Well, shucks, folks! It seems like Bitcoin‘s got a new trick up its sleeve. In 2025, companies have been using it as a reserve asset like it’s goin’ outta style, and that’s led to a right ol’ boom in Bitcoin-related stocks and bonds. Now, I know what you’re thinkin’, “What in tarnation is goin’ on here?” And I’ll tell you, it’s all thanks to two main reasons, according to fund manager Lyn Alden.

It seems that institutional demand is drivin’ this trend, and companies are gettin’ all sorts of strategic advantages from leveragin’ Bitcoin. Now, I ain’t one to toot my own horn, but I reckon it’s high time we took a gander at these reasons.

Reason 1: Sneakin’ Past the Fund Police

It turns out that many investment funds are stuck between a rock and a hard place. They’re only allowed to invest in stocks or bonds, and they’re prohibited from buyin’ Bitcoin or them fancy cryptocurrency ETFs. That’s like tryin’ to catch a fish with your bare hands, ain’t gonna happen!

So, what’s a fund manager to do? Well, they’ve found a sneaky way around this restriction by investin’ in stocks of Bitcoin-holdin’ companies like Strategy (formerly MicroStrategy) (MSTR). It’s like hidin’ a rabbit in a hat, folks!

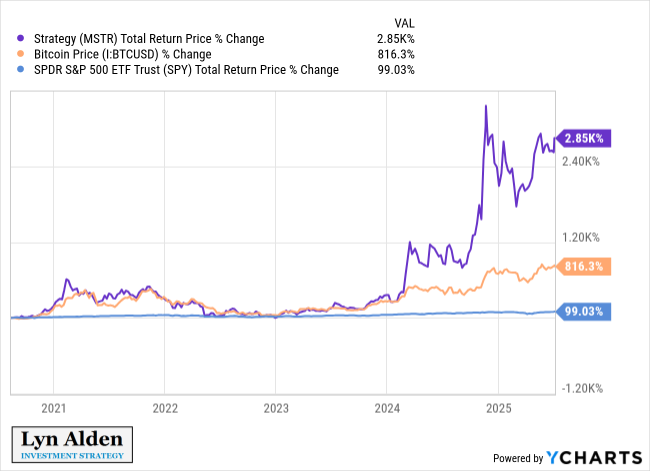

Now, I know what you’re thinkin’, “Is this some kinda magic trick?” But nope, it’s just good ol’ fashioned investing. A chart provided by Lyn Alden shows MSTR’s total price return from 2021 to mid-2025 at a whoppin’ 2,850%! That’s like findin’ a golden egg in your backyard, folks! 🐓

“In short, there are many funds, due to mandates, that can only own stocks or bonds with bitcoin exposure; not ETFs or similar securities. Bitcoin treasury corporations give them access,” Lyn Alden explained. Ah, shucks, it’s like she’s talkin’ straight from the horse’s mouth! 🐴

Lyn Alden also shared her own experience with her model portfolio. Back in 2020, she chose MSTR because her exchange platform didn’t support direct Bitcoin or GBTC purchases. It’s like she found a secret passage to the Bitcoin party! 🎉

Reason 2: The Long-Term Bond Bandwagon

Lyn Alden’s second reason is that companies can issue long-term bonds, which helps ’em avoid the margin call risk that hedge funds often face. It’s like they’re ridin’ a unicorn through a field of rainbows, folks! 🦄

Hedge funds typically use margin borrowing, which can trigger forced asset sales when Bitcoin prices fall sharply. But companies like Strategy can issue multi-year bonds, which lets ’em hold their Bitcoin positions even during them volatile market conditions. It’s like they’re sailin’ a ship through calm waters, ain’t no storm gonna rock their boat! 🛥️

This approach creates a safer form of leverage, which helps companies capitalize on Bitcoin’s price swings better than them leveraged ETFs. It’s like they’re playin’ a game of chess, thinkin’ three moves ahead! 🏰

“This type of longer-duration corporate leverage is also usually better in the long run than leveraged ETFs. Since leveraged ETFs don’t use long-term debt, their leverage resets daily, and so volatility is often quite bad for them,” Lyn Alden added. Ah, shucks, she’s like a wise ol’ owl, ain’t she? 🦉

Investors Are Gettin’ All Aboard the DAT Train

Lyn Alden’s insights are shinin’ a light on the growin’ investor interest in them Digital Asset Treasury stocks (DATs). It’s like they’re buyin’ tickets to the Bitcoin express, folks! 🚂

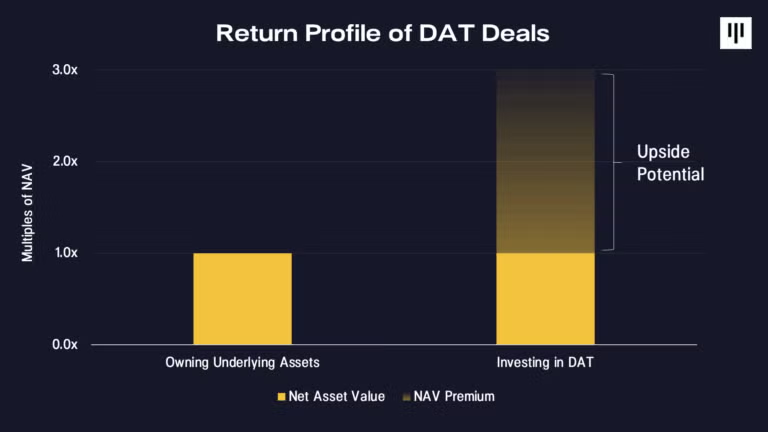

A recent report from Pantera Capital highlighted that DATs bridge traditional finance and digital assets, lettin’ investors gain exposure through familiar instruments. It’s like they’re crossin’ a bridge over troubled waters, ain’t no worries ’bout gettin’ wet! 🌉

Pantera also believes investin’ in DATs could generate higher returns than the underlying digital assets. It’s like they’re findin’ a pot of gold at the end of the rainbow, folks! 🌟

“The game has changed after Coinbase gets included in S&P500. Every tradfi PM is hungry and forced to add some digital assets. It’s DAT season, not alts season… The trend is still in the early stage,” investor Nachi commented. Ah, shucks, it’s like he’s callin’ the shots, folks! 📣

Additionally, a recent BeInCrypto report shows that during this altcoin winter, the stocks of crypto-focused companies like Coinbase, Circle, and Robinhood are outperformin’ major tokens. It’s like they’re the cool kids on the block, ain’t nobody touchin’ ’em! 😎

However, this shift in investor focus toward external profit opportunities might cause the crypto industry to lose its growth momentum. It’s like they’re sailin’ into uncharted waters, folks, and we’ll just have to wait and see what happens next! 🌟

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Network’s New Apps: The Future of Crypto or Just Another Snake Game? 🐍

- SHIB PREDICTION. SHIB cryptocurrency

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

- ProShares Dives into XRP Futures ETF: The Countdown Begins! 🚀

- ETC PREDICTION. ETC cryptocurrency

2025-07-07 12:49