Bitcoin Bonanza: Who’s Raking it in? 🤑

What’s the Haps, My Friends? 🤔

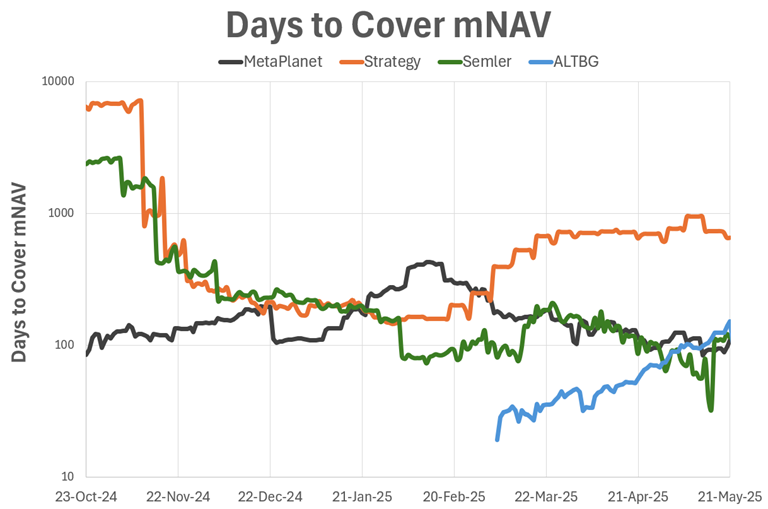

- MetaPlanet and ALTBG are the dynamic duo of the bitcoin world, converting their high BTC yields (~1.5% daily) into short Days to Cover timelines. Talk about a match made in heaven! 💘

- Strategy (MSTR), on the other hand, is lagging behind despite its dominance. With a low BTC yield of 0.12% and a 626-day horizon to earn its mNAV, it’s like they’re stuck in the slow lane. 🚗

As bitcoin (BTC) continues to mature as an institutional asset, a growing number of public companies are jumping on the bandwagon, integrating BTC into their treasuries. And, of course, investors are going wild for those leveraged bitcoin equities (LBEs)! 🚀

But, let’s get real, folks. With valuations soaring, the question on everyone’s mind is: which companies are actually earning their premiums through consistent BTC accumulation, and which are just coasting on their rep? 🤷♂️

That’s where the “Days to Cover mNAV” metric comes in – the ultimate tool for separating the wheat from the chaff. It measures how long it would take a company to accumulate enough BTC to justify its market cap, based on its current multiple of net asset value (mNAV) and daily BTC yield. 📊

The formula is simple: Days to Cover = ln(mNAV) / ln(1 + BTC Yield). And, trust me, it’s a game-changer. 🔄

So, what do the numbers say? Well, Strategy (MSTR) is holding an mNAV of 2.1, but with a daily BTC yield of just 0.12%, it’s going to take them a whopping 626 days to cover their valuation. Yikes! 😬

On the other hand, MetaPlanet (3350) and The Blockchain Group (ALTBG) are compounding rapidly with 100-day average BTC yields near 1.5%. They’re supporting much higher mNAVs (5.08 and 9.4 respectively) in just 110 and 152 days. Talk about a bitcoin bonanza! 🎉

And, let’s not forget Semler Scientific (SMLR), with an mNAV of 1.5 and a yield of 0.33%, posting a competitive 114 Days to Cover. Not too shabby! 😊

These figures, reinforced by the “Days to Cover mNAV” chart from October 2024 to May 2025, show a clear trend: faster accumulators are compressing their coverage times and catching up to more established players. MetaPlanet and ALTBG are leading the charge, and investors are taking notice! 📈

In a sector defined by speed and volatility, Days to Cover mNAV provides a clear, data-driven lens through which to evaluate long-term sustainability and upside potential. So, which companies will come out on top? Only time will tell! 🕰️

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Ether’s Wild Ride: Will It Hit $3K or Just Keep Teasing Us? 🤔💸

- Corporate Giants Dive into Bitcoin with $458 Million Bet: Is This the End of Fiat?

- Dogecoin’s Journey to $5: The Hilarious Truth Behind the Hype! 🚀💰

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Bitcoin to Moon? Tom Lee’s Wild Predictions and a Universe of Imbalance 🚀

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

2025-05-21 13:13