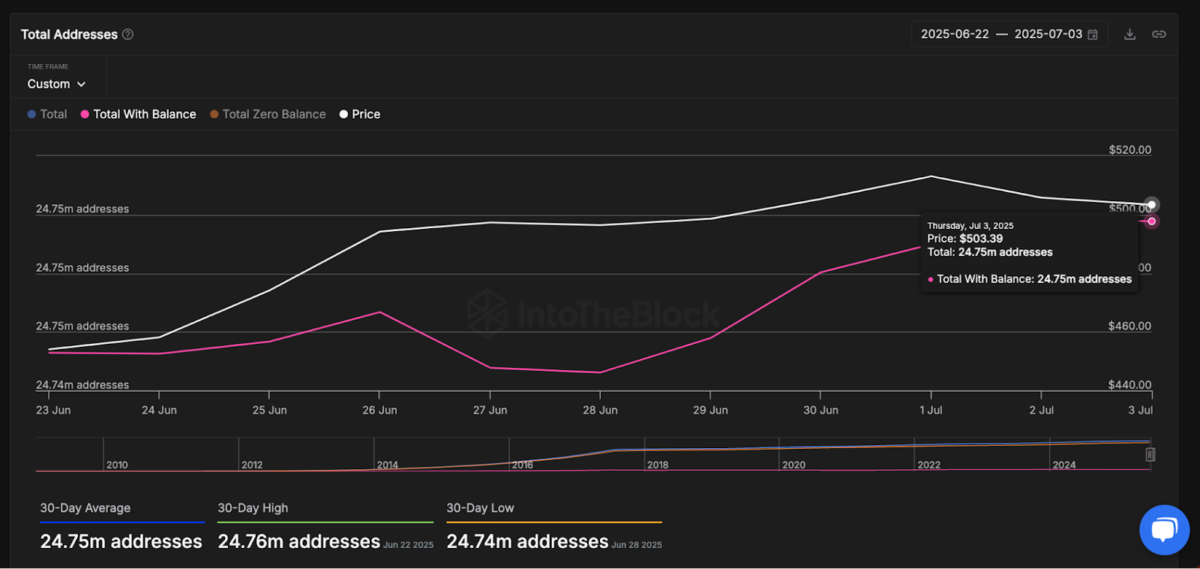

The soothsayers of data—those notorious on-chain analytics—murmur that BCH’s obstinate steadiness is moored in a wild rush of network activity. Will 10,000 fresh addresses in one week save us, or will they be the mourners at the wake?

Bitcoin Cash Total Funded Addresses | Source: IntoTheBlock

This outpouring of new BCH disciples—and in such times of dread market sentiment!—echoes the eternal theme: we all seek shelter from chaos. The great Bitcoin itself, stoic at $107,000 (with only a 1.5% flinch), reinforces this tragic ballet:

BTC

$107 660

24h volatility:

1.4%

Market cap:

$2.14 T

Vol. 24h:

$22.67 B

.

In the theater of coins, BCH and Bitcoin play the roles of ‘hedge’—though, let’s be honest, sometimes that’s just a word for “I have no idea what I’m doing.” 😏

Perhaps, then, hope rustles. More funded addresses? Fantastical! A sign of strength, or just more lost souls entering the casino?

Golden Crosses and the Endless Longing for $500

Ah, the technical signals—the tarot cards of modern finance. On the daily BCH/USD chart, not one, but a double Golden Cross appears. The 50-day and 100-day averages vault over the 200-day like drunken Dostoevskian intellectuals jumping tables in a Petersburg tavern. Divine omen… or Satan’s trickery?

Bitcoin Cash Price Forecast | Source: TradingView

As of this very moment, the 200-day average embroiders itself at $460—a stubborn buffer, a mother-in-law at the threshold, refusing entry to further sorrows. If this rampart holds, the bulls will scale the dizzying heights of $500, even $525!

The RSI, that delicate-nerve’d index, twitches at 56—so near to fever, yet still ‘safe,’ though in life, as in finance, “safe” is a comedy routine.

Those who wager for glory must beware! If BCH dares flirt with the $460 precipice—one wrong step, and the descent is long, down to $402 and perhaps the pit of despair last visited in June’s blackness. If the bears take the field, the bullish fantasy perishes quicker than a Dostoevsky protagonist’s innocence. 💔

Snorter: The Meme Bot for Men Without Qualities

Meanwhile, in another corner of our absurd universe, a Telegram trading bot named Snorter has raised over $1.5 million in presale. Yes, Snorter. A Solana-based beast, ready to empower meme-coin chasers with real-time on-chain data, MEV protection, and—one presumes—existential dread.

As meme markets ignite, Snorter positions itself as a tool for those brave enough to gamble on the next pink elephant coin. Low fees. Early access. Much delusion. Visit their website and perhaps find glory, or at least something to laugh about.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- Bitcoin’s on Fire! Institutions Hoarding Like It’s Toilet Paper 2020 🚀💰

- Bitcoin’s Rollercoaster Ride: Hold Onto Your Hats, Crypto Fans! 🎢💸

- Crypto Chaos: Powell Holds the Keys! 🔑

2025-07-05 03:41